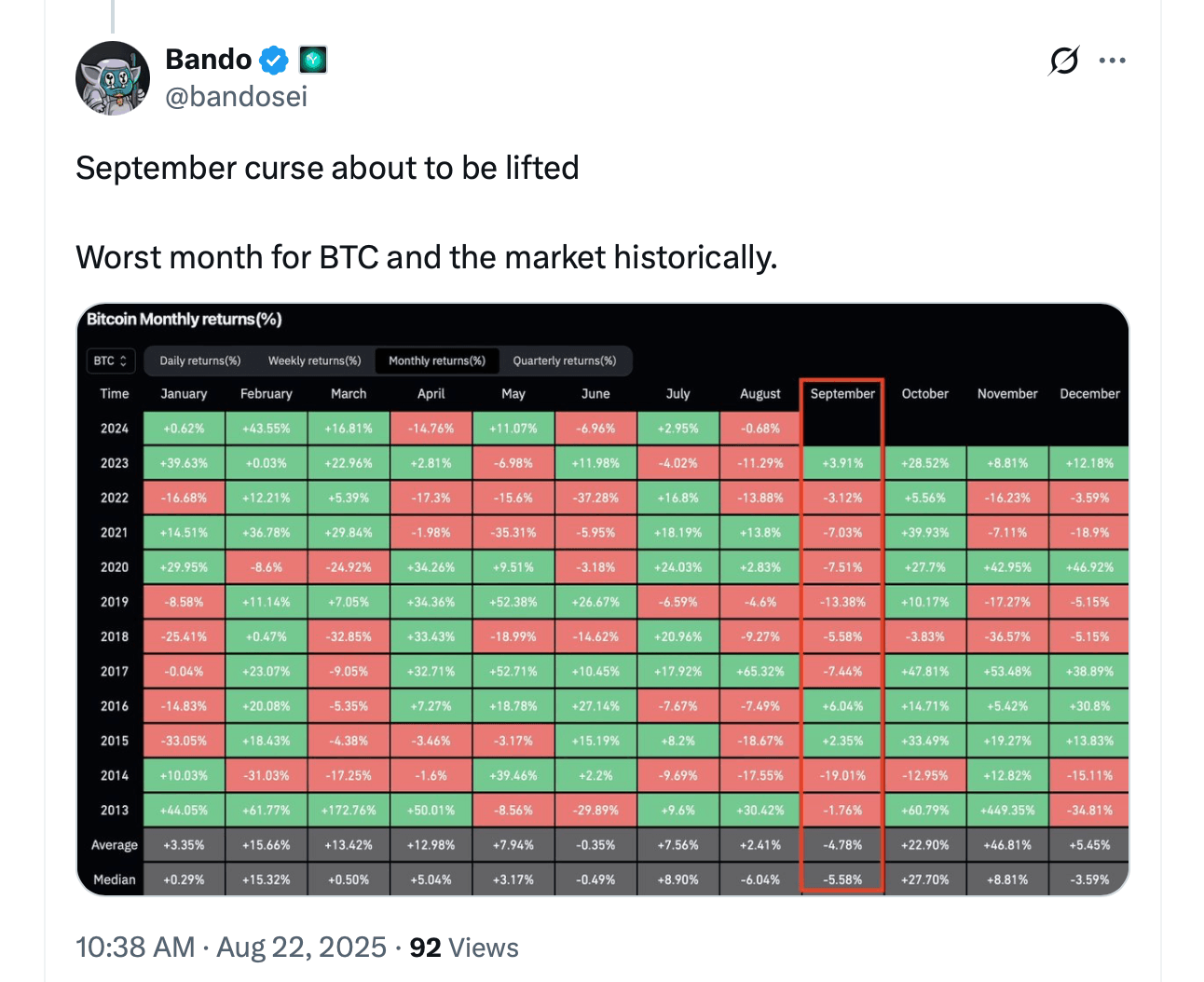

From 2013 to 2024, Bitcoin’s September performance became negative and caught up in the end of August, so chatter across social media is once again filled with the “Curse of September” talk.

From repository to tax drain: September mix can hit bitcoin again

September 2025 is only three days long, and as usual, traders are already weighing the outlook for Bitcoin for the month. Historical data from Coinglass.com shows that Coin often struggled in September.

I managed profits last year and 2023, 2016 and 2015. Historically, Bitcoin closed about 67% in September and will continue to close the conversation.

“For your information, September has been the worst month for Bitcoin returns in a long time. It’s the perfect time to stack up cheaply,” one user commented on X on Monday. “September isn’t just difficult with stock alone. It’s one of BTC’s weakest months since 2015,” Trendspider said.

Illya Gerasymchuk noted that the reporate rate will rise normally and borrowing will be slower at the end of the quarter, including September. X Account added that September 15th marks the US corporate tax deadline. This is a factor that emits global liquidity and often weighs the prices of assets, such as cryptocurrency.

Some believe this time it differs due to certain factors.

However, September is often a drug, but October and the entire fourth quarter usually brought positive momentum. Bitcoin closed October with 83% of the time in green. Just like the “Curse of September,” October has acquired its own lore and often lives on the nickname “Uptover.” Streak began in 2013 with a ferocious +60.79%.

In 2014, I slid to -12.95%, but in 2015, I heard a roaring sound at +33.49%, and in 2016 I was tacked at +14.71%. The 2017 rally saw a surge of +47.81%, but in 2018 there was a modest flooding of -3.83%. In 2019, it returned at +10.17%, and after +27.7% in the 2020s and +39.93% in 2021, it achieved even more lean stretch.