Bitcoin (BTC) prices continue to rise to around $108,000, with a miner increase of 0.33% over the past 24 hours. The flagship cryptocurrency continues to remain stable within a broader integration range between $100,000 and $110,000, reflecting a period of indecisiveness in the market. Within the current market situation, popular trading experts using the X username Daan Crypto highlight important liquidity clusters that may play a key role in shaping short-term price actions for Bitcoin.

Impending Bitcoin Front: $107,000 and $110,500

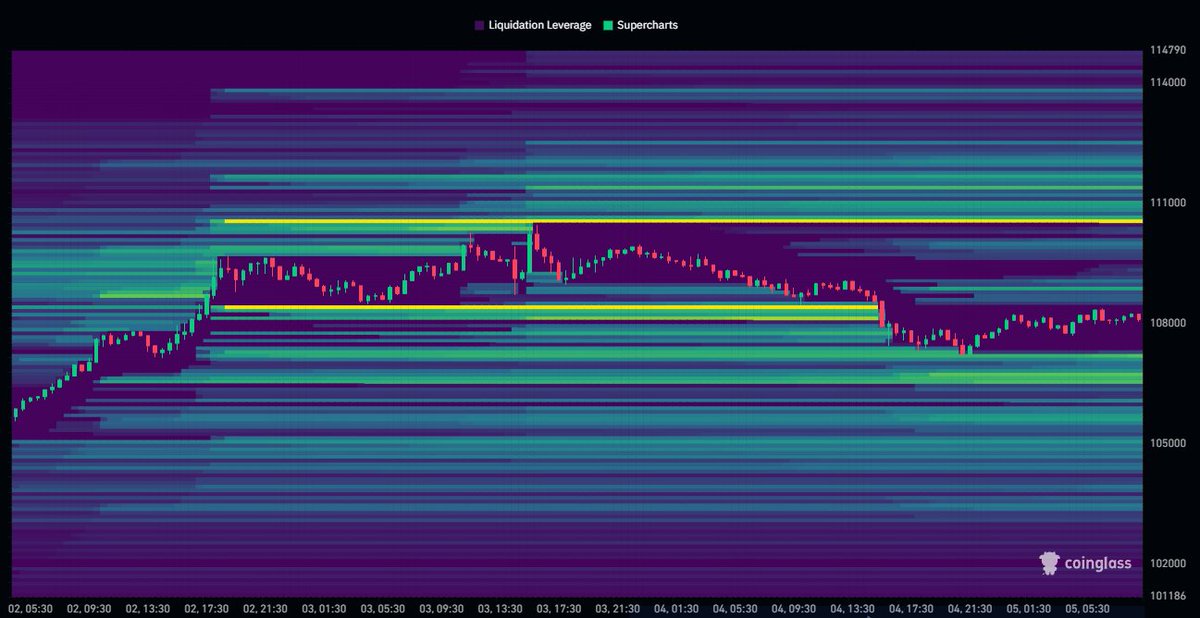

In a July 5th X post, Daan Crypto shares important insights into Bitcoin’s potential price action compared to liquidity levels. Coinglass data explains that the well-known analysts have led to a massive liquidation of regionally-centric leverage positions with price activity on Friday at $108,000. Following this development, investors’ profits are now focused on a new liquidity zone, forming around $107,000 and $110,500.

Of the highlighted regions, the $107,000 region appears to serve as immediate support, with some traders defending their status surviving the recent liquidation. Therefore, BTC may experience short-term rebounds when retesting this level. However, a price drop below $107,000 will force a massive liquidation into areas as low as $100,000 in line with recent range-bound movements.

Meanwhile, $110,500 has emerged as a short-term resistance where potential sales pressures or short entries could stack up, especially if Bitcoin attempts another breakout. A successful price above this level will eliminate multiple short positions and induce short apertures, allowing for quick movement of current highs at $111,970.

Overall, the BTC market appears to be stable within the $107,000-110.5,000 zone, following the sharp liquidation sweep on Friday. This lateral price movement usually sets the stage for a quick breakout or breakdown.

Bitcoin Exchange Leverage reaches new highs

In other developments, the encrypted data reveals that Bitcoin traders show a high market desire as the estimated leverage ratio for all exchanges reached a new annual high of 0.27. This metric, which tracks the amount of open interest associated with exchange BTC reserves, shows an increase in risk behavior as traders deploy increasingly borrowed capital in anticipation of larger price movements.

Meanwhile, the best cryptocurrencies continue to trade around $108,232, reflecting market profits of 0.70% and 6.41% on weekly and monthly charts, respectively. Its market capitalization is $2.15 trillion, and Bitcoin remains a 64.6% market advantage as the world’s largest virtual asset.

Pexels featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.