Bitcoin price rise stagnated at just under $120,000, and turned sideways as the wider crypto market pivots into altcoins. This stagnation follows a recent rally where BTC approaches its record high.

However, the increased saturated demand and selling pressure have reduced Bitcoin’s momentum and raise concerns for a potential reversal.

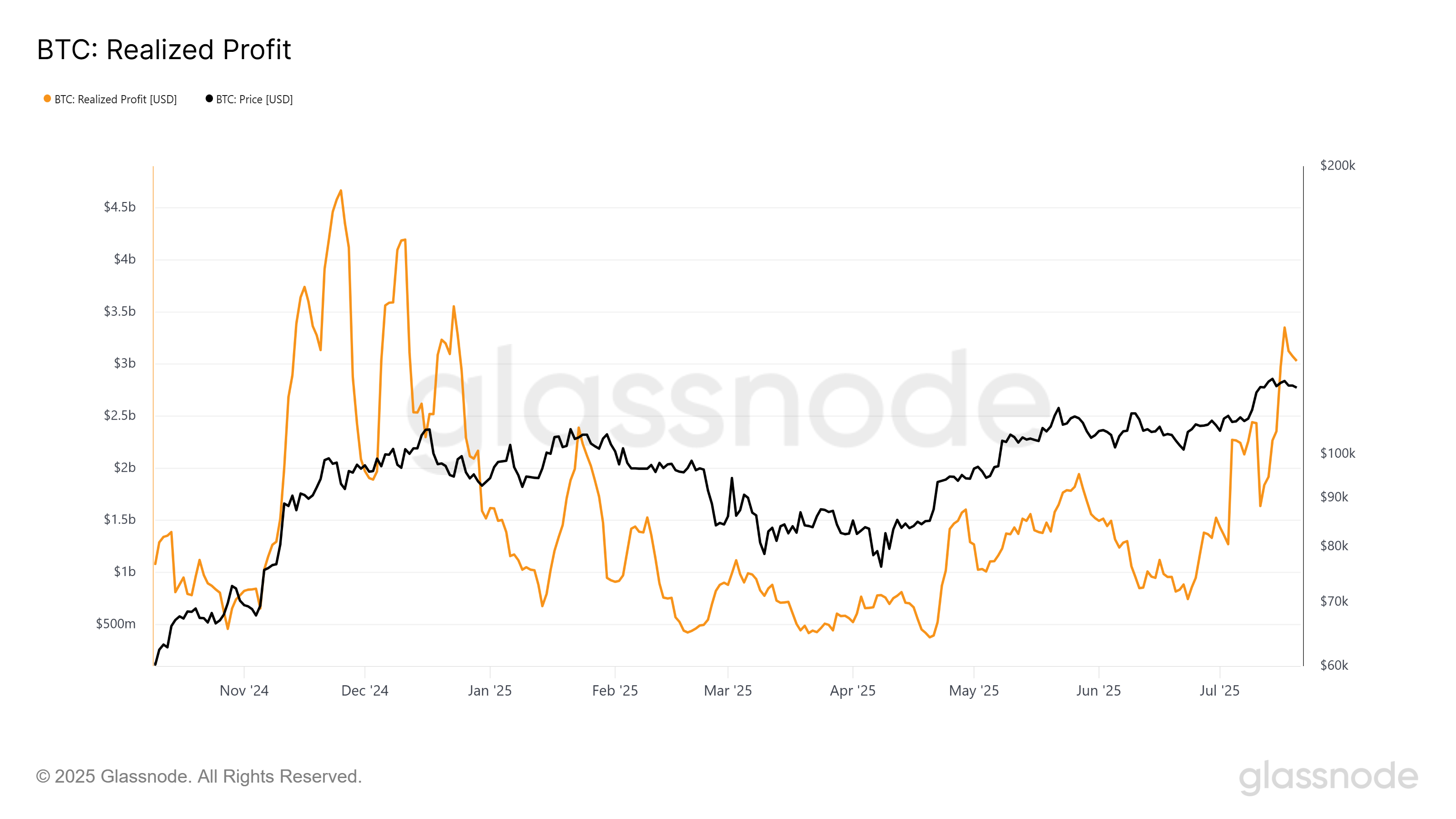

Bitcoin investors start to get profit

Bitcoin’s realised profits have skyrocketed to a seven-month height, indicating an increase in sales activity among investors. Spikes show that the holders are securing profits rather than making more profits. This behavior often manifests when investors lose confidence in their ongoing bullish momentum.

Once profits were made, investors’ sentiment began to move away from Bitcoin. This could limit the likelihood of an upside in the short term. When a large number of investors leave at once, they usually put downward pressure on prices, enhancing the possibility of consolidation or correction.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Bitcoin has made profits. Source: GlassNode

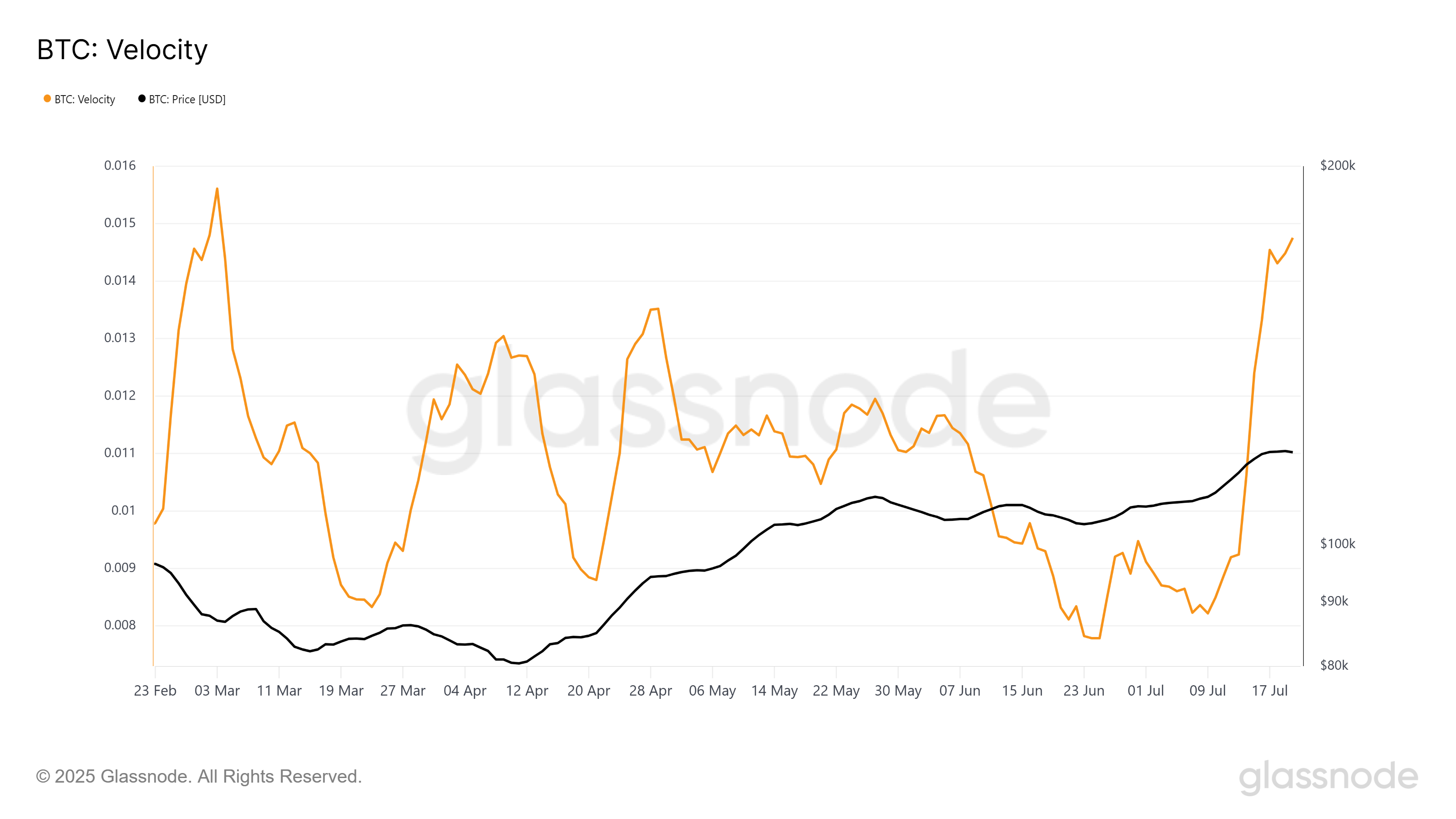

Another important indicator, Velocity, has also skyrocketed, and is now at four months high. This metric tracks how quickly Bitcoin changes hands within the network. Higher speeds usually reflect an increase in trading activity and investors try to capitalize on short-term movements.

This speed rise indicates that demand for Bitcoin is still present, but it is driven by rapid trading rather than long-term accumulation. The conflicting signals of profitability and growing demand are preventing Bitcoin from moving rapidly in either direction. This tug of war has contributed to a continuous price stagnation.

Bitcoin speed. Source: GlassNode

BTC prices could escape integration, but even worse

At the time of writing, Bitcoin priced at $119,366. Crypto Giant is struggling to break past the $120,000 resistance level. That decline control suggests that capital is moving towards altcoins, reducing the likelihood of breakouts that surpass this barrier in the near future.

Bitcoin’s current indicators support horizontal price movement. If the market is stable, BTC can continue to consolidate between $117,000 and $120,000. This range could remain intact unless significant purchasing momentum has returned.

Bitcoin price analysis. Source: TradingView

On the downside, if sales pressure exceeds demand, Bitcoin could fall below $115,000. A stronger fix could push the price up to $110,000, negating current bullish narratives and strengthening concerns about short-term debilitating.