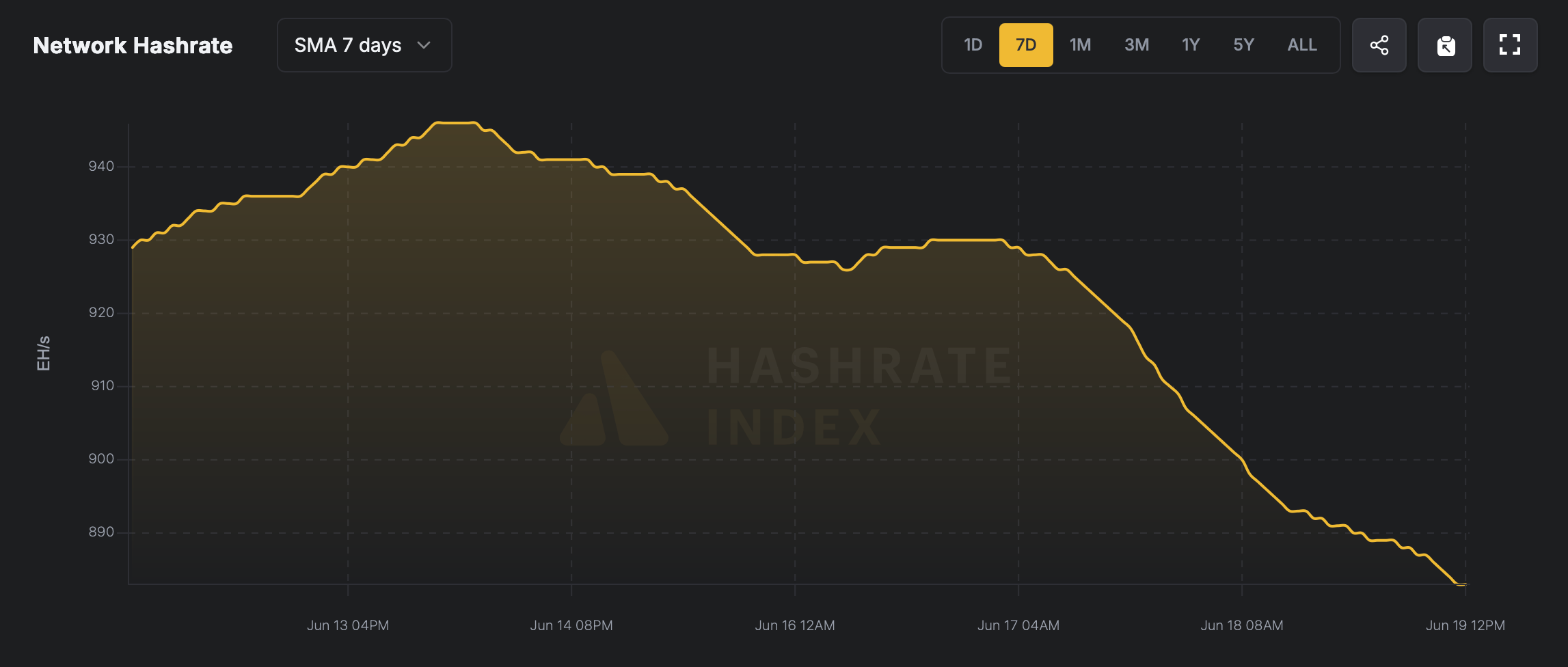

After achieving a peak of 946 exahashes per second (EH/s), Bitcoin’s computational power has receved under the 900 EH/s threshold, and the corresponding mining profitability shows a similar decline.

Mining Pressure Mount: Hashrate Drop, Less Revenue

By early Thursday morning, Bitcoin (BTC) ratings had risen just above the $104,000 threshold. A few days ago, the previous weekend, Bitcoin hashrate registered an unprecedented peak of 946 EH/s, as shown by the seven-day simple moving average (SMA).

However, contractions have been observed since June 14th, with the current hashrate currently present at 880 EH/s. HashrateIndex.com statistics. This corresponds to approximately 66 EH/s of hashrate, or approximately 66,000 petahashes per second (pH/s).

The slump follows a recent decline in mining difficulty observed at the last retargeting event six days ago at block height of 901152. Still, this adjustment was negligible and manifested as a reduction of just 0.45%.

A 5.05% reduction is projected on June 28, 2025, as the recent reduction in computational power and the current average block interval is long over a long period of 10 minutes and 31 seconds per block. However, this estimate remains revised before the foregoing.

Furthermore, mining profitability has experienced contractions consistent with the downward trajectory of BTC assessment over the previous week. From May 19 to June 19, the hashprice, which represents the estimate of a single PH/s, fell by 4.37%. The single petahash is currently around $52.51, down from the former $54.91.

Bitcoin’s current hashrate metrics and market valuation vibrations bring in close proximity to the state of dynamic equilibrium in profitability. The undulating patterns of computing power and their correlated revenues help to identify the challenges miners face as they counter BTC price volatility and invariant difficulty adjustments that maintain a consistent rhythm of block intervals.