Bitcoin’s computing power is surged until miners record levels to increase BTC sales and deal with reduced profit margins.

The strength of the Bitcoin network reached a new milestone in early April, even as miners floated with increasing Bitcoin (BTC) sales. On March 5th, the hash rate achieved a hash of one sextirion per second per second each day, according to data from BitinFocharts.

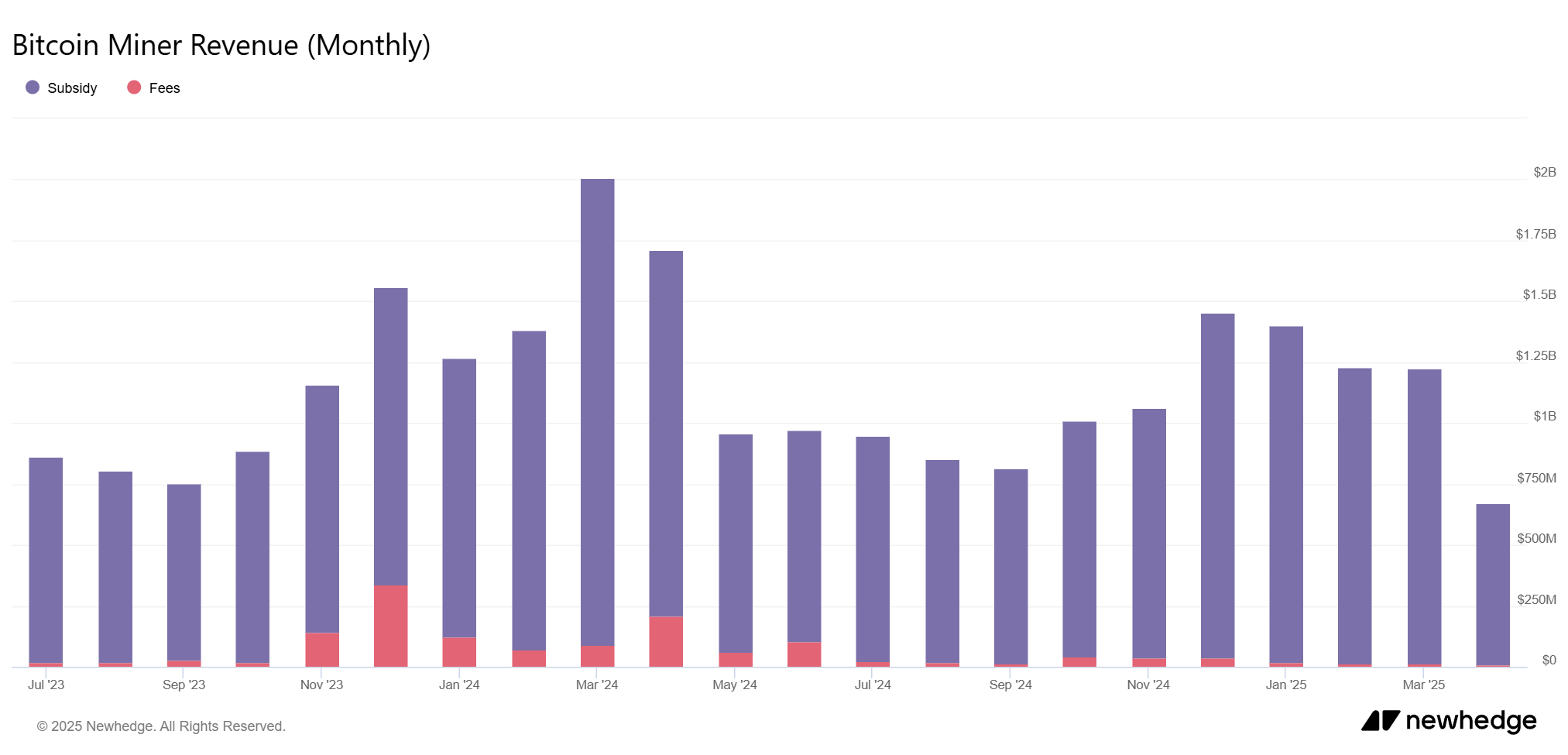

Bitcoin Minor Revenue (Monthly) | Source: NewHedge

You might like it too: Miners win most from the US strategic Bitcoin reserve | Opinion

However, while the hashrate rises, miners’ incomes are under pressure. Bitcoin Miners revenue in March fell nearly 50% from March 2024 to around $1.2 billion, according to data from blockchain analytics platform NewHedge.

Miners earn rewards from two sources: blocking subsidies and transaction fees. Prices have become more important as the latest half of April cuts the rewards to 3.125 BTC per block. However, with low fees and blocks often empty, miners are seeing a shrinking margin.

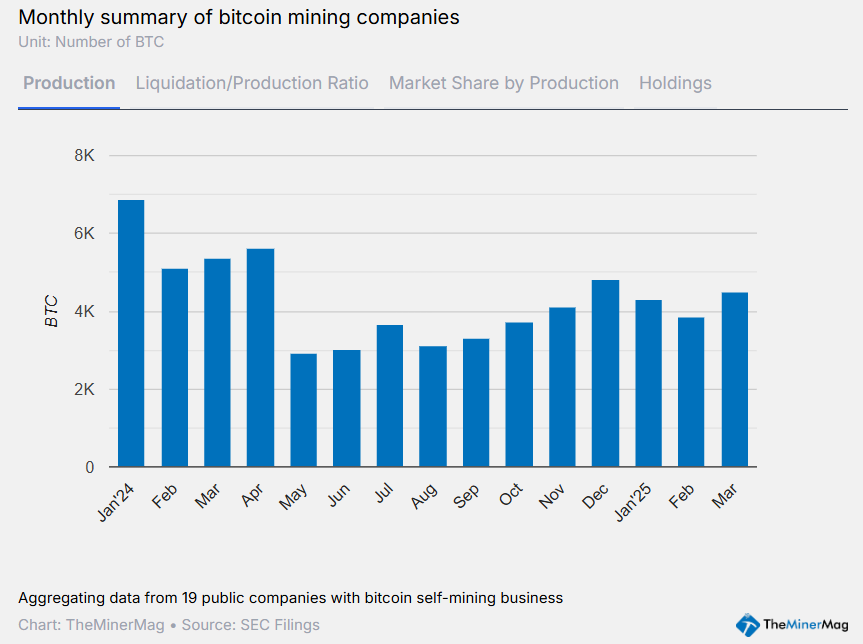

Number of BTCs generated by public miners | Source: Theminermag

According to data from Theminermag, published miners sold more than 40% of Bitcoin production in March. This is the highest level since October 2024. The report suggests that sales increase “is responding to miners’ tightening profit margins amidst rising uncertainty in the trade war.

Some companies have gone even further. According to the report, Hive, Bitfarms and Ionic Digital sold “over 100% of production in March,” while other digital products like Cleanspark appear to be adjusting their strategy.

read more: BTC Mining Hashrate Hits, Strengthening Pressure on US Miners Squealed by Tariffs