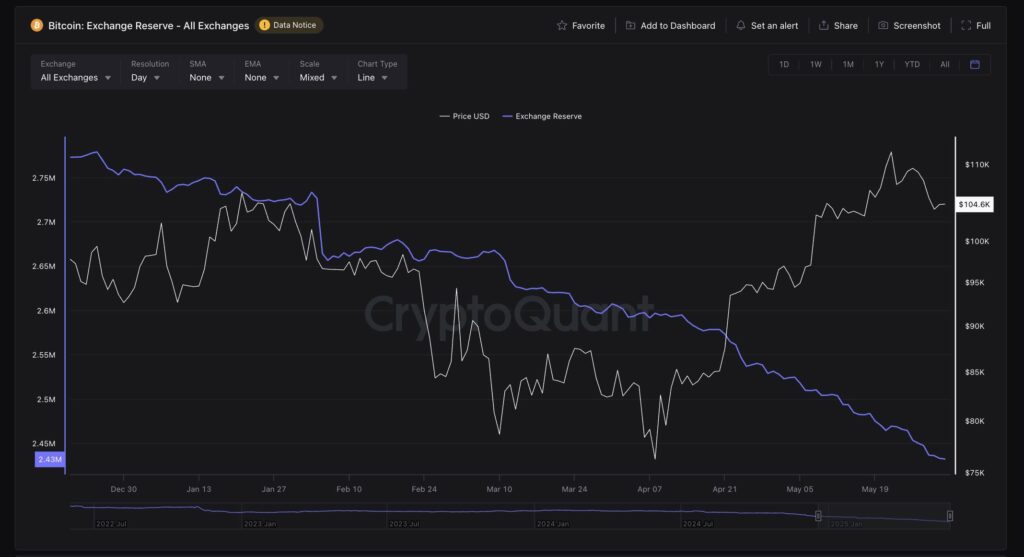

Bitcoin supply for exchanges has fallen to a lowest level, raising expectations for a potential surge in volatility.

According to Cryptoquant data, the total amount of Bitcoin (BTC) held by all centralized exchanges had fallen below 2.5 million BTC as of late May 2025.

The data shows a significant difference between replacement reservations and prices. The amount of Bitcoin held on the exchange is decreasing, but its value is increasing. In the cryptographic chart, this is shown by a white line moving upwards for the price and a blue line tilting downwards for the reserve.

Bitcoin prices and exchange reservations. Credit: Cryptoquant

Historically, the decline in Bitcoin supply on exchanges has raised prices, particularly when demand is high. This is seen by many analysts as indicating that the market may be about to enter a new phase.

You might like it too: Bitcoin price target: $113K if rare harmonic patterns are completed

Institutional accumulation appears to play a major role in the current market structure. Large holders, including wallets of 1,000-10,000 BTC, are steadily accumulating, with much of the BTC being sent to cold storage.

The strategy added 7,390 BTC in May, raising its total holdings of 576,230 BTC and about 2.75% of total supply, with an average price of $69,726. Other public companies, including GameStop and Japan-based Metaplanet, are also actively adding to their holdings.

Meanwhile, the Spot Bitcoin Exchange-Traded Funds has resulted in an influx of $5.23 billion over the past month, according to SoSovalue data. Several governments have followed suit. While the UAE and Pakistan have stepped up their accumulation efforts, US lawmakers are debating the creation of the National Bitcoin Reserve.

From a technical standpoint, Bitcoin appears to be in the waiting stage. The momentum indicators are mixed. The relative strength index is 52, showing neutral momentum, but the moving average convergence divergence has become slightly bearish. The short-term moving average shows downward pressure, but the long-term outlook remains.

Bitcoin price analysis. Credit: crypto.news

Bitcoin is far ahead of the 200-day EMA and SMA, but both are on an upward trend. If Bitcoin is able to recover its short-term moving average of approximately $106,000, the rally can continue to last at more than $110,000. However, if you can’t maintain support, you can reduce it by $98,000 or $94,000.

read more: Bitcoin prices will be receding as analysts promote the possibility of $1 million to $2.4 million