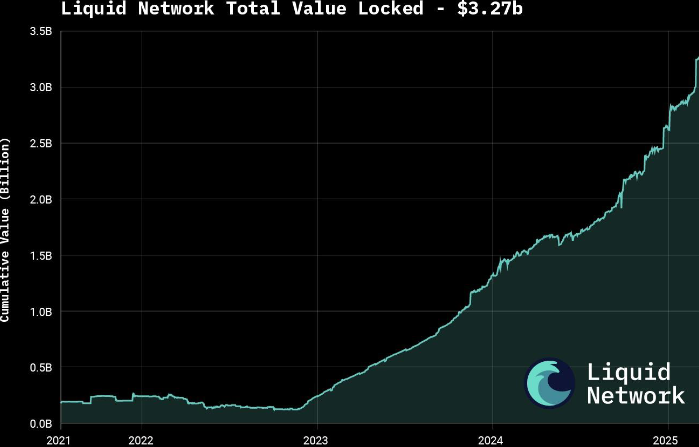

According to a press release shared with Bitcoin Magazine, the Liquid Federation today announced that Liquid Network is surpassing its $3.27 billion total lock (TVL).

“Beyond the $3 billion threshold, there are pivotal moments for both liquids and Bitcoin, demonstrating the evolution of the Bitcoin ecosystem to a full-fledged platform for global financial markets.” “As Bitcoin gains mainstream acceptance and demand for regulated asset tokenization accelerates, liquids are positioned more than ever to bridge Bitcoin with traditional funds and drive the next wave of capital market innovation.”

The announcement follows a growing interest in the symbolism of real-world assets (RWAS) along with major moves such as BlackRock’s decision to tokenize its $150 billion financial fund. According to a 2025 report from the Security Token Market, the tokenized asset market is projected to grow to $30 trillion by 2030.

Liquid supports more than $1.8 billion in tokenized private credits and offers products such as US Treasury Notes and Digital Currencies through Blockstream’s AMP platform. The network also features fast, low cost, and confidential transactions that support atomic swaps and robust smart contracts.

Dominated by more than 80 global institutions, Liquid was launched in 2018 as Bitcoin’s first sideshane. Currently, we are preparing for major upgrades with the mainnet release of Simplicity, which aims to expand our smart contract capabilities.

To meet the growing demand, Liquid Federation is strengthening developer resources and technical onboarding, along with integration with exchanges, custodians and service providers. Recent bootcamps and key conferences with policymakers in Asia, Europe and Latin America reflect the network’s global presence.

This post, Bitcoin Liquid Network, which first appeared in Bitcoin magazine, exceeded $3.27 billion in total and is written by Oscar Zarraga Perez.