Keynote

- Whale investors accumulated 66,040 BCH on Tuesday, marking the highest daily influx since peak activity in early July.

- Technical indicators show that if the BCH trade is $587 near the Aupper Bollinger Band Resistance and momentum is maintained, the potential target is $615.

- Ethereum’s profit acquisition drives capital rotation into mid-cap altcoins like Bitcoin Cash and supports continuous upward pressure.

Bitcoin Cash BCH $568.0 24-hour volatility: 0.8% Market Cap: $11.30 b Vol. 24H: $288.80 m Prices surged beyond the $570 level on Wednesday, appearing as one of the few top 20 altcoins to post daytime profits. This bullish breakout is closely aligned with new whales’ interests and informs potential institutional accumulation.

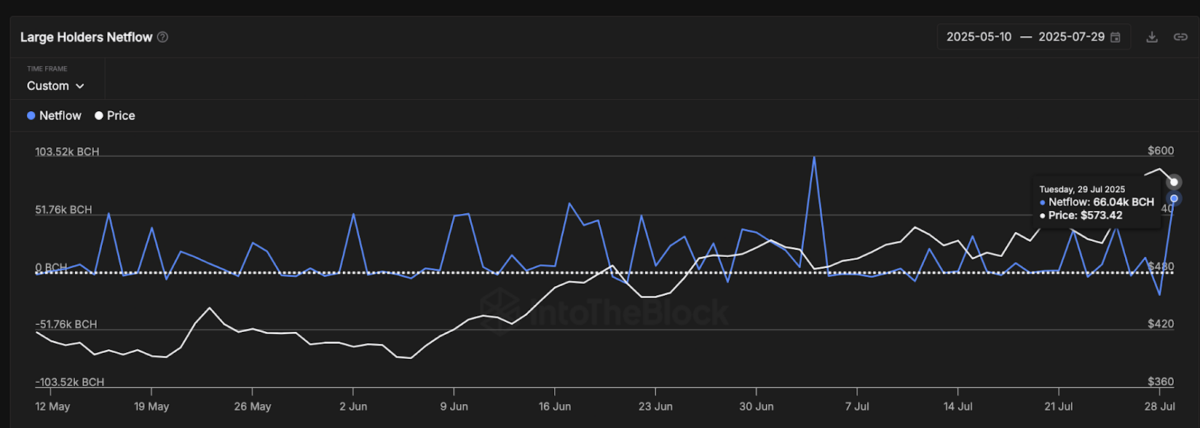

IntotheBlock’s large-scale holder Netflow metric tracks the daily movement of the net of coins coming and going into the wallet that controls at least 1% of the circulation supply. According to the latest data, Bitcoin Cash Whale recorded a net inflow of 66,040 BCH on Tuesday. This shows the maximum daily whale accumulation of 103,520 BCH per month on July 4th.

Bitcoin Cash Large Holders ‘Netflow | Source: IntotheBlock, July 30th

In particular, the price of BCH has steadily risen from $483 to $571~~~~~ tests the positive correlation between whale accumulation and BCH price action. Based on historical trends, the latest increase in whale influx could mark the early stages of another rally as Bitcoin Cash prepares for potential bullish momentum in August.

However, market watchers are still evaluating whether this momentum can be maintained beyond the $570 zone, or whether a rejection at a $600 resistance could lead to a long-term correction phase.

BCH price forecast: $600 resistance focus as demand for whales heats up

From a technical analysis standpoint, Bitcoin Cash has been trading above its 20-day moving average ($530.70) and is currently at $571.34, reflecting a 1.28% increase on Wednesday.

The Bollinger Band shows that BCH is currently trading near the upper band for $587.10. A clean breakout and closure above $587 could pave the way for a retest of the $610 psychological resistance level that will be last seen in early March 2024.

Bitcoin Cash Price Prediction | BCHUSD 24H Chart | TradingView

Meanwhile, the MACD line (21.20) remains above the signal line (17.40), confirming its bullish momentum. The histogram bar is still green, but slightly reduced, suggesting that if $587 is found to be too strong this week to overcome, the purchase pressure could be faced with fatigue.

If BCH regains a resistance band of $580 to $587 beyond $560 support, the Bulls could target $615 in early August. Conversely, a DIP that falls below the 20-day MA at $530 could disable this breakout and correct the price of BCH towards the $510 zone.

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information, but should not be considered financial or investment advice. Market conditions can change quickly, so we recommend that you review your information yourself and consult with an expert before making a decision based on this content.