The leading Crypto Exchange Binance witnessed a major spill in Bitcoin (BTC) and Ethereum (ETH) on June 23, with investors pulling out 4,000 BTC and 61,000 ETH in a day. This change comes in the process of easing geopolitical tensions, reducing inflation and promoting speculation about new gatherings.

Bitcoin is likely to rally to the global tensions boil

According to a recent cryptographic quick take post by contributor Amr Taha, Bitcoin could resume its upward trajectory, strengthened by a recent string of macroeconomic and geopolitical developments. Analysts highlighted multiple positive signals that could bring top digital assets closer to their all-time highs (ATH).

One important development was an announcement by US President Donald Trump. He said a ceasefire agreement has been reached between Israel and Iran. The deal removes the immediate threat of closing the Strait of Hormuz, a key chokepoint for the world’s oil supply.

The ceasefire has an immediate and positive effect on the global stock market, with the S&P 500 index surpassing 6,000 for the first time since February 2025. This recovery has boosted investors’ confidence as geopolitical risks sink.

Furthermore, crude oil prices fell 14%, increasing the narrative of disinflation. Reducing energy costs helps reduce production and transportation costs, thereby helping to reduce inflationary pressures more broadly. Taha concluded:

The convergence of a key cryptocurrency leak from Binance, a fall in oil prices, a bullish breakout in US stocks, and a decline in tensions in the Middle East presents an impressive scenario. With geopolitical overhangs removed, inflation mitigation eased and macro markets stable, Bitcoin is currently good to resume its upward trajectory.

Meanwhile, Bitcoin Zilla – Wallet Holding a Large Volume of BTC – appear To accumulate quietly in anticipation of breakouts. In another encrypted post, contributor Mignolet noted that BTC has been steadily rising since BOTTOM hit bottom in April.

Mignolett noted that whale activity usually increases during periods of low markets and growing fear, often foreseeing bullish reversals. Historical data support this trend, indicating that accumulation increases often precede a significant price surge.

BTC bullish quarter

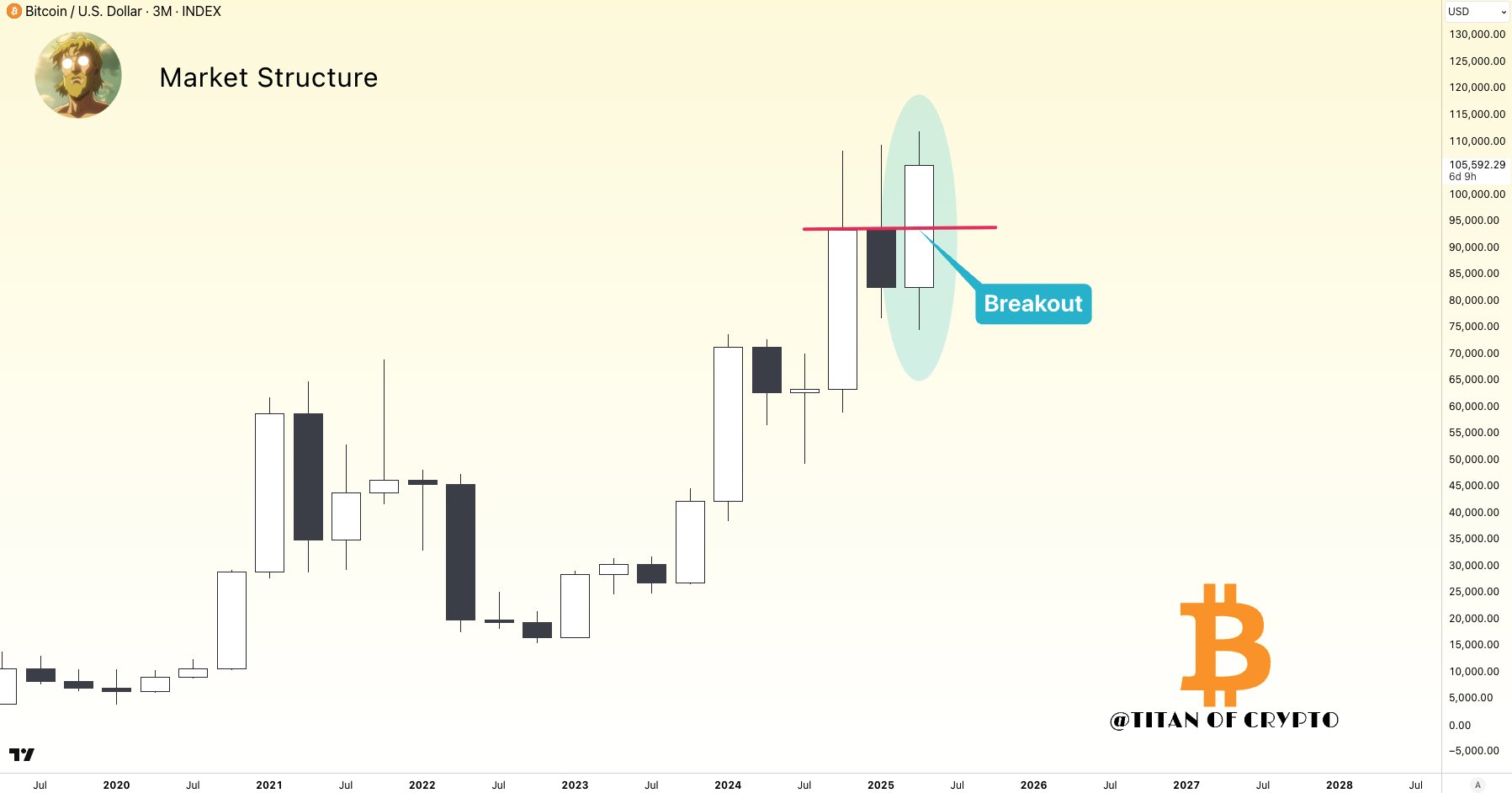

In an X post released today, Crypto Crypto analyst Titan said BTC is set to tighten up the long-term uptrend in its flagship cryptocurrency, with BTC set to close bullish monthly candles.

Several other chains and technical indicators also suggest the possibility of further rise. For example, Bitcoin Binary CDD show Its long-term holders continue to hold rather than sell, indicating a strong belief in the long-term value of BTC.

At the same time, the number of short positions is climbing BTC is integrated between $100,000 and $110,000. This dynamic could increase the possibility of short apertures and drive Bitcoin to new ATHs. At the time of pressing, BTC will trade at $105,408, an increase of 5.2% over the past 24 hours.

Featured images from charts on Unsplash, Cryptoquant, X and tradingView.com