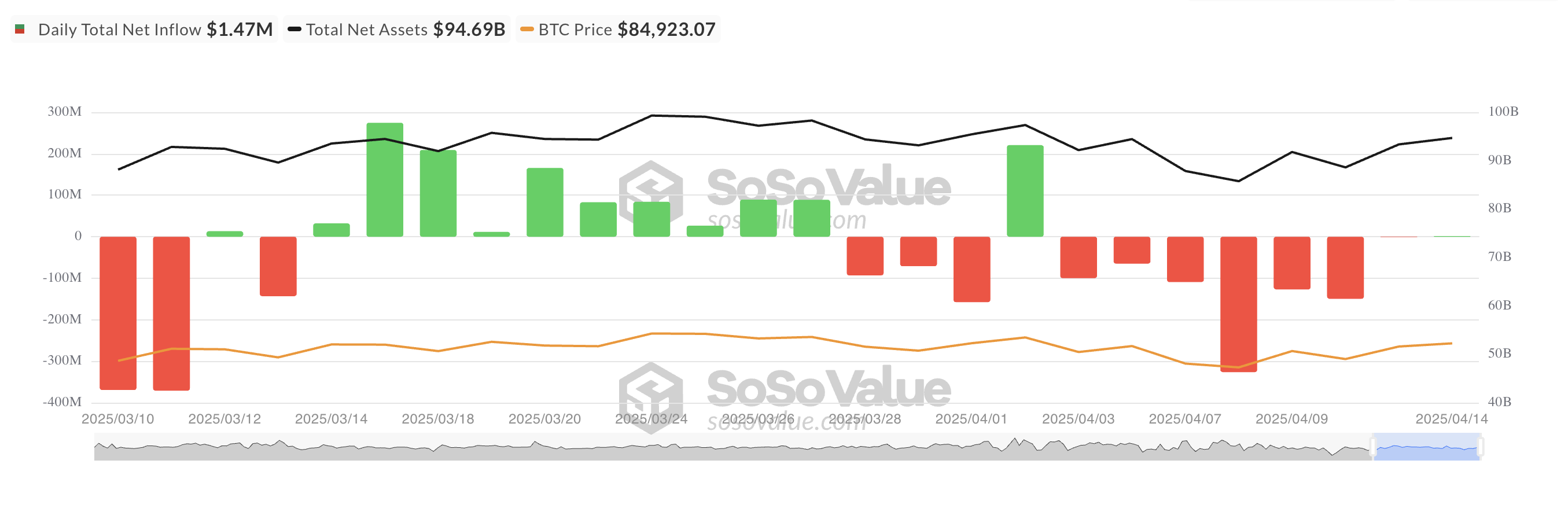

After seven consecutive days of leaks, institutional investors appear to have rekindled their love for Bitcoin ETFs. The US-registered Spot Bitcoin ETF posted its net inflow for the first time since April 2nd, drawing out fresh capital of $1.47 million on Monday.

Although this figure is modest, it marks a marked shift in sentiment and the first indication of a new institutional appetite for Bitcoin exposure through regulated funds.

Bitcoin ETF ends seven-day drought with a modest inflow

Last week, Bitcoin investment funds recorded a net outflow of $733.3 million as the broader cryptocurrency market was struggling to float amid the rising effects of Donald Trump’s escalating trade war rhetoric.

However, the tide may be beginning to spin.

On Monday, US list Spot BTC ETFS recorded a net inflow of $1.47 million, marking its first capital flow to these funds since April 2nd. The amount is modest, but it could break the drought for nearly two weeks and indicate a gradual change in institutional sentiment towards BTC.

Bitcoin spot ETF online inflow. Source: SosoValue

The largest net inflow of the day comes from IBIT in BlackRock, attracting $3,672 million. This will result in a total cumulative net inflow of $3.96 billion.

Meanwhile, Fidelity’s FBTC recorded its biggest net spill on Monday, cutting $35.25 million in a day.

BTC Derivatives Market is hot despite careful options flow

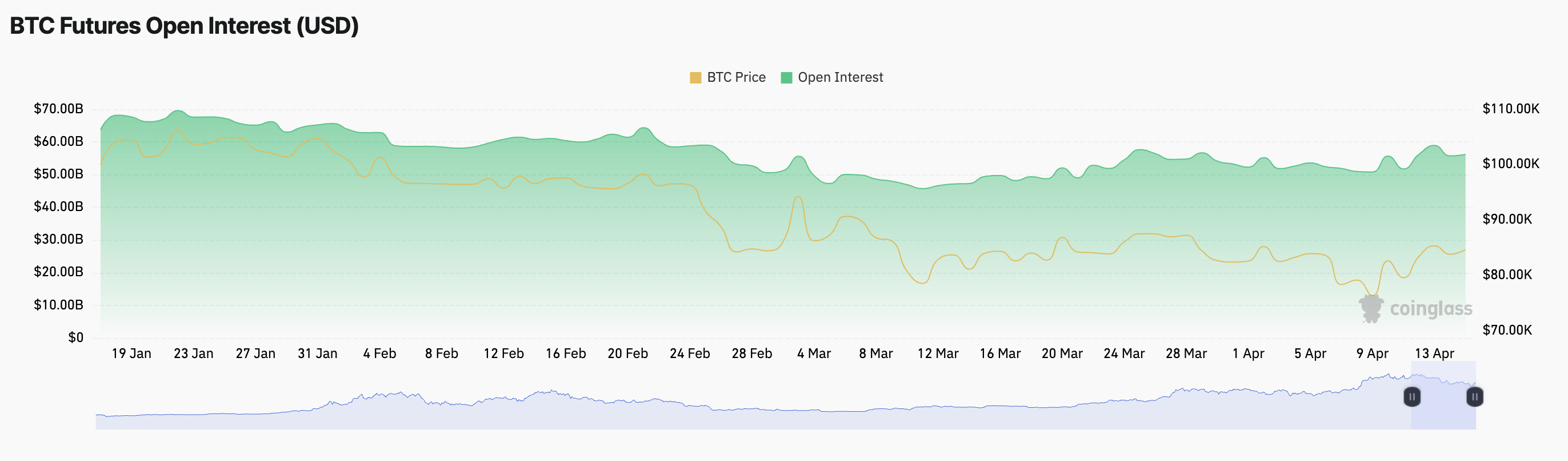

On the derivatives side, open interest in BTC futures has been higher over the past 24 hours, indicating an increase in derivative activity.

This was $56 billion, up 2% over the past day. In particular, during the same period, the BTC period rose 1.22%.

BTC futures are open to interest. Source: Coinglass

Open profits on BTC futures refer to the total number of unresolved futures contracts that have not yet been resolved. It suggests that rising prices during such a rise could lead to new money entering the market to support an upward movement, strengthening bullish momentum.

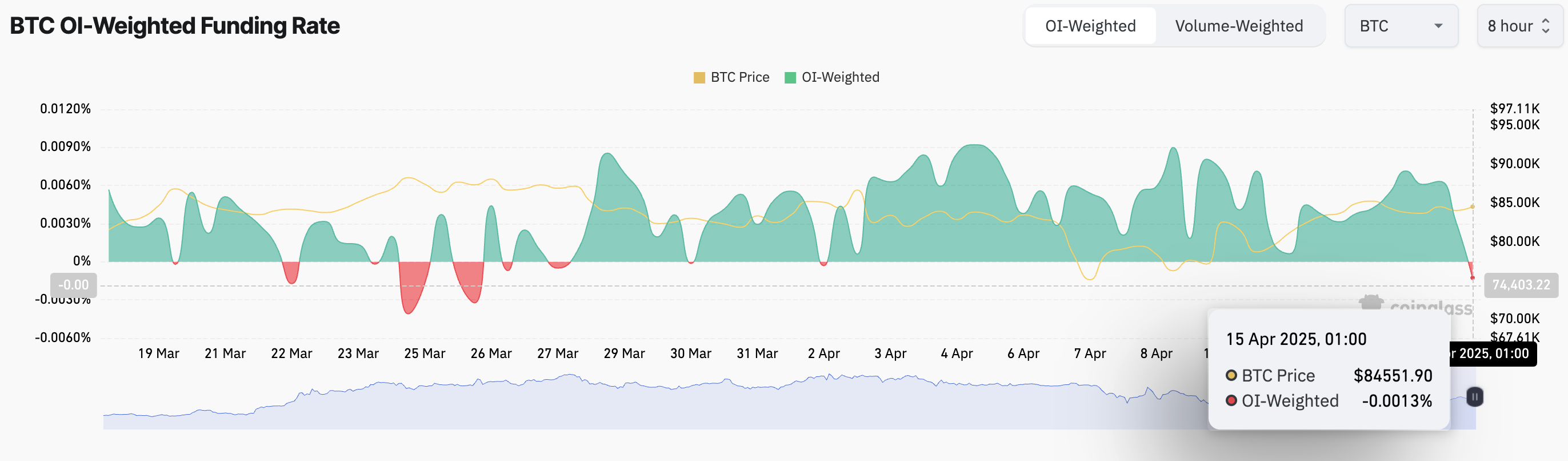

But there’s a catch. There is growing open interest in BTC futures, but the nature of these new positions appears bearish. This is evident in the coin’s funding rate. This is the first negative flip since April 2nd.

BTC funding rate. Source: Coinglass

This means that more BTC traders are paying to hold short positions over long. This suggests that more and more market participants are betting on potential pullbacks despite the modest influx into spot ETFs.

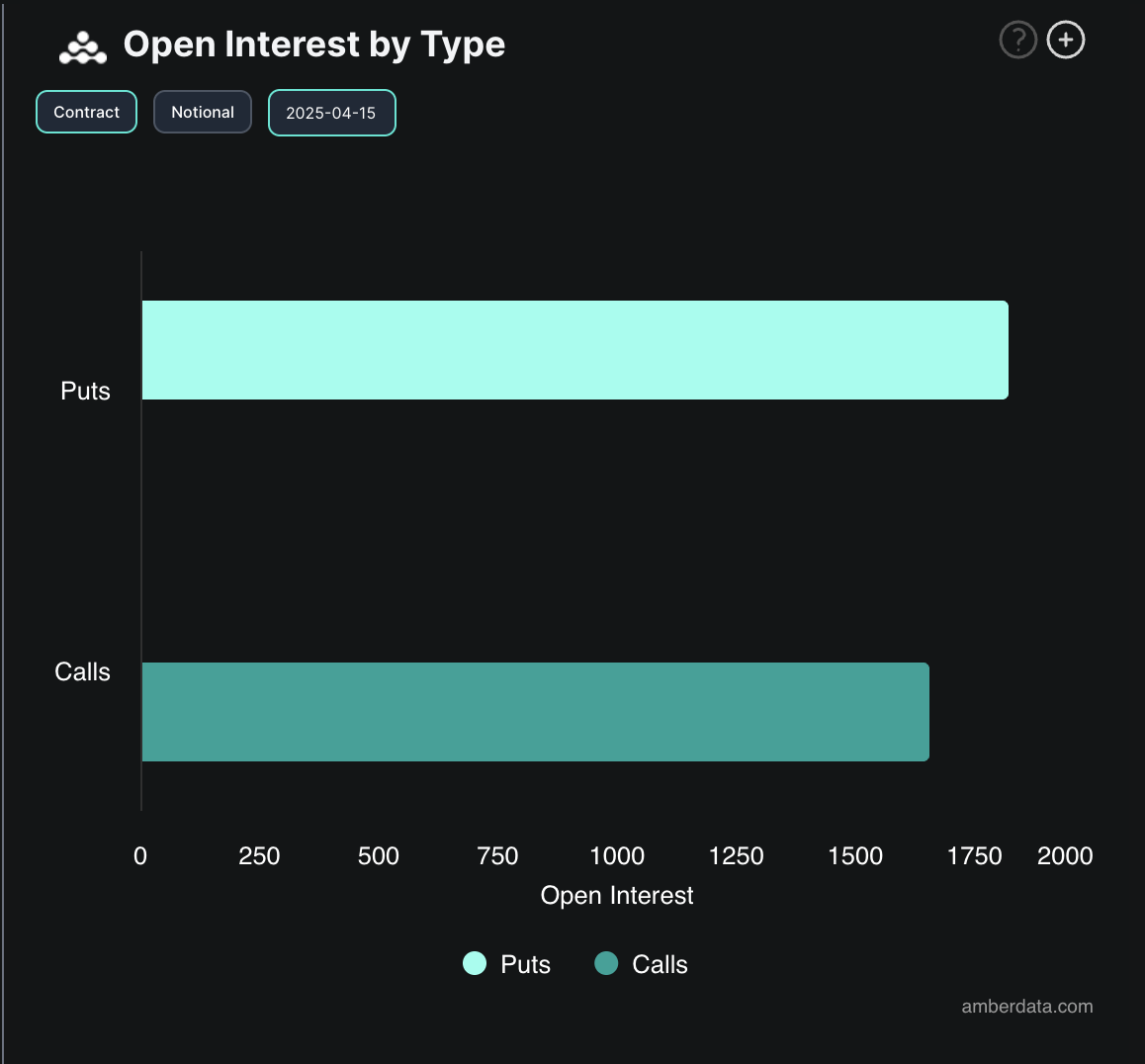

Furthermore, mood remains cautious on the options side. Today there are more contracts than Call, indicating that even if some traders are hedging bets or other metrics are bullishing, they may be predicting even more downsides.

Interested in BTC options. Source: Deribit

Still, in the case of the BTC ETF, the influx after two weeks of silence feels like a victory. With wider market sentiment about coins becoming increasingly bullish, it remains to be seen whether this trend could last for the rest of the week.