Bitcoin Rose and US stocks shook Wednesday after the Fed kept its interest rates untouched and warned of rising threats to both employment and prices.

The S&P 500 closed 0.1% higher after a messy session. Dow Jones added 237 points (0.6%) in a jump in Disney’s stock.

The NASDAQ, which suffered technical losses, slid 0.3%. The Federal Open Market Committee said it has maintained its one-night borrowing rate, which is in the same location since December, at 4.25% to 4.5%.

The Fed condemns tariffs, Trump doubles

Fed head Jerome Powell told reporters that if there is still a “significant increase in tariffs” currently on the table, the country could face slower growth, long-term inflation and increased job losses. “They could lead to slower economic growth, increased long-term inflation and increased unemployment,” Powell said. His comments were not subtle.

The response from the White House was not subtle either. President Donald Trump spoke with reporters on the same day and said he would not roll back tariffs in China despite talks scheduled for the weekend in Switzerland. His trading team is scheduled to meet Chinese officials, but there is no promise of compromise.

David Kelly, Chief Global Strategist at JPMorgan Asset Management, said on CNBC Power Lunch“This is a somewhat hawk statement.

“We are not going to rush to cut fees as there are risks on both sides of our mission. I said The Fed’s message was clearly aimed at the Trump administration.

“Reading between lines, “Your policies have led to higher inflation, higher unemployment.”

Tech stocks dragged the market while policy drama unfolded in DC. The alphabet has dropped by around 8%, and Apple lost 1.5% after Bloomberg Report revealed that Apple plans to add AI-driven search tools to Safari, and that it will replace Google as its default search partner.

Bitcoin rises when traders make profits

Outside of Wall Street, Bitcoin traded about $96,500 shortly after the Fed’s announcement. It’s an increase of 1.7% in just an hour. Coingecko data BTC showed a 22% rise last week. But it’s not just overflowing with new money – investors are actively taking profits.

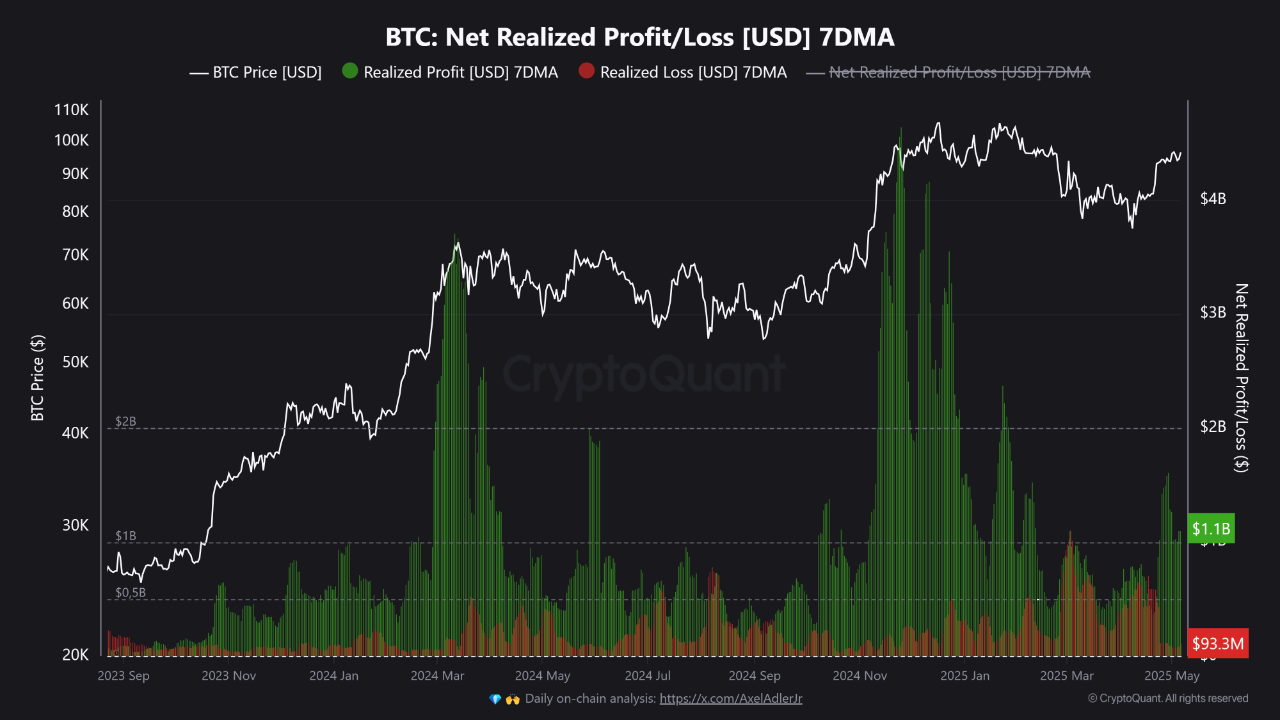

According to a May 8 post from Cryptoquant, Bitcoin’s seven-day moving average against net profit/loss has been strong and positive since early 2024. It currently exceeds $1 billion a day. It’s not as wild as the November-December surge 2024, but it’s enough to raise your eyebrows.

Cryptoquant has linked this trend to late stage bull market behavior. Traders are making profits while prices continue to rise. They were referring to previous cycles like 2021. In this cycle, this exact pattern occurred before local tops or sudden corrections. This time they said the market looks the same.

Since the introduction of SPOT ETFs in January 2024, the structure of the crypto market has changed. But the behavior is not the case. Encryption I wrote it The tools are new, but the way you think is exactly what it used to be: “Same behavior, a bigger scale.”

They warned that as long as the profits realized remain this high, the chances of pullbacks will increase. If profits are slower, it may be a sign that the market is entering a new stage.