The cryptocurrency market, especially Bitcoin and Ethereum, worked very well in the second quarter of 2025. This is in stark contrast to first quarter performance. The best cryptocurrencies have used this bullish momentum to jump to a new all-time high, over $111,000.

Similarly, Ethereum prices began their own revival, regaining the $2,000 mark in early May. Despite the uncertainty in the brewing market due to the escalating tensions between Israel and Iran, Bitcoin and Ethereum have managed to float.

US investors are floating crypto prices

In a new post on the X platform, on-chain analyst Burak Kesmeci revealed that US investors have been active in the market over the past few weeks. Analysts at Crypto explained that this is correlated with the prices of Bitcoin and Ethereum, which have withstanded bear pressure in recent weeks.

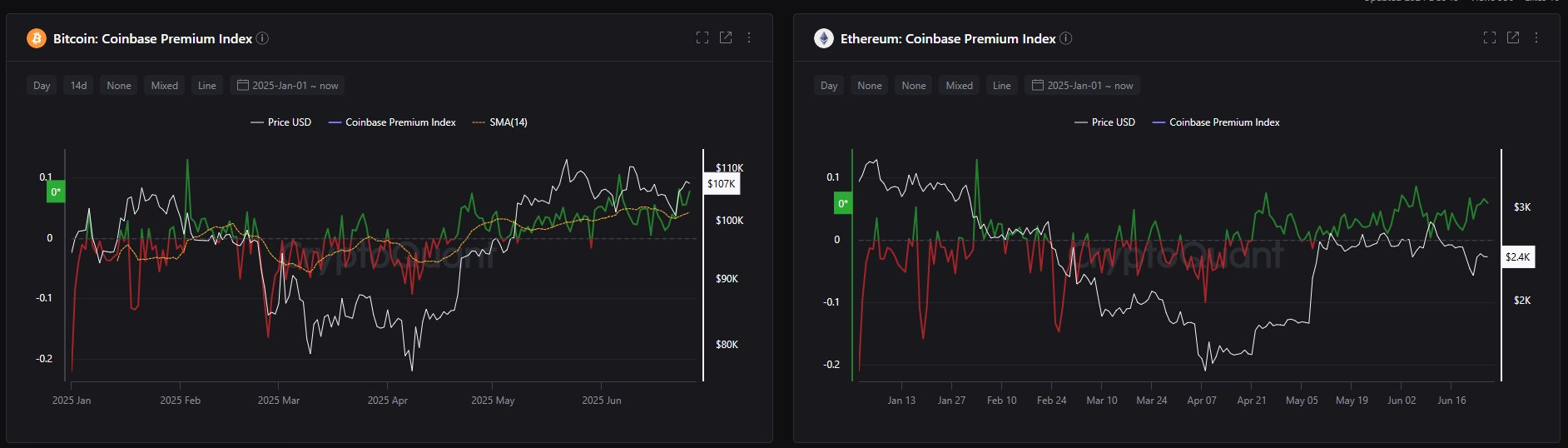

This on-chain observation is based on the Coinbase Premium Index, which tracks differences in crypto prices for US-based Coinbase Exchange (USD pair) and Global Binance Exchange (USDT pair). This metric reflects the sentiment of US institutional entities (the major players in Coinbase) compared to global exchanges.

Usually, if Coinbase’s price premium has a positive value, it means an increase in demand from US investors willing to spend more than other global investors to buy cryptocurrency (in this case, Bitcoin and Ethereum). Conversely, Coinbase Premium Index falls under the zero mark signal that US investors make fewer purchases than global traders.

According to Kesmeci, the Bitcoin and Ethereum Coinbase Premium Index (except for the sudden DIP at BTC on May 29th) has been in positive territory since May 9th, 2024.

Kesmeci added:

In the US, institutional investors and Bitcoin & Ethereum ETF investors (except fidelity) continue to make bulk purchases through Coinbase (and there are weeks). This is why Coinbase Premium has shown strong positive momentum. For this reason (in my opinion), despite the crisis, we have not seen a sharp drop in Bitcoin or Ethereum in the market.

Essentially, on-chain analysts believe that Bitcoin and Ethereum prices have been able to survive the storm due to rising Asian tensions as US investors operate in the market. Naturally, risk assets tend to succumb to bear pressure in unstable situations such as wars and global pandemics.

Bitcoin and Ethereum prices

At the time of this writing, the BTC priced around $107,100, not reflecting any significant movements over the past 24 hours. Meanwhile, ether tokens are valued at around $2,420, with a price increase of just 0.6% over the past day.

ISTOCK featured images, TradingView chart