After a strong rebound from the $102,000 region last week, Bitcoin prices today trade around $109,100, slightly below the $110,000 barrier. BTC is currently compressed into symmetrical triangles on the daily chart, but the 4H structure remains bullish beyond the $107,000 short-term support. Derivative funding has been slightly positive, suggesting a long and cautious optimism ahead of a potential breakout.

What will happen to Bitcoin prices?

BTC price dynamics (Source: TradingView)

Daily charts show that BTC continues to respect well-formed symmetrical triangular structures. The Bulls have defended the $105,000-$106,000 zone multiple times since late June, with the latest bounce returning the price to an upper-diagonal resistance of around $110,000. This resistance overlaps with horizontal supply, making it difficult to crack.

BTC price dynamics (Source: TradingView)

The 4H Supertrend has turned bullish over $107,270, but the candle continues to close beyond the short-term ascending trendline that began to form from the June lows. The structure remains compressed until BTC exceeds $110,000 or below $107,000, setting a stage of greater directional movement.

Why are Bitcoin prices falling or rising today?

BTC price dynamics (Source: TradingView)

Why Bitcoin prices are falling or rising today depends on weakening the momentum and mixed signal across the time frame. On the 30-minute chart, MACD has begun to flatten after the recent bullish cross, with histogram bars shrinking, indicating a decrease in momentum. Meanwhile, the RSI remains neutral at 56.5, with no immediate divergence and no confirmation of continuity of trends.

BTC price dynamics (Source: TradingView)

On the 4H chart, BTC faces rejection near the upper bollinger band ($109.5k), while VWAP resisted resistance slightly above the current market price. This is a daytime rise. Furthermore, parabolic SAR dots outweigh prices, suggesting short-term trend fatigue.

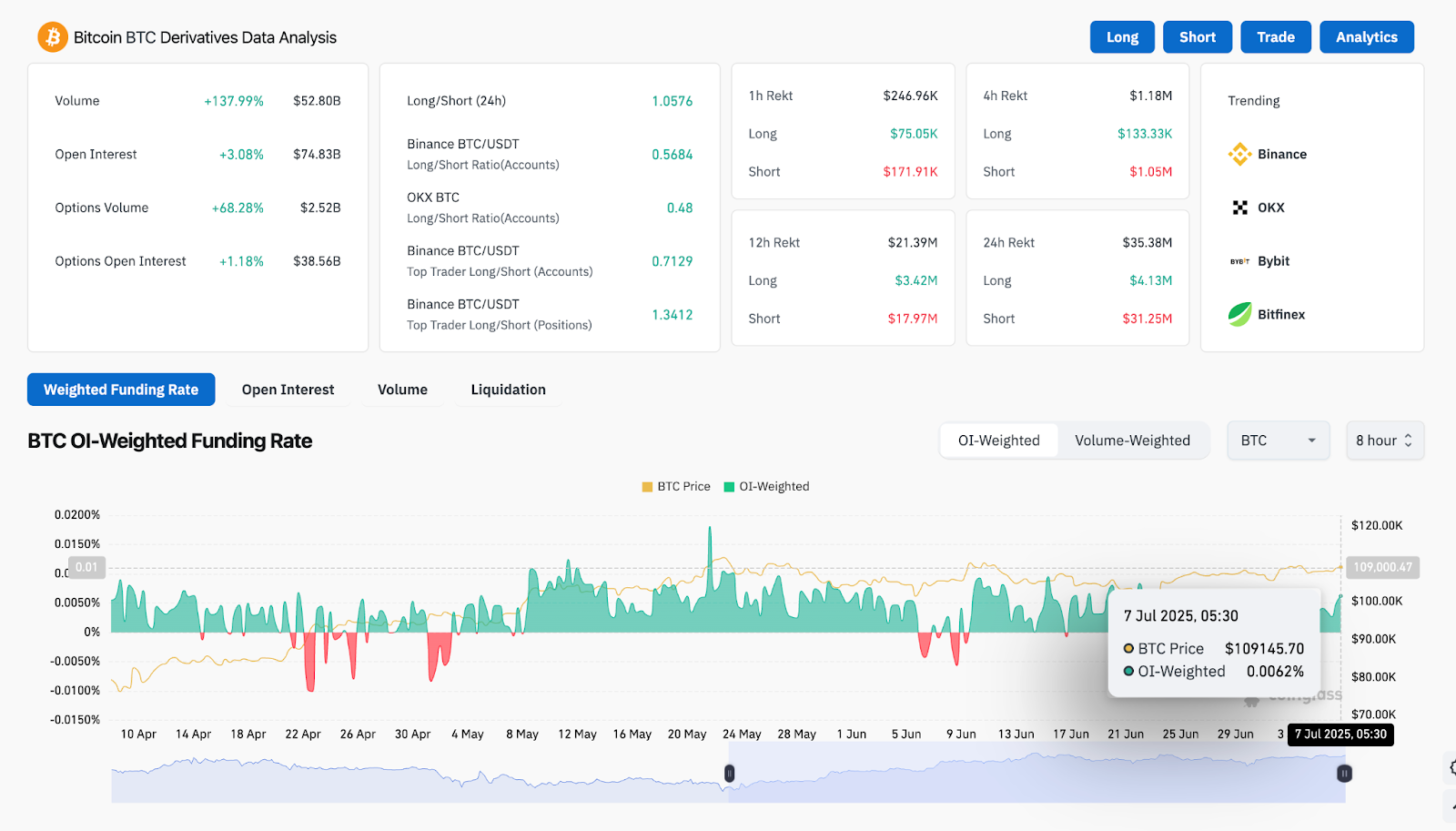

BTC Derivative Analysis (Source: Coinglass)

However, the funding rate has been slightly positive, with open profits increasing by more than 3%, suggesting that offensive shorts could face pressure if BTC breaks above the triangle.

Compression is built as BTC prices fall below $110K

BTC price dynamics (Source: TradingView)

Several metrics show that Bitcoin’s price volatility can quickly increase. On the 4H chart, the Bollinger band begins to squeeze again, with Price riding in the midband. This usually precedes a breakout move.

The EMA ribbon shows alignment. 20/50/100/200/200 EMA is stacked between $108,500 and $106,200 and now serves as dynamic support. If the BTC holds above this zone, the Bulls retain structural control. The Directional Movement Index (DMI) shows a modest bullish bias with +DI (24.65) above -DI (13.64), but ADX remains below 20, suggesting that trend intensity has not returned completely.

BTC price dynamics (Source: TradingView)

From a smart money perspective, the latest chocks and liquidity suggest that the bears were unable to gain control over liquidity sweeps on the daily charts between $102,500 and $105,000. The current push targets weak heights around $110,500.

Bitcoin price forecast: Short-term outlook (24 hours)

BTC price dynamics (Source: TradingView)

The Bitcoin price structure remains in the tightening range, but the bullish defense of the $107,000 and repeated supply zone taps means a tap of about $110,000. If the BTC can exceed $110,500, you can open a run heading from $113,500 to $115,000. On the downside, the $105,000 and $102,500 will recur as they failed to hold $107,000.

Given the low volatility and mixed metrics, BTC could remain in the range within $107,000 to $110,500 in the short term. Traders should closely monitor volume spikes and triangle breakages.

Bitcoin Price Prediction Table: July 8, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.