After bleeding billions of dollars from the flagship fund, Cathie Wood’s Ark Investment Management reportedly has made a defensive turn. Enter the burgeoning “Buffer ETF” arena with a fresh lineup of loss-limiting products.

Last week, the company submitted proposals for four new exchange trade funds, ARK Q1, Q2, Q3 and Q4 to define innovation ETFs. These exchange sales funds are designed to mitigate the risk of drawbacks while limiting upward returns. Each product follows a rolling 12-month strategy starting in January, April, July and October, respectively. The space turned out to be a hunt for investors’ recession protection while BlackRock, Allianz and innovators were already in control.

Ark makes a big bet on the buffer ETF

According to the report, the proposed ETF aims to protect investors from around 50% of the ARKK decline, while providing full exposure to profits above the 5% threshold. Arkk is ARK’s $6.8 billion flagship innovation fund. The Buffer ETF market, led by BlackRock, is expected to reach $650 billion by 2030.

He added that the assets of the defined result ETF already reached $69 billion in 2025. In an environment characterized by rate volatility, trade tensions and rising geopolitical risks, downside protection is becoming a hot product.

Traditional, crypto and all sorts of markets already deal with massive fluctuations led by the indecisive situation created by US President Donald Trump. With a fresh trade threat, Trump has set 14 countries on the list. This includes the important US allies and South Korea in a notice facing a 25% to 40% increase from August 1st.

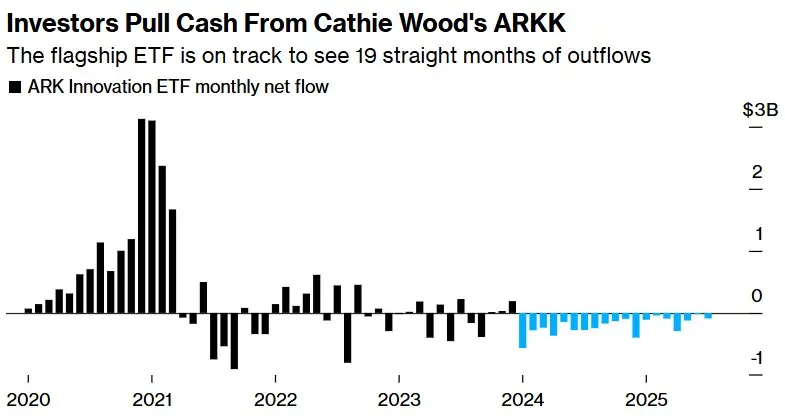

The timing of ARK is no coincidence as it has achieved strong returns in 2025. ARKK has grown 50% over the past 12 months, with ARKW, the company’s internet-centric fund, winning 80%. The report says retail enthusiasm appears to be dry as ARKK is moving to a 19th consecutive net spill pace. It has cut $2 billion over the past year. Arkk Price saw a slight decline in its final trading session. It traded for around $70.44.

“These are like diet arcs,” says Eric Balknath of Bloomberg Intelligence. “Investors want a kick, but there’s no sleepless night.”

Kathy Wood Rebalance Ark Invest

A buffer ETF push comes when the ark appears to fine-tune its core position. On July 7th, the company added 659,428 shares of Beam Therapeutics (Beam). Valued over $13 million. Meanwhile, Ionis Pharmaceuticals (Ions), 908 Devices (Mass), and Roblox (RBLX) have also been reduced. We sold 12,143 shares (approximately 522K) through the ARKG ETF.

The Spot Bitcoin ETF recorded a net inflow of $217 million on July 7th. This indicates a net inflow for three consecutive days, suggesting a stable market situation. However, the ARK 21Shares Bitcoin ETF (ARKB) reported a $10.07 million spill in the same session. This happens when ARKB saw a massive inflow of $114.25 million on July 3rd (previous trading session).

Bitcoin prices have dropped slightly in the last 24 hours. BTC trades at an average price of $108,382 at press time. Last year it still has an 87% increase. Bitcoin’s 24-hour trading volume rose 19% to $472.5 billion.