Following major price adjustments over the past three months, Bitcoin Bull Market remains in balance. Despite a small price rebound in April, the best cryptocurrencies have yet to show strong intentions to resume the Bull Rally amid a lack of positive market factors. However, Crypto analyst Axel Adler Jr. highlights the promising development that could show a big rise in Bitcoin.

Long-term Bitcoin holders trying to stop selling pressure

In a recent post about X, Adler Jr. shared a key update on Bitcoin Long Term Holder (LTH) Activity.

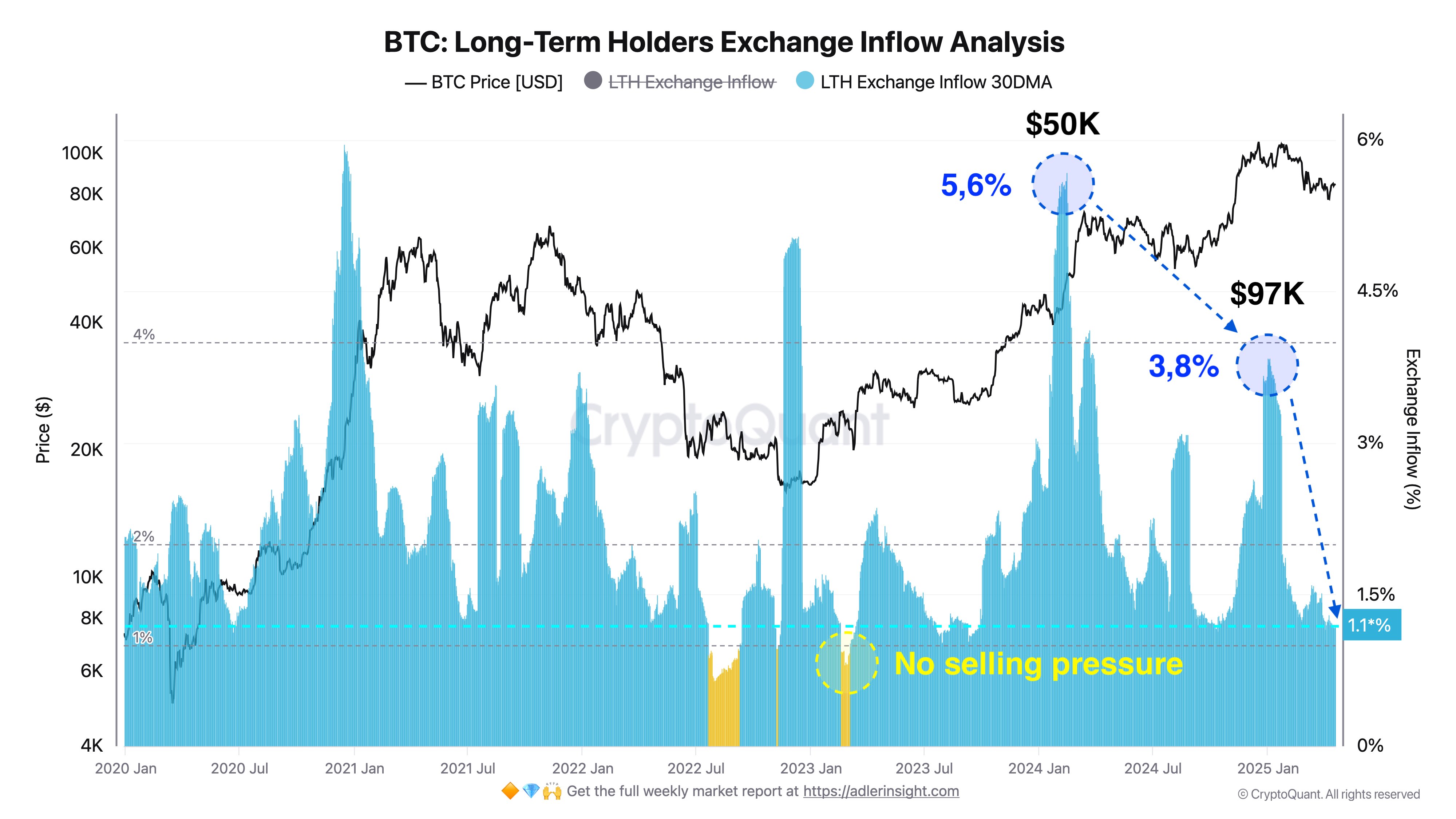

Using Cryptoquant’s on-chain data, well-known analysts report that long-term holder sales pressure, or exchange LTH holdings, reached 1.1%, to its lowest point in the past year. This development shows that Bitcoin Lth is currently choosing to hold assets rather than profit.

Adler explains that a further decline in these LTH Exchange Holdings to 1.0% indicates a total absence of sales pressure. In particular, this development could encourage entry into new markets and sustain accumulation, creating strong bullish momentum in the BTC market.

Importantly, Alder highlights that the majority of Bitcoin LTH have entered the market with an average price of $25,000. Since then, Cryptoquant has recorded its highest LTH sales pressure at $50,000 in early 2024 at $50,000 and 3.8% at $97,000 in early 2025.

According to Adler, these two instances could represent the main profit acquisition stage for long-term holders intended to withdraw from the market. Therefore, there is little revival of sales pressure from this cohort of BTC investors in the short term. This supports the building bullish incident as long-term holders control 77.5% of Bitcoin currently in circulation.

BTC price overview

At the time of writing, Bitcoin was trading at $85,226, with an increase of 0.36% in the past day and a loss of 0.02% in the past week. Both metrics reflect on the ongoing market consolidation as BTC continues to struggle to achieve a compelling price breakout of over $86,000.

Meanwhile, assets performance in monthly chats reflects a profit of 1.97%, indicating a reversal of potential trends as market revisions stop. Nevertheless, BTC needs a strong market catalyst to set fire to sustainable price gatherings. Its market capitalization is $1.67 trillion, and Bitcoin ranks as the largest digital asset, dominating 62.9% of the crypto market.

Adobe Stock featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.