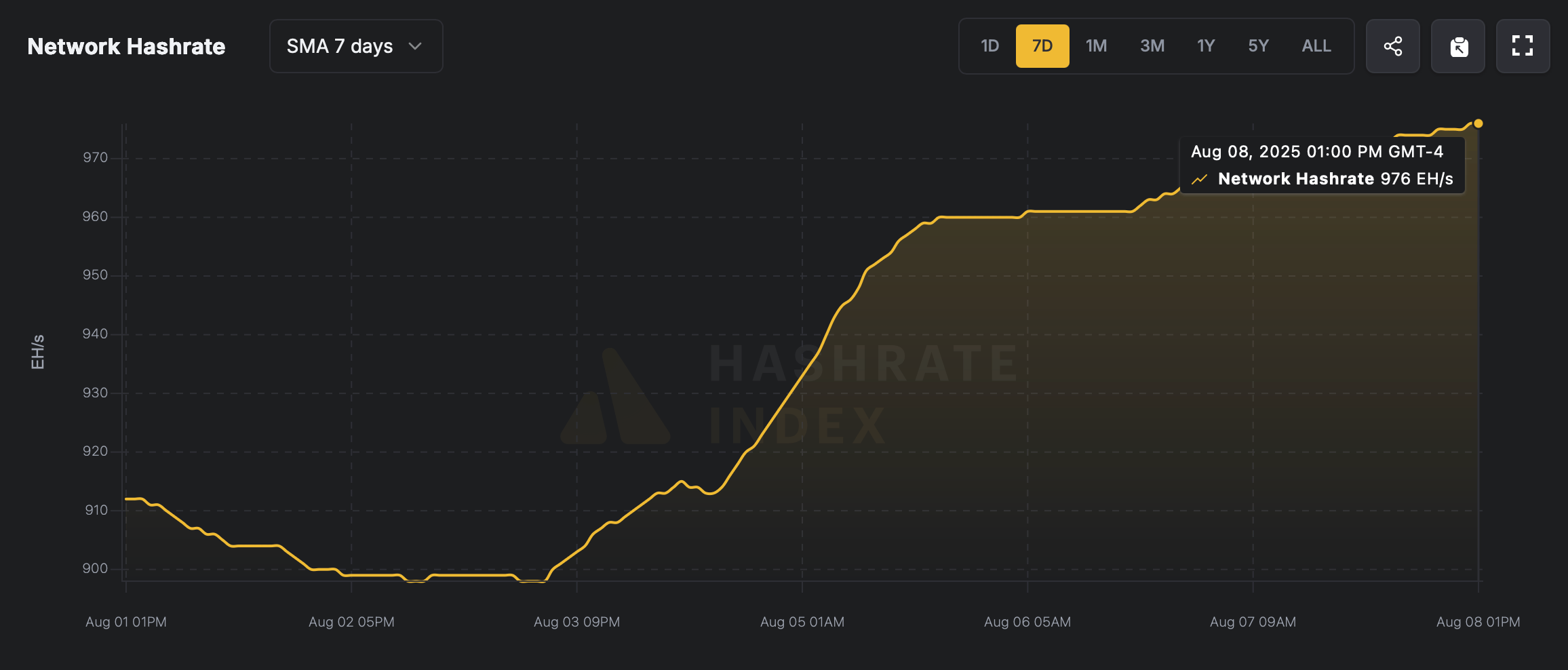

On Friday afternoon, after powering up to 970 exhahash (EH/s) a second ago, Bitcoin’s calculation power cranked further, hitting 976 EH/s.

Bitcoin mining may continue to bend

According to metrics from HashrateIndex.com, the hashrate kept pushing upward, reaching 976 EH/s based on a 7-day simple moving average (SMA) just 10 blocks before the next difficulty adjustment of the network.

Calculated power metrics recorded by HashrateIndex.com.

S7-day SMA metrics smooth out short-term swings by averaging the data over a set period, and identifying the exact hashrate is tricky, making it easy to find true direction trends.

The 7-day SMA will become the industry’s go-to scale and provide standardized snapshots that will keep your analyses consistent. For example, the 3-day Simple Moving Average (SMA) paints a much higher picture of Bitcoin’s horsepower, indicating that the network temporarily touched on 1 Zettahash between August 5th and 6th earlier this week.

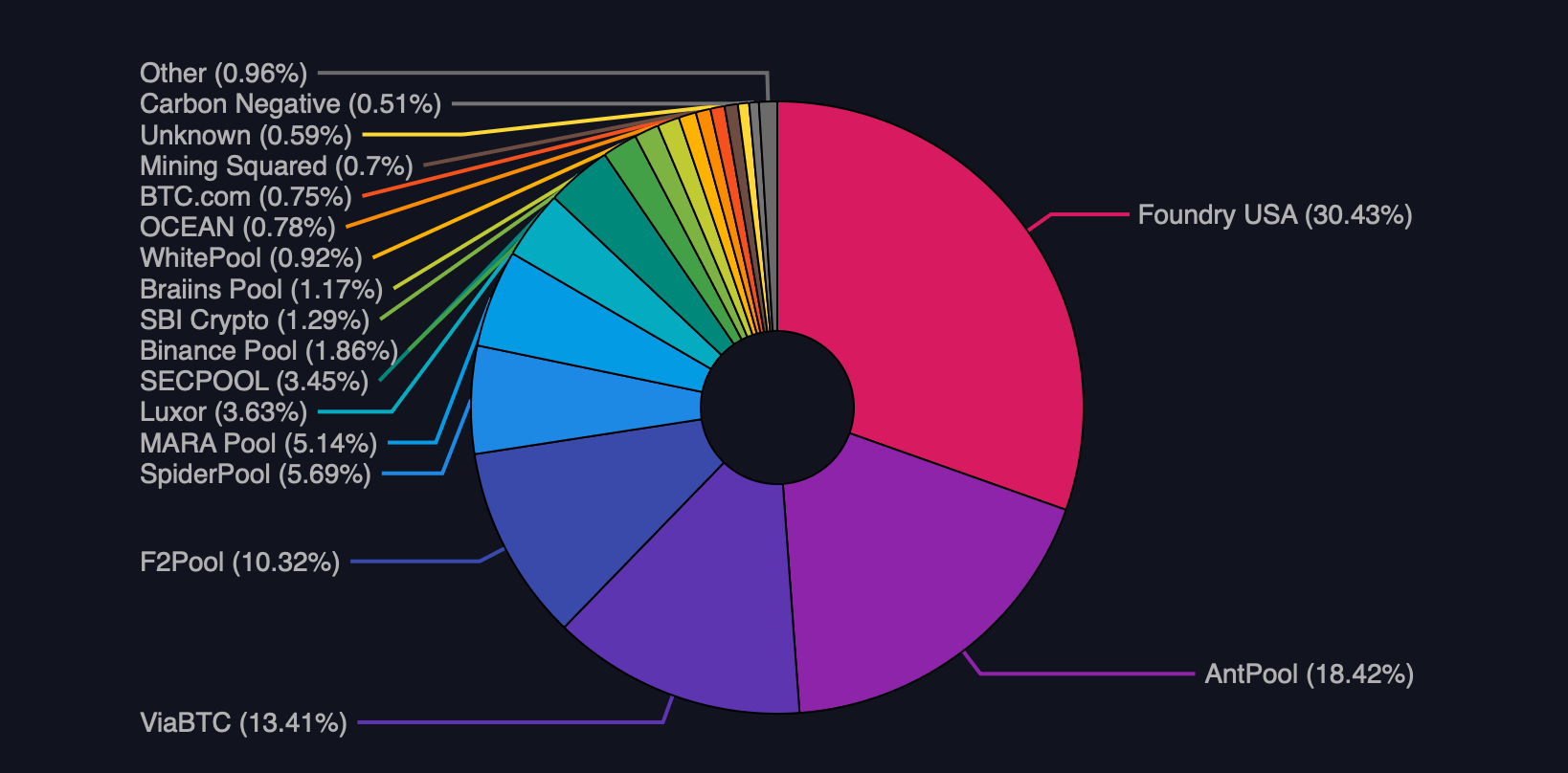

At 2:05pm ET, the live reads recorded 972 EH/s, and the foundry operated a massive 278 EH/s, 28.64%. Antpool ranks second, with Hashrate’s 18.1% above 175 EH/s, followed by VIABTC at 128 EH/s (13.25%). F2Pool took fourth place, accounting for over 100 EH/s, or 10.35% of the network.

Distribution of mining pools according to mempool.space.

In fifth place, Spider Pool runs at 83 EH/s, claiming 8.5% of Bitcoin’s aggregation computing firepower. If growth continues at this rate, milestones can quickly rise, potentially redefine the industry’s benchmarks and strengthen the protocol’s position as the safest and most resilient blockchain on the planet.

Bitcoin climbs towards the 1 Zetahash mark (1 Sextirion Hash per Second), showing a pivotal moment for the network, suggesting the size of the resources supporting security. If growth continues at this rate, milestones can quickly go beyond and remain constant, redefine the industrial benchmark, and strengthen the protocol’s position as the safest and most resilient blockchain on the planet.

Such calculation strength also reflects the increased competitiveness between mining pools where efficiency and scale can determine dominance. As key players contribute higher and advance, hashrate-controlled races could trigger new investments in hardware, energy procurement and global mining infrastructure, rebuilding the power balance of Bitcoin Mining Arena.