Bitcoin (BTC USD) is often traded in parallel with the US stock market index, the Nasdaq Composite, and the S&P 500.

However, Onchain Data Analytics Provider Cryptoquant revealed a negative correlation between Bitcoin and Nasdaq.

Bitcoin prices have risen by more than 10% in the past week, but Nasdaq has plummeted dramatically within the same period.

Insights on Chart Separation

Cryptoquant shared a screenshot of the correlations between the BTC and S&P 500 indexes in the X-Post.

The chart shows that the historical correlation between BTC USD and the stock market is broken. The stock market and BTC are currently moving in the exact opposite direction.

Cryptoquant analyst Oinonen_t noted that Bitcoin correlation with NASDAQ, which is 0.91, fell to 0.83 in January.

Image Source: x Encryption

Similarly, the correlation with the S&P 500 fell from 0.88 in the second half of 2024 to 0.77.

Bitcoin prices have been relatively stable since US President Donald Trump declared a moratorium on global tariffs.

Flagship coins rose 10.3% last week. The weekly spikes are as Bitcoin continues to collect $90,750, up 3.3% from the “liberation day.”

Meanwhile, traditional assets trembled. The NASDAQ and S&P 500 indexes have fallen by 4.6% and 5.2% over the past month, respectively.

Decoupling of Bitcoin from traditional “risk-on” assets marks the beginning of a major change.

This shows that Bitcoin’s unique value proposition is increasingly resonating with investors with rare, decentralized, globally accessible assets.

As more investors adopt Bitcoin amid ongoing geopolitical tensions, BTC prices are expected to reach an all-time high.

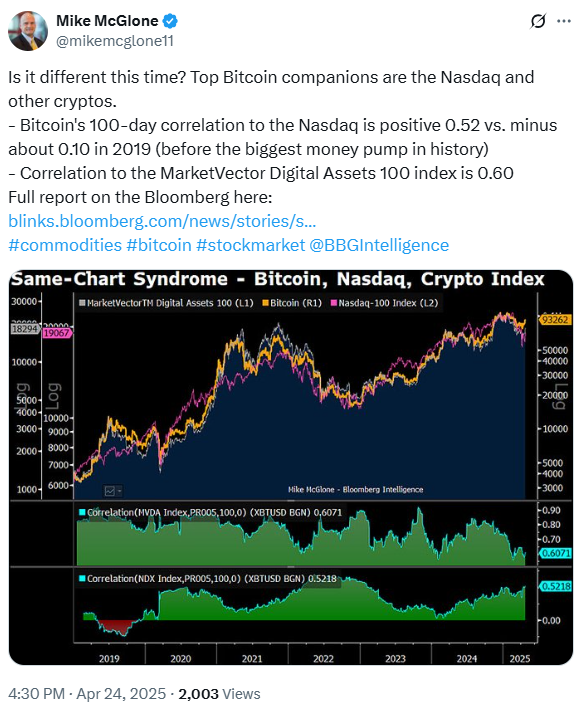

Correlation of BTC USD with Nasdaq becomes positive

Mike McGron, senior community strategist at Bloomberg Intelligence, focuses on Bitcoin’s correlation to his 100-day correlation with the Nasdaq. He noted that the correlation is preferred at 0.52.

Image Source: Mike McGlone from X

This value shows a major move from the negative values recorded in 2019 (before the largest money pump in history).

During this period, the correlation fell to -0.10. It is important to note that 100-day correlations often change to negative changes during or after a significant bitcoin drawdown.

Simply put, “positive” correlations indicate that Bitcoin and Nasdaq are moving in the same direction.

On the other hand, negative correlations indicate that assets are moving in the opposite direction.

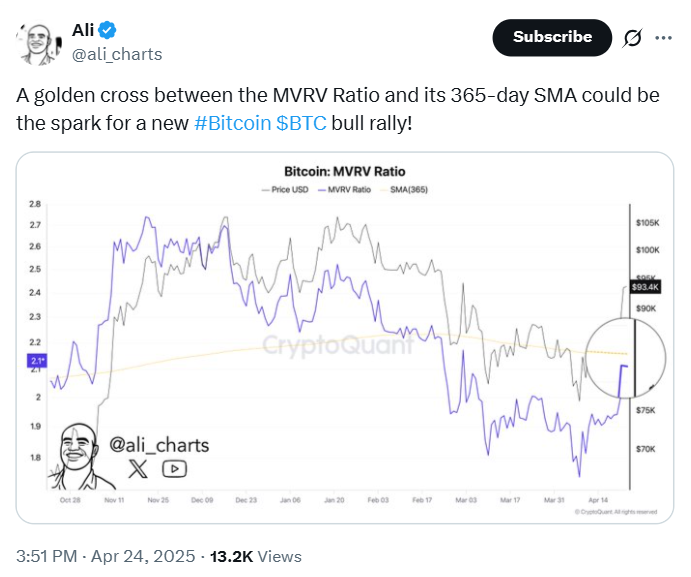

Market Analyst Spotlight Bulling Signal

The BTC USD price traded at $93,529 at press, up 0.13% over the past 24 hours. Bitcoin has moved past a critical important level, but market analysts claim that more gatherings are ahead.

Popular on-chain analyst Ari Martinez is shining the spotlight on key bull signals from major cryptocurrencies.

Image Source: Ali Chart for x

Analysts noted that a golden cross pattern was formed between the MVRV ratio and its 365-day SMA. Ali claims that this pattern could indicate a continuation of the ongoing Bitcoin Bull Run.

In particular, when the short-term moving average crossed above the long-term moving average, a golden cross appeared, maintaining its potential upward momentum.

Market analysts show the $92,000 level as key support for the BTC chart.

Currently, as Bitcoin outweighs this important support, MVRV and the 365-day SMA golden cross could enhance bullish sentiment.

Bitcoin can easily surpass the $100,000 psychological level in the coming days.