Bitcoin has been in bullish form since April as it rose more than 4% to a surge of over $97,000 in the first two days of May. Following this recent profit, the best cryptocurrencies have experienced a minor setback as investors try to decipher the current market stage.

Meanwhile, prominent crypto analysts with X-handle IT Tech share valuable insights into Bitcoin’s market structure, highlighting key pricing levels that can determine asset movements in the short term.

Bitcoin cools off after price rally: Breather or Bull Trap?

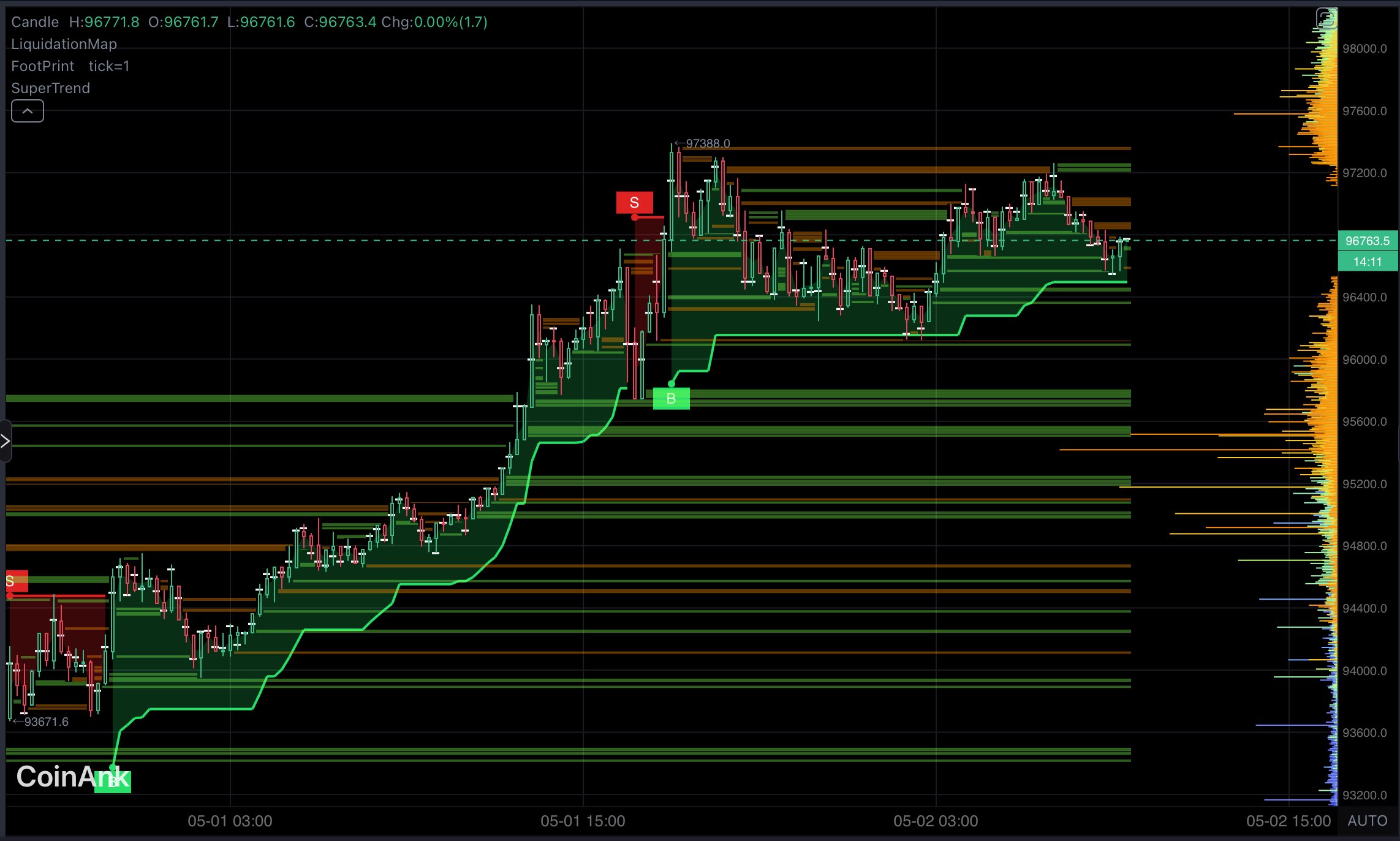

According to IT Tech in a post on May 2nd, Bitcoin appears to be holding its breath following a price rise of $93,600 to over $97,000. To see if this would be a mere cooling-off period before another rise or an initiation of deeper price adjustments, IT Tech shared some helpful technical and on-chain insights on potential price targets.

Analysts say Bitcoin Supertrend Indicator printed a buy signal when the price reached $94,000, followed by a sale signal of $97,300. However, as market prices still exceed $94,000, the Bitcoin market structure and supertrend indicators remain bullish.

On the other hand, liquidation data suggests potential points of price volatility. Most notably, there is a long liquidation zone between a price region of $95,200-96,000 and another dense order cluster in price regions of $93,600-$94,000. Both regions are expected to serve as strong price support in the event of an unexpected decline.

In deciding on the next move for Bitcoin, IT Tech says that market sentiment will remain cautiously bullish as long as the $96,000 support level is in effect. This is because when the critical price falls below this level, the liquidation cascade will push the price back to $94,000. Meanwhile, another price breakout exceeding $97,400 to allow Bitcoin to trade as high as $98,500.

What’s next for Bitcoin?

At the time of pressing, Bitcoin was trading at $96,463, reflecting a 1.64% increase over the past seven days. Meanwhile, asset trading volume fell 21.82%, valued at $26 billion.

As mentioned earlier, bullish sentiment continues to destroy the market, as shown by recent developments, including a surge in Bitcoin spot ETF influx. Meanwhile, the US willingness to negotiate a new trade agreement with China may not imply further negative developments on international trade tariffs.

In Bitcoin’s recent bullish stint, analysts continue to roll out bullish forecasts with a high price target of $150,000.

Pexels featured images, TradingView charts