Since hitting a new all-time high in January, Bitcoin (BTC) has struggled to establish bullish shape, bringing a decline that has continued for the past two months. According to renowned market analyst Egrag Crypto, the best cryptocurrencies could continue to be revised for the next few months before they start a price rally.

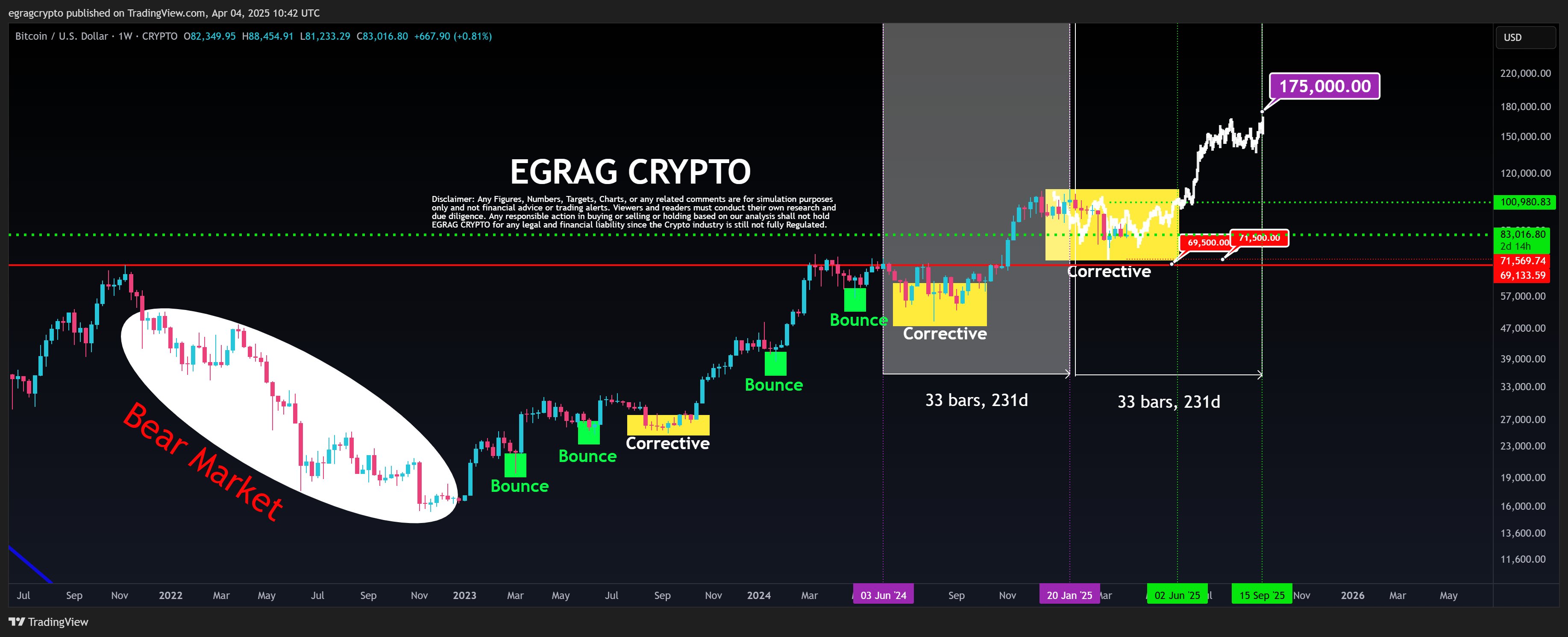

Bitcoin’s 231-day cycle suggests a $175,000 target by September

Following the initial price decline in February, EGRAG Crypto had assumed that Bitcoin could experience a price correction due to the CME gap before it experienced a price bounce. However, the lack of strong bullish belief over the past few weeks has forced us to conclude that the best cryptocurrencies are stuck at a potentially long corrective phase.

According to Egrag, in a recent post, the continued revision of Bitcoin is consistent with the fractal pattern, that is, the recurring price structure displayed over multiple time frames. This pattern is based on a 33-bar (231-day) cycle in which BTC passes from the correction stage to an explosive price increase.

When comparing it to the previous and currently developing cycles, EGRAG predicts that Bitcoin could emerge from its recalibration by June. In this case, analysts expect Crypto Market Leader to reach the market top of $175,000 by September, suggesting a potential profit of 107.83% at current market prices.

However, to ignite this priced rally, the Market Bulls will need to ensure a breakout that exceeds the tough price range of $100,000. Meanwhile, the possibility could fall below the $69,500-$71,500 support price levels, which could disable current bullish setups and mark the end of the current bull run.

BTC investors wait when exchange activities slow

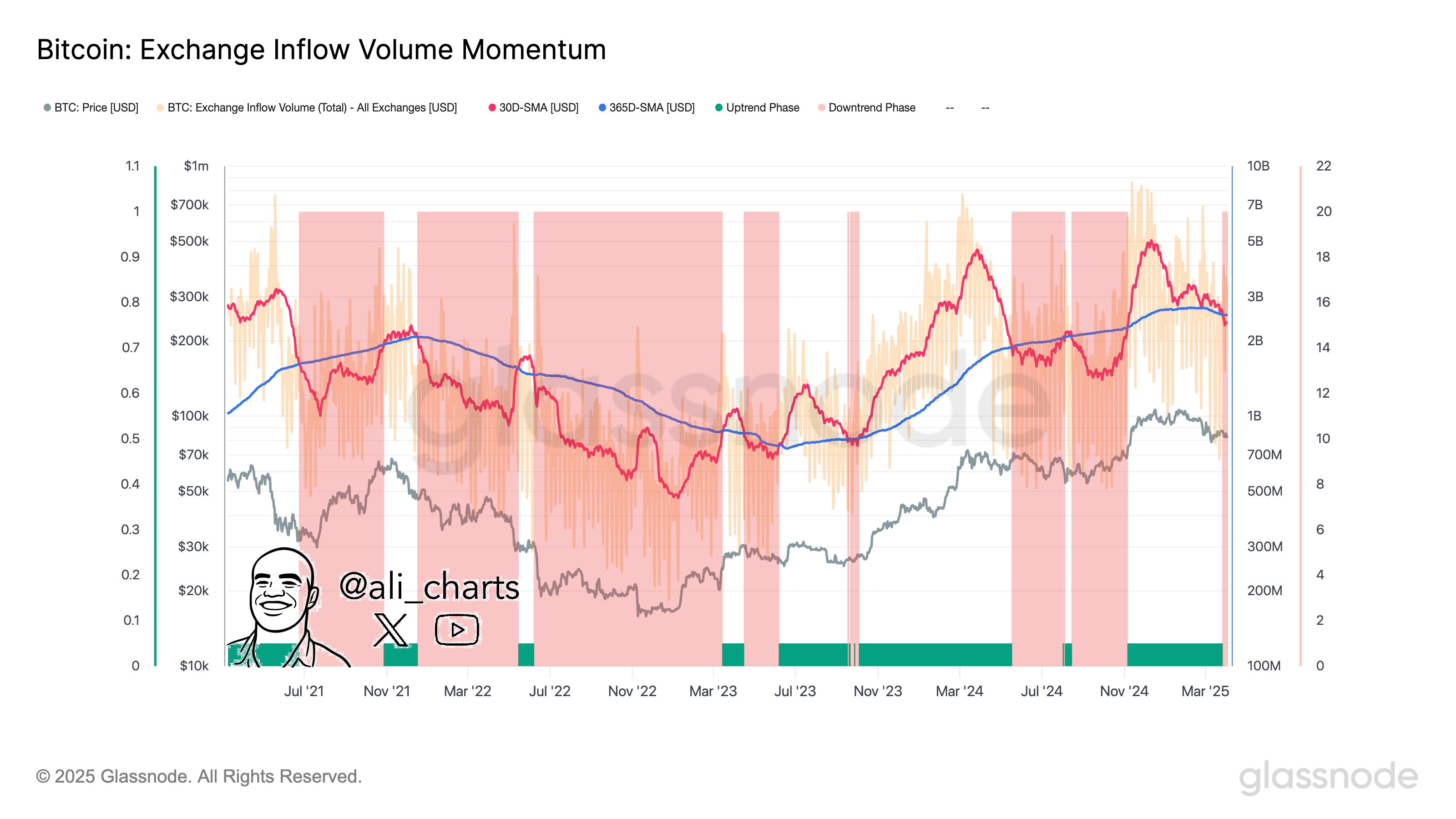

In other news, popular crypto expert Ali Martinez reports a decline in Bitcoin exchange-related activities, indicating a decline in investor interest and network utilization. In particular, this development suggests that investors are hesitant to deposit or withdraw Bitcoin in exchange, possibly due to market uncertainty regarding the immediate future trajectory of the assets.

According to Martinez, Bitcoin could undergo a trend shift as investors are waiting for the next market catalyst. In particular, Bitcoin shows admirable resilience despite the new tariffs imposed by the US government on April 2nd. According to Santiment data, BTC prices were only immersed by 4% in the time since the announcement.

Since then, BTC has brought several price increases, and now trading at $83,805 in a crypto market where investors have recorded an influx of $5.16 billion in the past day. Meanwhile, BTC trading volume has grown by 26.52%, valued at $43.4 billion.

UF News featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.