Bitcoin exchanged hands about $115,685 on Sunday afternoons, and the derivative desk was not sleepy as it was stacked with stacked futures and optional activities throughout the venue. Spot Market doesn’t even need drama. Positioning is talking about everything for now.

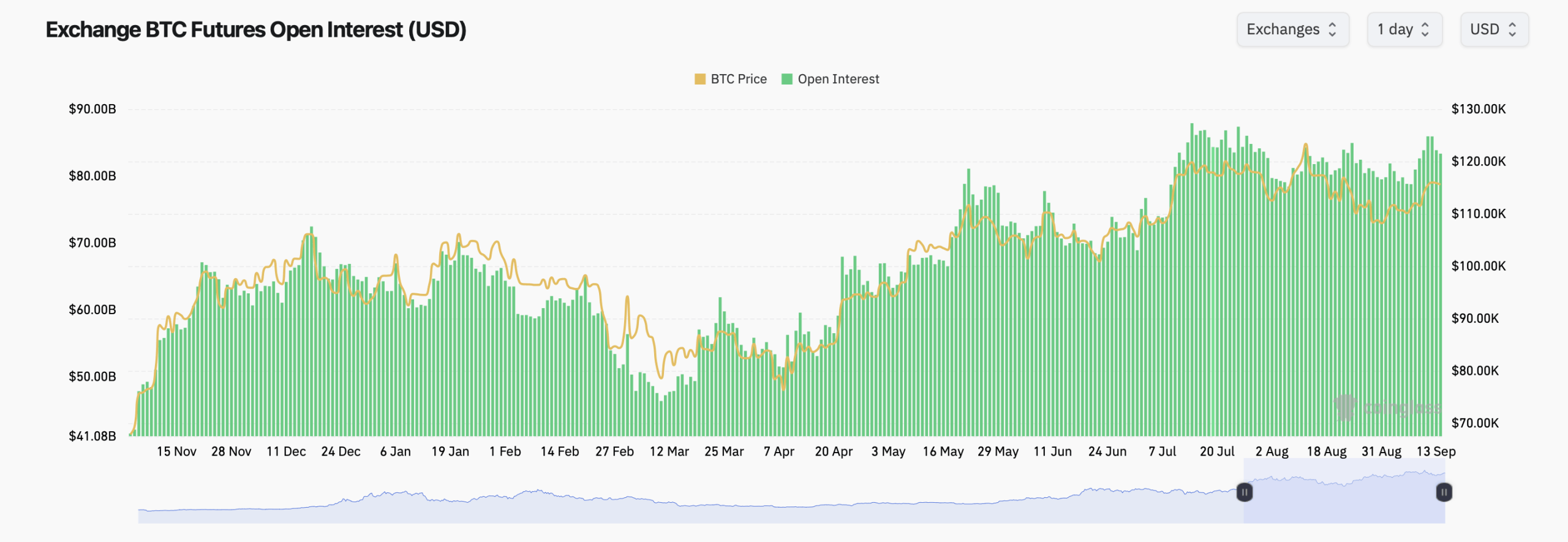

Bitcoin’s open interest approaches Cycle Highs

Futures first: According to statistics from Coinglass.com, Total Bitcoin (BTC) Open Interest (OI) is hovering near the $80 billion medium-term zone, increasing the pace near the height of the cycle. Among the 21 venues, CME has worn the crown with a public profit of $16.73 billion, equivalent to 144.81K BTC and a 20.08% share.

Bitcoin futures are interested on September 14th, 2025, according to Coinglass.com.

Binance continues at $147 billion (127.07K BTC; 17.63%), with Bybit holding $101.5 billion (87.82K BTC; 12.18%). Gate costs $8.69 billion (10.42%), OKX costs $4.53 billion (5.43%), and HTX costs $4.56 billion (5.47%). The Big Five operates the board firmly, but is wide in depth and extends to middle-class venues such as White Bit, MEXC and Coinbase.

Daytime dynamics are mixed. Kucoin’s 24-hour change is mild +0.91%, Bitunix +2.52%, some others are very flat, and Bingx is printing sharp -30.42%. The small book has $393.67 million in Bitmex and Kraken with $383.18 million, while Dydx holds $55.23 million. No matter how much you slice it, the futures complex remains thick, and the expected tally creeps up higher with the step with the spot.

The biggest pain keeps the price in the middle

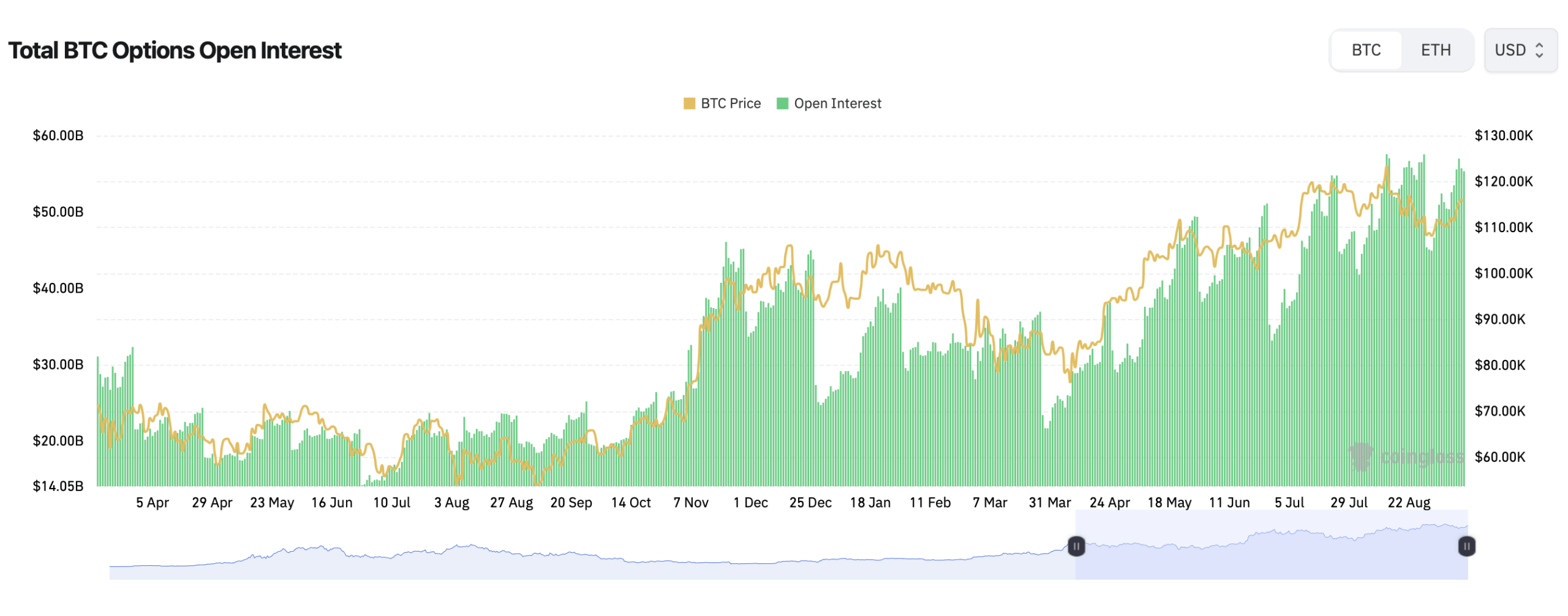

The optional numbers tell an equally vibrant story dominated by Delibit. Total Bitcoin Options Open Interest is around $500 billion and is leaning long. Call accounts for 59.97% (253,574.9 BTC) of 40.03% OI (253,574.9 BTC) at PUTS (169,270.6 BTC). However, the last 24 hours have been slightly defensive, skewed at 52.76% (4,070.3 BTC) of the volume and 47.24% (3,644.41 BTC) calls. Traders seem to be putting their energy into the long gamma, but they are paying for downside insurance.

Bitcoin options will be of interest on September 14th, 2025, according to Coinglass.com.

The heaviest lines of the board gather around the familiar battlefield. Top OI deals include a $95,000 put (10,113.6 BTC) on September 26, a $140,000 call (10,022.5 BTC) on December 26, and a $140,000 call (9,985.6 BTC) on September 26, bringing the $108,000 and $110,000 demand for $110,000 along with September chunky September. That mix is currently screaming out the scope with ambition.

The greatest pain levels are also listed in the reading material. The date is almost $115,000, with quarterly expiration of $110,000 on September 26th, with a year-end cluster of $100,000. Simple English: The biggest discomfort pathway continues to magnetize the magnet into a pocket of between $110,000 and $115,000 unless a fresh catalyst loosens it and loosens it.

Another scoreboard note: The dance of positions from the price still rhymes. As the spots rose from the end of summer, both Bitcoin futures and options climbed in tandem. Essentially, it means that more utilized positions stack up in the same direction, so when emotions turn around, liquidation, hedge flows simultaneously hit, allowing prices to be exaggerated.

Conclusion: Derivative arenas are fully loaded, CME and Binance are weighted necks and necks, options traders are bullish, but they are also well hedged. If the spot flirts in six figures, expect fireworks on September 26th.