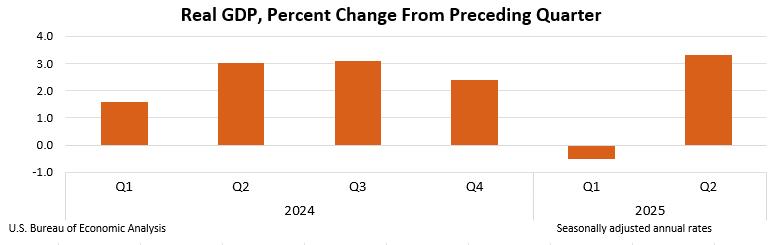

The U.S. Economic Analysis Agency (BEA) released better economic data than expected on Thursday morning.

A stronger GDP diagram than expected will lift BTC modestly

The US economy rose to past expectations in the second quarter, expanding 3.3% in the second quarter, according to a Thursday announcement by the Bureau of Economic Analysis (BEA). Economists had forecast where growth rates, from 3.0% to 3.1%, but the decline in imports, coupled with a surge in consumer spending, supported gross domestic product (GDP) and boosted the market, while Bitcoin (BTC) rose by a small amount.

(The US economy grew by 3.3% stronger than expected in the second quarter of 2025/US Economic Analysis Bureau)

Imports that cut GDP have skyrocketed by 29.8%. As imports subtract from overall GDP metrics, a decrease in imports, as reported today, results in an increase in GDP. Conversely, exports have an additive effect on GDP, with BEA reporting a slight 1.3% decline in export goods in the second quarter. The net effect was a massive decline in imports, largely due to the controversial tariff policy of the Trump administration, resulting in a higher than expected gross domestic product. Consumer spending increased by 1.6%, and added to GDP figures.

The stock market has been promoted in news on the S&P 500, Nasdaq and Dow, with all postings increasing by 0.31%, 0.60% and 0.09%, respectively. Bitcoin rose at a very modest 0.15% that day. This means that performance has been weak in the past four days, nominally.

Market Metric Overview

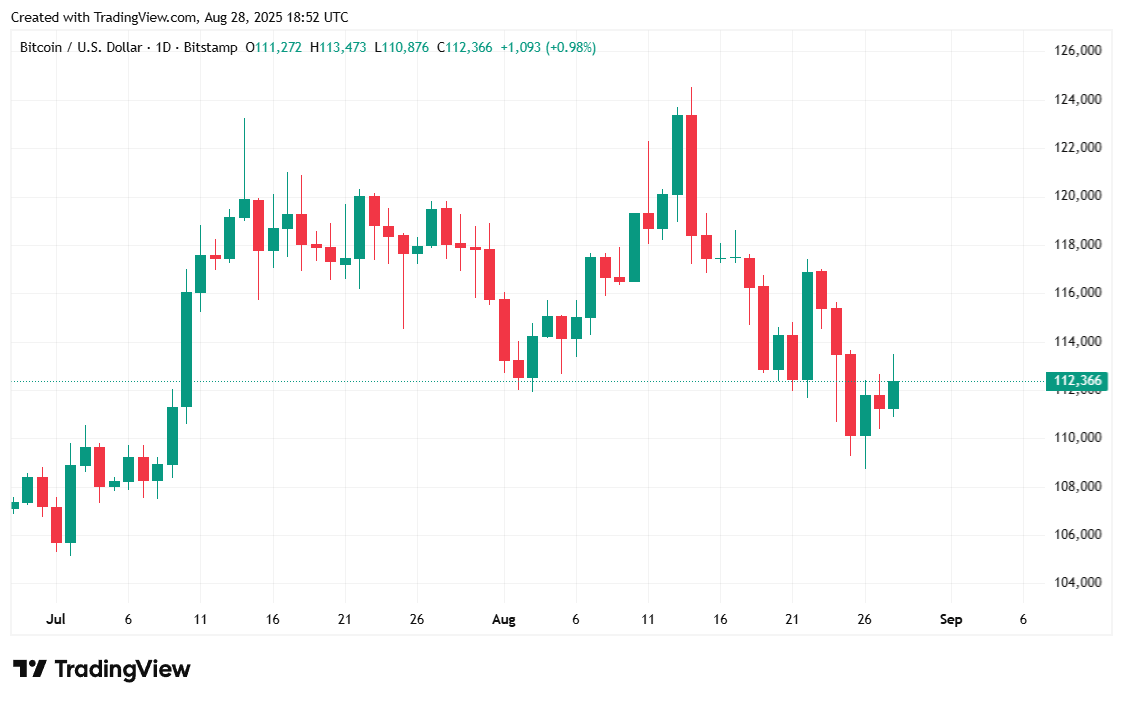

Bitcoin was trading almost flat at $112,367.34 at the time of writing, up 0.15% over 24 hours, trading almost flat. Cryptocurrency prices have moved between $110,900.92 and $113,450.08 starting Wednesday.

(BTC Price/Trade View)

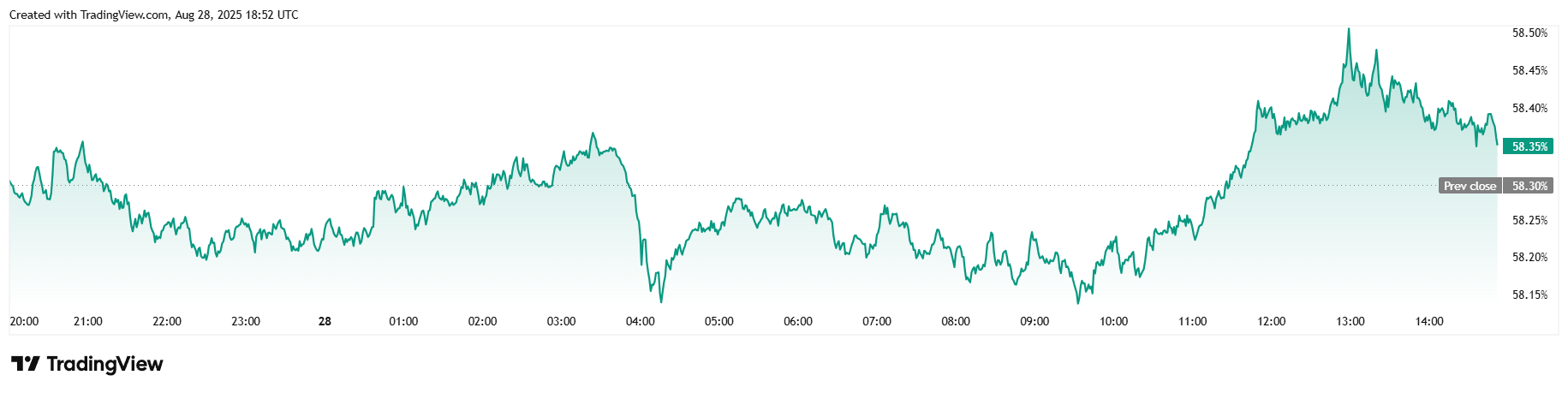

Trading volume rose 2.62% in 24 hours to $6.376 billion, while market capitalization rose 0.28% to $2.23 trillion. Bitcoin’s advantage has risen 0.16% since yesterday, at 59.39% when reported.

(BTC dominance/trade view)

Total Bitcoin futures fell to $81.23 billion on Thursday, down 0.40%. Coinglass’ Bitcoin liquidation totaled $41 million, of which $21.03 million was a long liquidation, with the remaining $17.97 million being attributed to shorts.