Bitcoin (BTC) long-term holders (LTH) spending activities suggest that they are increasingly confident in major cryptocurrencies.

The group’s spending activity has dropped to its lowest level in the last eight months, according to recent on-chain data shared by analyst Axel Adler Jr.

Large accumulation of 300,000 BTC

The group also purchased 300,000 BTC over the past 20 days. What stands out from the tweets chart is the sharp decline in LTHS spending. It is currently located at the bottom of historic range.

This trend indicates that people who have Bitcoin for a long period are not being sold, but are choosing to buy more.

In the past, similar behavior by these holders has coincided with the bullish era of the cryptocurrency market. The supply of BTC on cryptocurrency exchanges is low as long-term holders are not on sale. If demand remains stable or needs to continue rising, rarity will increase BTC prices.

Less than a month later, the accumulation of 300,000 BTC by this group of Bitcoin holders reflects the long-term outlook and belief in rising prices for key cryptocurrencies.

Many would have expected that some of these holders would benefit if BTC returned to their previous peak prices. But the opposite is true. The group, who has experienced multiple market cycles, has doubled their holdings.

Lower new supply (half after the last BTC) and a decline in existing supply are a combination that can increase the price of BTC, and demand remains.

The long-term holder cost basis (the average price these investors purchased BTC) also serves as a psychological floor. Long-term holders often intervene to buy when BTC prices fall near this level.

The bullish BTC signal returns

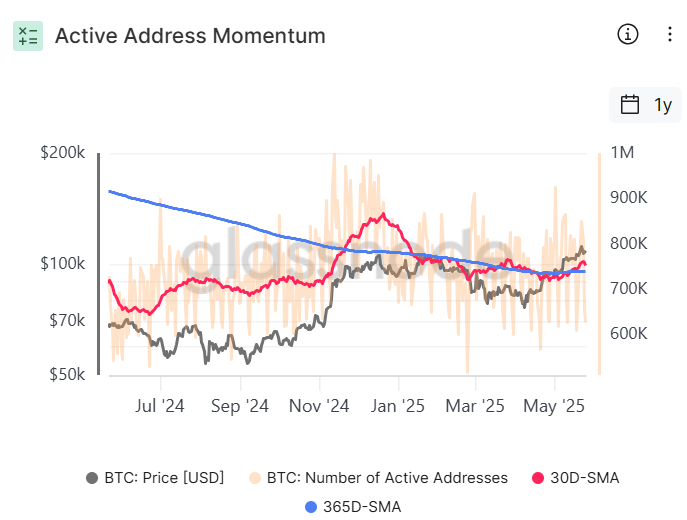

New data from GlassNode shows that the number of unique BTC addresses is on an upward trend, indicating an increase in transaction activity and user engagement on the network.

The 30-day SMA rose above the 365-day SMA in the second half of 2024, peaking in January 2025.

The 30-day average then fell below the 365-day average, suggesting a cool-off period. This crossover usually acts as a bullish signal and occurs when the short-term momentum of user activity exceeds the long-term average.

Over the past few weeks, the 30-day average has once again exceeded the long-term average. This new crossover could set the stage for a strong market stage.