US President Donald Trump signed an executive order on Thursday that opened the door for Americans to include crypto and other alternative assets in their 401(k) retirement accounts and other defined inconsistencies plans.

Trump’s executive order directs the U.S. Labor Bureau to reassess the restrictions on alternative assets such as Crypto, Private Equity and Real Estate in 401(k)S and other defined inconsistency plans.

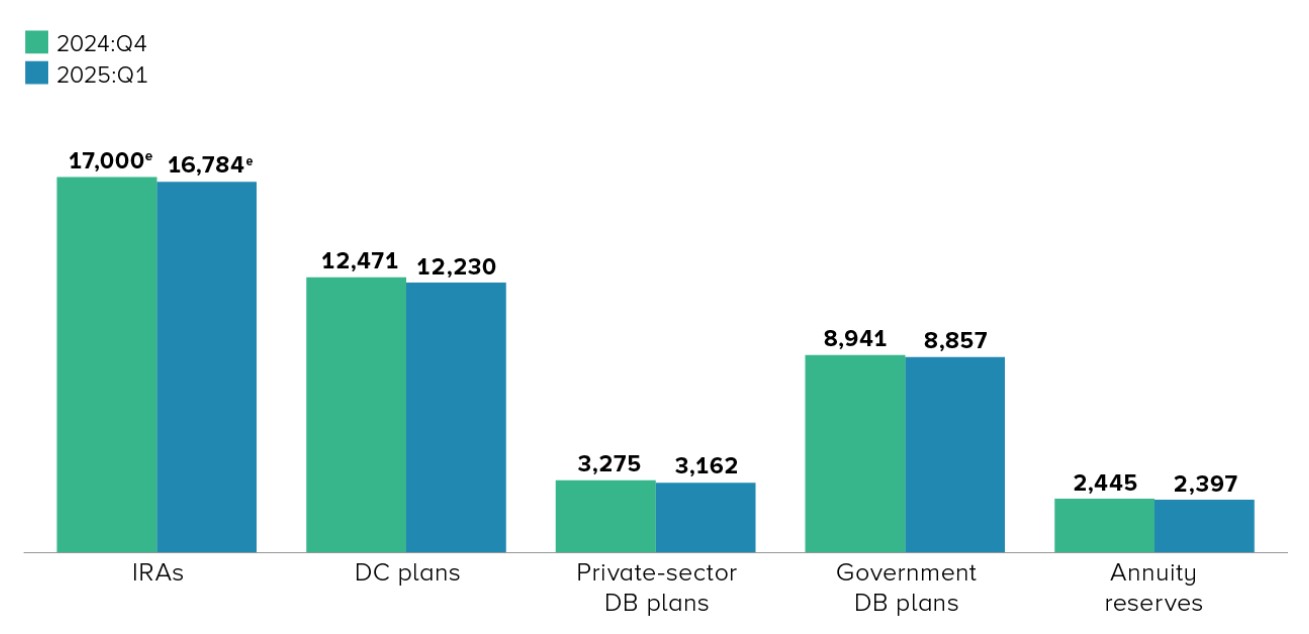

As of the first quarter of 2025, US retirement assets totaled $43.4 trillion, according to the Institute of Investment Companies and the Federal Reserve. The predefined contribution plan, including $8.7 trillion for 401(k), accounted for more than $12 trillion.

Industry stakeholders shared their opinions and reaction to the executive order as billions of dollars could flow into the code.

Retirement assets by type. Source: Investment Company Research Institute and the Federal Reserve Committee

Stable demand could restructure the crypto market

Bitwise Chief Investment Officer Matt Hougan said the change will allow the Crypto market to be transformed by introducing “slow, stable and consistent bids” from the contributions of retirement. “The result is higher returns and lower volatility,” Hougan added.

Hougan also said that Crypto belongs to the 401(k) for some investors. “It has been the world’s most performant asset class in the past decade and is well positioned for the next decade,” added Hougan.

Ji Hun Kim, CEO of Crypto Council for Innovation Counce for Innovation, said the decision confirmed the location of digital assets in the US financial system. “Americans should have the opportunity and freedom to include these investments in their retirement plans,” Kim said.

Kim added that the CCI praised the administration’s continued commitment to a clear policy to make the United States “global crypto capital.”

Abdul Rafay Gadit, co-founder of compliance-centric blockchain platform Zigchain, said it will help build the infrastructure needed to support large-scale tokenized investment vehicles.

“The reason this is important is because it connects with broader regulatory clarity from Atkins’ SEC leadership,” Gaditt said. “Unified frameworks are beginning to emerge.”

The impact of the executive order depends on its implementation.

Michael Heinrich, co-founder and CEO of 0G Labs, said the executive order is a “basin moment” for Crypto to integrate into the financial system. However, he warned that development could proceed in both ways.

“The truth is, this could unlock trillions of retirement capital for Bitcoin and other compliant assets,” he said. “It’s done inadequately and puts political and financial backlash in danger.”

Heinrich also emphasized that details such as what qualifies the token, how custody will be handled, and which guardrails will be introduced are important.

Joshua Krüger, head of growth at the Deuro Association, said that the main short-term beneficiary is likely Bitcoin (BTC). As BTC has the strongest institutional acceptance, he predicts that he will be first integrated into regulated pension products.

“Asset managers like BlackRock, Fidelity and Franklin Templeton are already on par with their corresponding products,” says Krüger.

He said Altcoins and small crypto projects are likely to benefit only in the medium term as they require resilient structures, including regulated products, reliable standards and strengthened trust from institutions.

Tezos co-founder Arthur Breitman agreed that the size of the US retirement market could set precedents that justify encryption, but also warned of potential pitfalls.

Brightman supports giving savers more investment options, but added that many investors can make allocation decisions.

“Private assets could trade off illiquidity for higher returns, which fits the long horizon of retirement accounts,” Brightman said.

“But in reality, it rarely plays it well. High prices, difficult-to-determine pricing, and manager manipulation to mask volatility are common issues.”

Related: Trump chooses top economic advisers to temporarily meet US Federal Reserve seats

Peter Schiff says the move could exacerbate existing problems

Not everyone in the financial world welcomed the news. Gold’s advocate and code critic Peter Schiff warned that the development could exacerbate what he considers as a gap in America’s disastrous retirement savings.

“Most Americans are far less than the savings needed to have hopes for retirement,” Schiff wrote X.

sauce: Peter Schiff

magazine: The Philippines blocks big crypto exchanges and Coinbase scammers’ stash: Asia Express