Base Chain, Coinbase’s Layer 2 blockchain network released in 2023, is progressing smoothly. Its main indicator is jumps, with market share growing.

Nansen’s data shows that Base has solidified its position as the largest player in the Layer 2 industry. Weekly transactions increased from 27% to 65.9 million, much higher than Ethereum (ETH) 9.4 million.

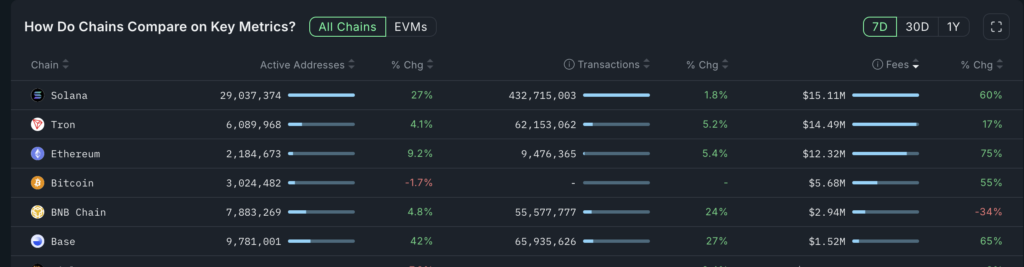

Base’s active addresses have increased 42% over the past seven days, up from Ethereum’s 214 million to 9.7 million. It also overtook other popular Layer-2 networks such as Arbitrum, Polygon and Optimism.

Base Chain Metrics | Source: Nansen

More data from Defi Llama shows that base chain protocols are approaching a $400 billion milestone.

They have dealt with over $363 billion since their inception, and have won $25 billion in the last 30 days. If the trend continues, the base could exceed the $400 billion level in June or July.

The most active DEX network in the base chain is Aerodrome, which has processed more than $183 billion in transactions since its inception. UNISWAP (UNI) is the second one after processing more than $130 billion. Another top players in the network are Pancakeswap, Woofi, Javsphere and Sushi.

The base chain has also become the sixth largest chain in decentralized finance or debt. The locked total jumped to $4.7 billion, making it a larger chain than most popular players such as SUI, Avalanche, Cardano and Cronos.

The base chain attracted users due to its significantly lower transaction fees and faster speeds. He has also become a major player in the Meme Coin industry. The market capitalization of that ecosystem token is over $1.7 billion.

The most notable are Bullet (Bret), Toshi, Degen and Ponke.

You might like it too: When Stablecoin’s market capitalization reaches $24.3 billion, Tether tightens its grip

The base chain resists pressure on the airdrop

Coinbase resisted measures to have a base airdrop. This allows investors to access the $Based Token. The poly-local odds for such airdrops are only 2%, indicating that traders don’t expect it to happen in the second quarter.

The base airdrop is notable and could be valued at billions of dollars. Arbitrum, smaller than the base, will have a fully diluted valuation of $3.9 billion, while optimism is $3.07 billion. Polygon (POL)’s FDV is $2.46 billion. This means that the base may give a higher rating.

read more: Coinbase Breach Strikes Paypal Mafia Royalty, Sequoia Capital Boss