Bitcoin showed some momentum today, topping the $93,000 milestone, as active buying was seen across the digital currency market. According to on-chain data, Bitcoin stored on Binance is in retreat despite rising prices.

Decreasing supply on major exchanges is one of several factors cited by traders as a tightening of coins available for sale.

Binance reserve shrinks

According to CryptoQuant analysis, Binance’s Bitcoin reserves are decreasing as more coins are leaving the exchange. Part of that change will come from holders moving their funds into private cold wallets for safekeeping.

According to the report, large buyers in the US (including spot ETF operators) are also taking coins off the market and depositing them with custodians.

These moves could reduce the float available to traders and put upward pressure on prices as demand increases.

Why Binance’s Bitcoin reserves are decreasing

“Historically, these conditions have supported medium- to long-term price appreciation. Current trends suggest that Binance’s reserve decline is a normal reaccumulation phase.” – by @xwinfinance pic.twitter.com/g3TCG4o6GD

— CryptoQuant.com (@cryptoquant_com) December 3, 2025

Purchase and self-storage of ETFs

Analysts say U.S. spot ETFs are buying significant amounts of Bitcoin for their products. Funds from large issuers are held by trusted custodians rather than trading platforms.

At the same time, ordinary holders and whales frequently move their holdings into safekeeping during bull markets, indicating they have no plans to sell anytime soon.

Taken together, these trends explain why Binance’s reserves are dwindling as supply from the exchange dries up.

BTCUSD trading at $92,678 on the 24-hour chart: TradingView

Derivatives and clearing

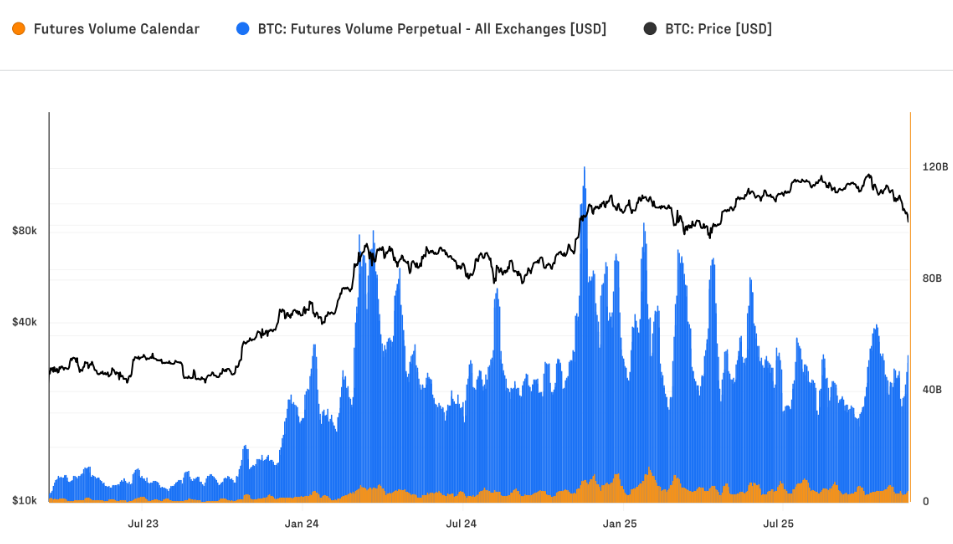

Derivatives activity also impacted recent foreign exchange balances. Daily futures wipeouts have increased from an average of about $28 million longs and $15 million shorts in the previous cycle to about $68 million longs and $45 million shorts this time.

The increase in evictions peaked on October 10th, when more than $640 million of long positions were liquidated per hour as Bitcoin fell from $121,000 to $102,000.

Open interest fell by about 22% in less than 12 hours, from nearly $50 billion at the time to $38 billion.

Market Activity in Bitcoin Futures. Source: Glassnode

still at a high level

Although these liquidations were dramatic, the futures market overall grew. Open interest reached a record high of $67 billion, and daily futures trading volume reached $68 billion.

More than 90% of its activity is in perpetual contracts, which tends to amplify short-term moves. This combination increases trading volume and increases the likelihood of sharp moves when sentiment reverses.

Noteworthy price levels

The market is eyeing the $92,000 to $94,000 zone as the main resistance area, according to traders. A daily close above this band could accelerate momentum toward $100,000.

Short-term support lies around $88,000 to $89,000, and we expect buyers to step in if the price pulls back. Trading volume on the busy day increased to nearly $86 billion, showing renewed interest from both retail and institutional participants.

Featured image from Safelincs, chart from TradingView

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.