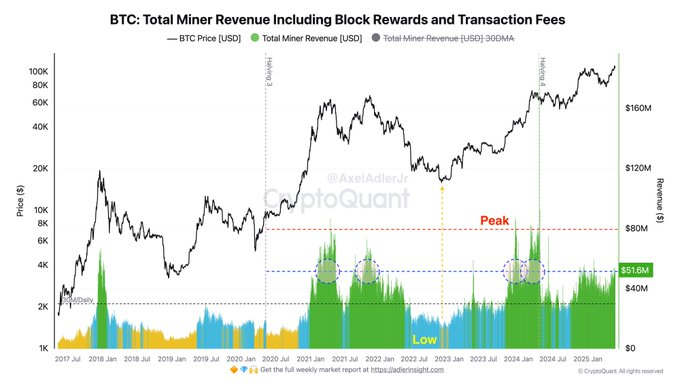

The Bitcoin market continues to stabilize with increased revenues for miners and exchanges of inflow exchanges, which refer to growth in network activity. However, these important metrics have not yet hit the levels seen at previous cycle peaks. According to recent data shared by market analysts, Bitcoin miners currently earn around $51.6 million per day.

After the ATH, miners strengthened sales in exchanges. The influx doubled from an average of 25BTC to 50BTC per day, but its historic peak reaches around 100BTC.

This shows that sales are actually accelerating, but we still have a long way from peak volume and…pic.twitter.com/ftsglykovc

– Axel💎🙌Adler Jr (@axeladlerjr) May 27, 2025

This figure is impressive, but it is still below the historic peak revenue level, which was last seen at the previous market top, exceeding $80 million per day. This suggests that while the network is very active, there is room for even more mining revenues before reaching historic highs.

Minor exchanges are twice as inflows, but the market absorbs supply. Activities below peak level

Another important trend is the increase in miner exchange inflows. Miners have stepped up sales activities after Bitcoin recently touched on a new all-time high. The average daily inflow has doubled. This is rising from about 25 btc to 50 btc per day. Historically, the peak of mine exchange inflow reached approximately 100 btc per day.

Source: Axel/X

Despite this increase in supply, the market has shown strong absorption, and is comfortable handling of additional bitcoins sold by miners. This steady demand suggests that it has not yet dominated the market while sales pressures are rising.

Rising miners’ revenues and increasing exchange inflows mean a healthy and active Bitcoin network. Current numbers still have space for further growth. It points to markets where there is room for expansion in this cycle as long as revenue and inflow numbers are below historic peaks.

Has Bitcoin reached the top? What’s next?

Analysts say Bitcoin’s next peak price forecast is expected to be between $200,000 and $250,000. Once you reach these levels, the modifications may continue. For example, if Bitcoin fell 50% after reaching $200,000, the price would settle at around $100,000. This is possible based on past market behavior.

Source: CoinMarketCap

Demand could increase if major hedge funds and Wall Street investors began looking at Bitcoin as a safe alternative to traditional Fiat currency, especially during periods of economic trouble. In that scenario, Bitcoin can not only reach $200,000 to $250,000, but can even climb higher.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.