Historically, Bitcoin prices have been indicators of blockchain health, with high activity often correlated with strong, positive price actions. However, the biggest cryptocurrency market appears to be witnessing major changes, and prices are currently not sensitive to changes in chain activity.

For example, Bitcoin’s prices continue to exceed $95,000, and despite persistent DIP for blockchain activity, it is trying to regain the $100,000 level. Analytics companies on the chain are valued on how and why this is possible with flagship cryptocurrency.

Why BTC prices are less correlated with on-chain activity

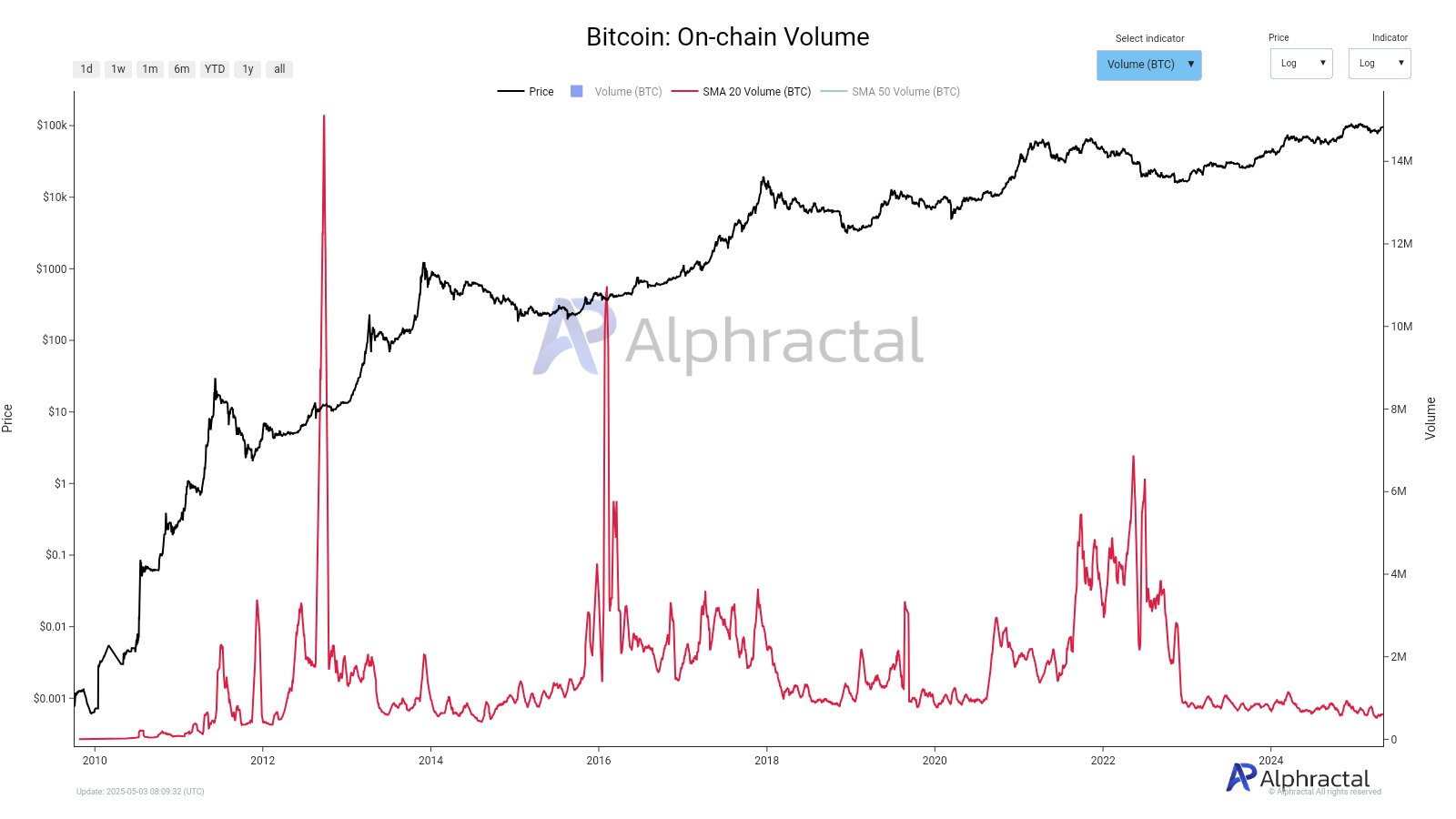

Crypto Analytics platform Alphractal shared in a new post on X why Bitcoin prices are somehow floating despite low levels of transaction volume and active addresses. The company said the rise in BTC prices does not necessarily correlate with increased blockchain usage.

First, Alphractal acknowledged that the Bitcoin market experienced dynamic changes when funds (ETFs) traded on US spot exchanges were approved in January 2024. Currently, BTC values are driven by capital inflows through these financial products rather than blockchain activities.

Source: @Alphractal on XHe also said that chain companies play a major role in playing in Bitcoin Network activities, where the market has historically low volatility. Due to relatively low price movement, traders have fewer incentives to acquire new positions and lower on-chain activity.

Additionally, Alphractal said that Bitcoin prices are primarily floated through the activities of speculative traders through derivatives and other financial instruments. As a result, daily adoption has decreased, and practical demand for the Bitcoin network is limited.

Alphractal also hinted at the macroeconomic uncertainty that has clouded global financial markets in recent weeks. According to the on-chain analytics company, the market conditions are improving, but most investors are waiting for a clearer bull signal before they move.

Finally, Alfractal highlighted the amount of artificial exchanges among the main reasons for the price of Bitcoin floating around. “Some exchanges may be inflated, creating a misleading sense of activity whilst the actual use of the network remains modest,” the platform on the chain added.

Bitcoin price at a glance

At the time of writing, BTC priced around $96,150, reflecting a decline of over 1% over the past 24 hours. According to Coingecko data, there is a choppy price action this weekend, but the best cryptocurrency in the weekly time frame is still up nearly 2%.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.