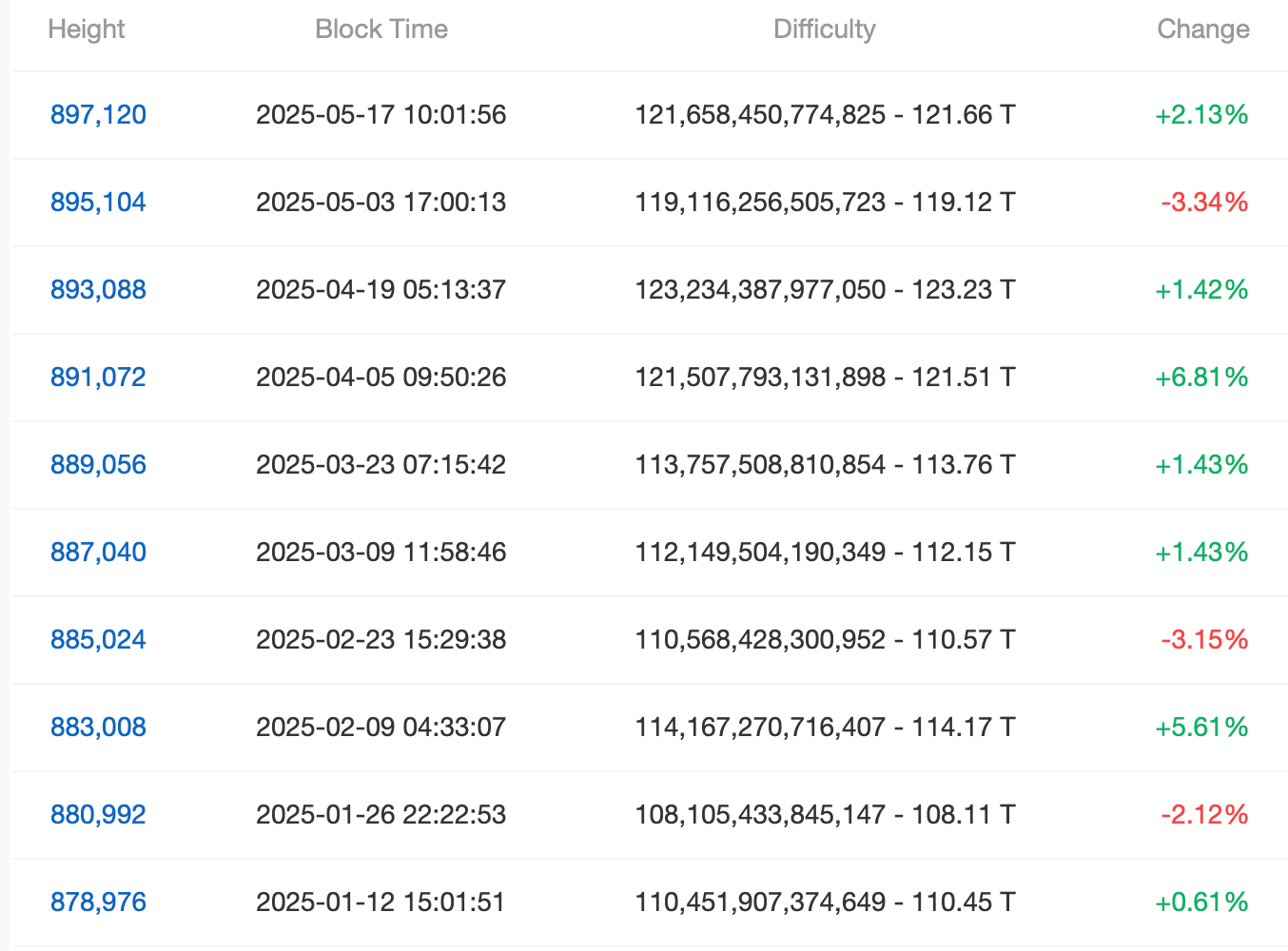

On Saturday, Block Height 897,120 saw Bitcoin mining difficulties increase by 2.13% to 121.66 trillion, slightly elevating the computational challenges needed to discover new blocks.

The difficulties of bitcoin mining climb over 121 trillion

Miners now face a slightly sharper probability in their efforts to resolve blocks, and adjustments make the process 2.13% more difficult. The current figure is high at 121.66 trillion, but he’s shy about the difficulty of the peak set following block 893,088.

Source: CloverPool.com Explorer.

So far, in 2025, the network has experienced six upward difficulty adjustments, collectively referred to as an increase of 13.83%, along with three downward shifts of a total of 8.61%. In parallel, Bitcoin’s total processing power was reduced from 929 exahash per second to 848.53 EH/s based on the seven-day simple moving average (SMA) recovering shrinkages above 80 eh/s, based on the seven-day simple moving average (SMA) tracked on HashrateIndex.com.

Despite the decline in raw hashforce, miners are benefiting from stronger profitability metrics as Bitcoin prices have exceeded $100,000 for the 10th consecutive day. About a month ago, hashpris (predicted revenue for manipulating petahash per second per second in a day) was close to $44.29 per PH/s. As of today, that figure has improved significantly, at $54.93 per PH/s.

Bitcoin difficulty adjustments and hash power fluctuations provide a subtle glimpse into the evolving dynamics between minor incentives and network resilience. As economic situations, energy costs and price trajectories continue to influence mining economics, the delicate balance between participation and profitability remains an important story.