Today’s Bitcoin prices are trading around $106,950 after facing a denial from the $108,000 resistance zone early in the session. Over the past 48 hours, Bitcoin price action has remained choppy as assets navigate between the main supply zone and the short-term order block.

BTC price dynamics (Source: TradingView)

Refusal near the red liquidity area featuring character change (Choch) confirms sellers defending the $108,800-110,000 range. However, the Bulls hold the structure and still outweigh the $106,000 demand zone.

What will happen to Bitcoin prices?

BTC price dynamics (Source: TradingView)

A closer look at the four-hour chart shows that after testing the overhead imbalance zone, Bitcoin’s price has been boosted. Despite the bearish reaction, Price has not violated the recent bullish chotch support formed at nearly $105,900. The Bollinger band shows an expansion of volatility, but the upper band’s rejection coincides with the local top. Meanwhile, prices hover between $106,270 and $106,530 near the 20/50/100 EMA cluster, keeping the trend neutral in the short term.

BTC price dynamics (Source: TradingView)

On the daily charts, Bitcoin prices are today limited to a significant resistance of $109,870. That level is consistent with FIB confluence and historical rejection zones, and will remain the Bulls’ ascending target if structure is preserved. On the downside, the $104,800-$105,300 green zone remains a critical support cluster to prevent deeper pullbacks.

Bitcoin (BTC) Price: Momentum weakens after rally

BTC price dynamics (Source: TradingView)

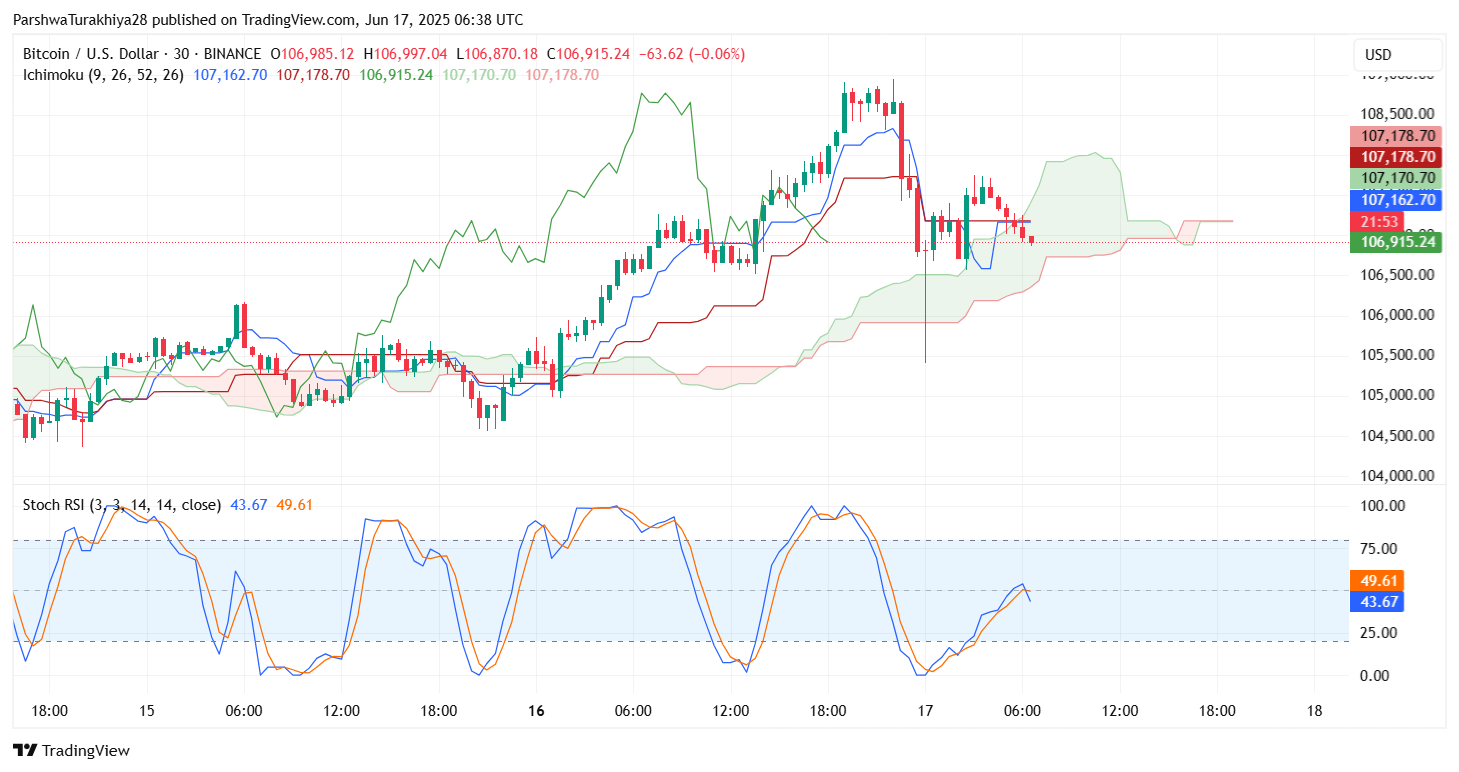

The short-term momentum indicator suggests fade strength. The 30-minute RSI shows fatigue after hovering near the over-acquired territory on June 16th, dropping to 42.5. MACD shows bearish crossovers that reduce the momentum of the histogram and supports the idea of temporary pullbacks.

BTC price dynamics (Source: TradingView)

One cloud in the lower time frame suggests short-term integration before the flat cloud first hover near the flat cloud, causing the next impulse to move. However, it indicates that the seller is currently lacking complete control, as it has not completely left bullish territory.

Bitcoin price forecast: VWAP and OBV support attention

BTC price dynamics (Source: TradingView)

The 30-minute chart’s Volume Weighted Average Price (VWAP) line shows the price that returns to an average return at $106,500, a level that intersects the Supertrend Flip Zone. Prices exceed session VWAP, but narrow bands suggest compression.

BTC price dynamics (Source: TradingView)

The on-balance volume (OBV) has been flattened, confirming that volume participation has stagnated during recent travel. However, the BBP indicator remains positive, suggesting a potential rebound if the buyer returns to a lower level. However, confirmation from the influx of fresh volumes is still pending.

Why is Bitcoin price dropping today?

BTC price dynamics (Source: TradingView)

Today, the reason for the price of Bitcoin is back to a denial from the Red Smart Money Concept Supply Zone, which is around $108,800. The area has historically caused a sale, and failing to break through the ceiling on Friday has resulted in short-term profits. Coupled with a drop in momentum and a drop in purchases, a corrective action, below $107,000, was triggered towards Monday’s session.

BTC price dynamics (Source: TradingView)

The Directional Motion Index (DMI) also shows the flattening of ADX while di+ and di- remain intertwined and indecisive rather than trend strength. This environment will help the Bulls look at mild vision from mildly weaker vision in the short term, unless they regain $108,200.

Short-term Bitcoin (BTC) Price Forecast

Over the next 24 hours, Bitcoin prices are expected to range from $106,200 to $108,000. This trend remains a bit bullish as long as $105,800 in support is retained. A clear break and closures above $108,200 pave the way for $109,870. Meanwhile, a loss of $105,300 could attract sellers targeting $103,600, or in some cases $100,000, in the case of a volume expansion.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.