The Bitcoin network is expanding on an industrial scale, and power-hungry mining rigs are driving energy consumption to unprecedented highs, even if transaction flows trickle. However, the network appears to be tense as the hashrate rise and infrastructure clashes with weak fee revenue and clearing rare memo pools, clashing with miners earning more than block subsidies.

summary

- Bitcoin’s mining network has grown into an energy-intensive giant, drawing more than 33 gigawatts and continuing to flow new blocks, even as on-chain transactions slow to their weakest levels in nearly two years.

- The Gomining Institutional Report depicts an ecosystem where hashrate and hardware deployments continue to rise, but fee revenue and overall activity remain silenced, creating discrepancies between network scale and minor revenue.

- Observers say this imbalance could remain for years, with operators relying on a decline in block subsidies, half every four years until the final Bitcoin was mined around 2140.

The Bitcoin (BTC) network is in a prominent stage of contrast. While the appetite for electricity is rising, the economic rewards for miners are under pressure from low trading activities. A new report from Gomining Institutional, seen by Crypto.News, sketches the landscape of an unusually quiet on-chain environment that accelerates energy use, reduces the difficulty of mining.e.

The report shows that networks’ estimated energy consumption is increasing, as researchers described as an “unprecedented pace.” Using data from Coinmetrics Labs, Gomining said it is trashing from 15.6 gigawatts (GW) in January 2024 to 24.5 GW in January 2025.

Much of that surge is concentrated in the early 2025. “The 35% rise in energy demand, which is just a jump from January to May — reflects both the increase in deployment of energy-dense mining infrastructure after half of April,” the report states.

Industry analysts cited in the report suggest that individual mining rigs are more efficient than ever, but their growth overpowers their profits. “The increased efficiency at the machine level is increasingly offset by the vast amount of deployed hardware,” the report states, adding that the importance of innovation now extends beyond ASIC designs to the way and where miners can source their strengths.

The sharp decline since 2021

Accelerated energy use is due to the relatively low difficulty in network mining (an indicator of how difficult it is to verify new blocks). In the first half of 2025, 13 difficulty adjustments were made, with metrics rising from 109.78 trillion at the beginning of the year to 116.96 trillion by the end of June. This represents an increase since the start of the year of just 6.54%, with an average monthly increase of 1.09%.

The report constitutes this slowdown against the rapid expansion in 2024, which averaged up 4.48% per month. The relatively calm of 2025 was interrupted by a moment of volatility. The 6.81% upward adjustment on April 5 and a 4.38% increase on May 30 bringing the record high of 126.98 trillion. However, the peak quickly gave way to a sharp inversion.

By late June, a heat wave across North America forced some operators to limit their activity, sending hashrates to 147 EH/s. “Bitcoin’s difficulties have been adjusted to -7.48% down, the sharpest decline since July 2021,” the report said, drawing comparisons with China’s period of banning mining.

You might like it too: Cango finalizes Pivot into a Bitcoin Mining Company

If a network power draw is climbing, that transaction layer tells the opposite story. On-chain activity in the first half of 2025 plummeted to a level not seen since October 2023. The seven-day moving average of daily trading also fell to about 313,510 by June 25th, with 256,000 confirmed cases confirmed on June 1st.

Its weakness has been converted to historically low rates. Throughout the year, users were able to broadcast transactions at one Satoshi lowest rate per virtual byte, regardless of their priorities. “Through H1, transactions could be broadcast at a minimum rate of just 1 SAT/VB, regardless of priority level, and highlighted the sustained low demand for block space across the network,” the report states.

Ghost Mempool

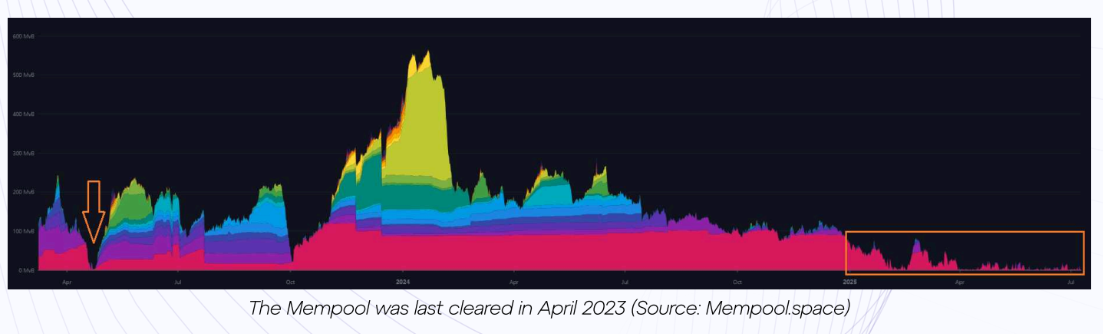

The environment produced a rare phenomenon: fully cleared memory. Mempool is a waiting room for unconfirmed transactions, and was empty for nearly two years in 2025. The final comparable event took place in April 2023, with ordinances and BRC-20 token activity not yet crowded the current norm block space.

Once Mempool is cleared, miners are temporarily operating with “lol trading fee revenues” and are almost entirely dependent on block subsidies. That dynamic highlights one of Bitcoin’s long-term economic problems. As fixed subsidies get halfway almost every four years and eventually disappear for good, the network relies on transaction fees to keep miners in place. Low-cost environments are welcome for users, but can pinch operators who are already working on high energy costs.

Bitcoin Members | Source: Gomining

For Bitcoin miners, the tension between rising electricity demand and thin revenues is becoming difficult to ignore. Extreme heat in major US mining regions has already demonstrated vulnerability in hashrates under environmental pressure. Meanwhile, doubling network energy consumption since early 2024 suggests infrastructure scaling faster than trading activity and fee revenue.

Industry observers suggest that this paradox may last. Mining companies continue to deploy energy-dense fleets to secure networks and earn block rewards, but long-term economics has led to control, network activity, user demand for block space, and the pace of programmed harving for Bitcoin.

read more: Bitmain: Bloomberg to launch the first US Bitcoin Mining Chip Factory by 2026