- Bitcoin exchange reserves have reached new lows, indicating strong accumulation by long-term holders.

- The price is under $106,000 and the price could drop even further if the buyer is unable to regain control.

- Analysts hope for a possible rebound in early June if the $100,000 resistance breaks soon.

The Bitcoin exchange reserve has fallen to a new low, indicating a continued accumulation from long-term holders and institutional investors. Encrypted data shows that Bitcoin exchange reserves have fallen to a fresh low of nearly 2.43 million BTC as they continue their long-term downtrend.

Just In: BTC Exchange Reserves hits fresh new lows. pic.twitter.com/xxtagdf6ud

– Whale Insider (@WhaleInsider) June 1, 2025

This decline indicates that long-term holders and institutions are still accumulating, which reduces pressure on short-term selling. The massive decline in reserves is consistent with increasing investors’ preferences for refrigeration and independence.

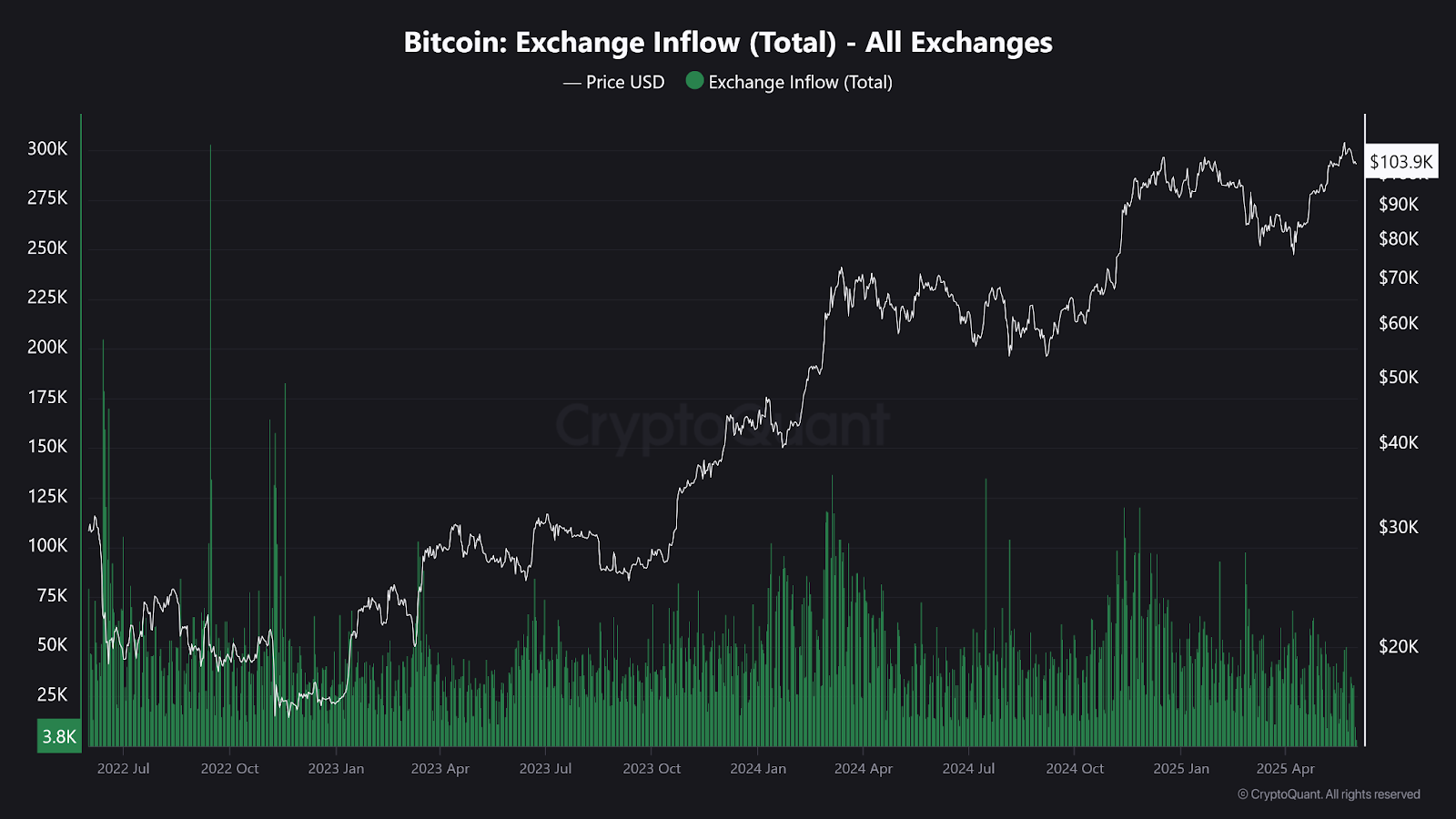

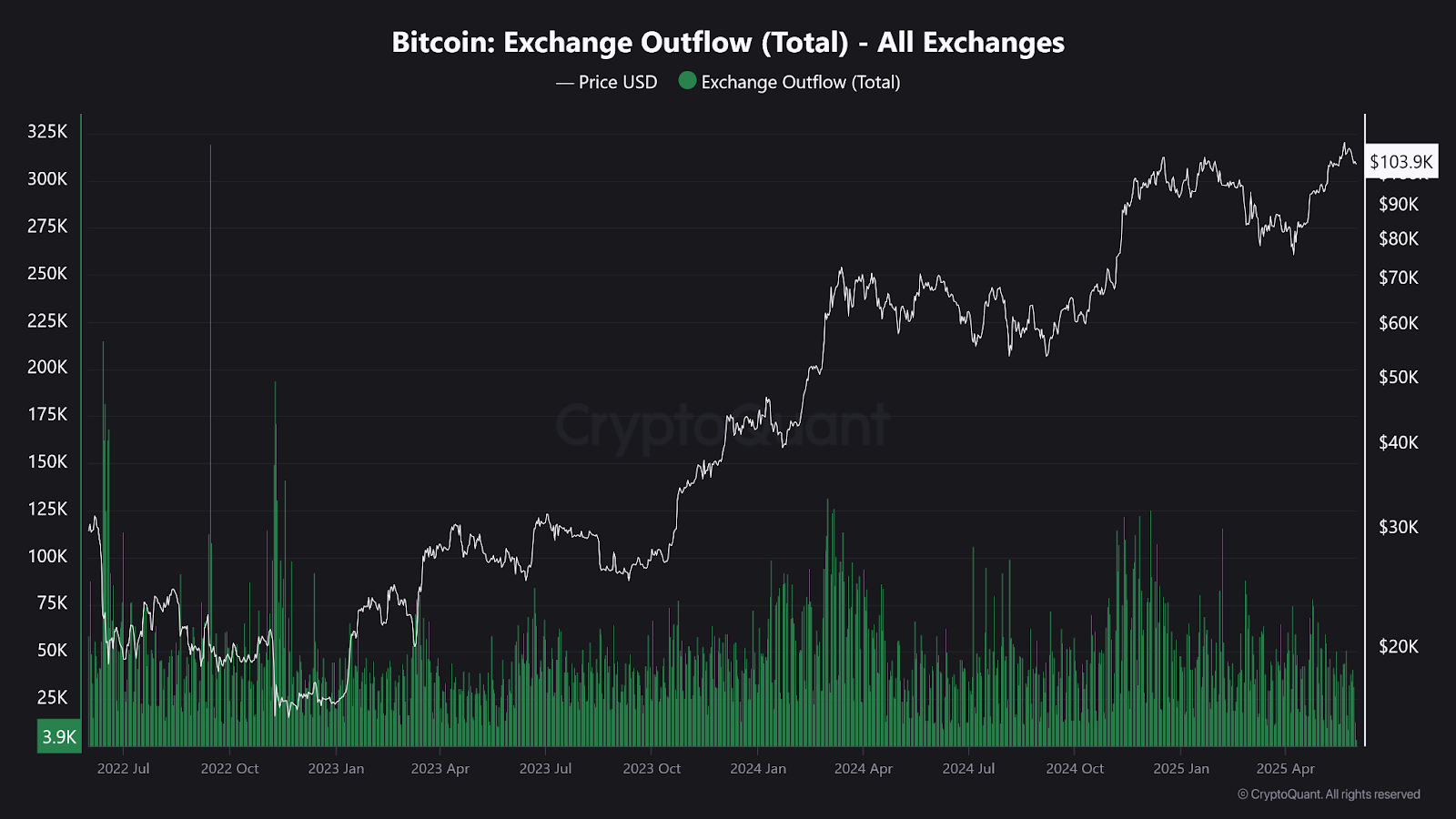

Overall, the total exchange inflow rate is inconsistent, but the latest chart shows that the price is $104,000, making daily inflow activity very poor at 3.8K BTC. The lack of aggressive exchange deposits indicates that the seller is retreating. Meanwhile, the spill is high even at 3.9k BTC, which supports bullish papers of long-term accumulation.

Source: Cryptoquant

Source: Cryptoquant

Bitcoin has been trading at $104,078 after a 2.60% loss in the last 24 hours, and sales activities have also slowed down. Similarly, daily trading volumes have fallen by 2.24%, indicating that there is less profit-taking play at this current price decline.

Analyst commentary: June rebound is still visible

Market sentiment is mixed while exchange supply is declining. Bitcoin has increased by more than 10% over the past seven months since the first week of each month, according to Crypto analyst Pattatrades. He expects the pattern to repeat in June. This trend could continue for the next few days, and the market could even recover.

However, the technical signal shows hesitation. MACD has become bearish with negative histograms, but RSI has now reached 50.24 from its recent high. Even though the long-term structure remains intact, these indicators suggest that they slow momentum.

Source: Trading View

On the four-hour chart, Bitcoin moved through several price ranges. The next important range of assets was between $93,000 and $96,000, then $101,000 to $105,000 after being destroyed from the $83K-$86,000 range. It currently collides between $106,000 and $112,000. Recently, the price level has returned to the bottom edge of the range and is a pullback.

Market analyst Daan Crypto said the Bulls need to exceed $106,000 to avoid further downsides. He added that failing to regain this level is likely to result in deeper pullbacks in the coming weeks. Meanwhile, other analysts believe there is a possibility of bear pressure that could cut the price from $100,000 to $102,000.

$ Notable changes in the dynamics of the BTC market.

The Bulls will want to like this by regaining their local range of over $106,000. Otherwise, I think there will be more cooldowns next week. https://t.co/zmvqqdc0eh pic.twitter.com/mjec8qkezq

– Daan Crypto Trades (@daancrypto) May 30, 2025

Crypto-controversy urges Czech ministers to resign

Cryptocurrency is also causing political waves outside of the market. Czech Minister of Justice Pavel Blazik resigned after revelation that his ministry had received a billion crowns of Bitcoin donations from convicted drug offenders.

Blazik said he knew nothing about the donor’s background or the illegality associated with the donation, but he still said he had resigned to protect the government’s credibility. The decision was quickly supported by coalition leaders who emphasized the importance of institutional integrity.