Bitcoin’s hashrate is near record levels, but miner revenue per unit of compute has fallen to record lows, pushing the network into a “high security, low profitability” phase.

While the network’s hashrate has surpassed the 1 zetahash watermark, a record for total computing power, the revenue supporting its security has collapsed to historic lows.

Still, the system appears to be robust to the protocol. However, the liquidation of the mining sector is slowly progressing in the capital markets.

Bitcoin mining difficulty folds, hash rate maintains

According to Cloverpool data, Bitcoin mining difficulty has decreased by about 2% to 149.30 trillion from the November 27th block height of 925,344. This is the second consecutive decrease this month, but the block interval remains close to the 10-minute goal.

This decrease in difficulty coincides with a period when Bitcoin mining economics became increasingly challenging.

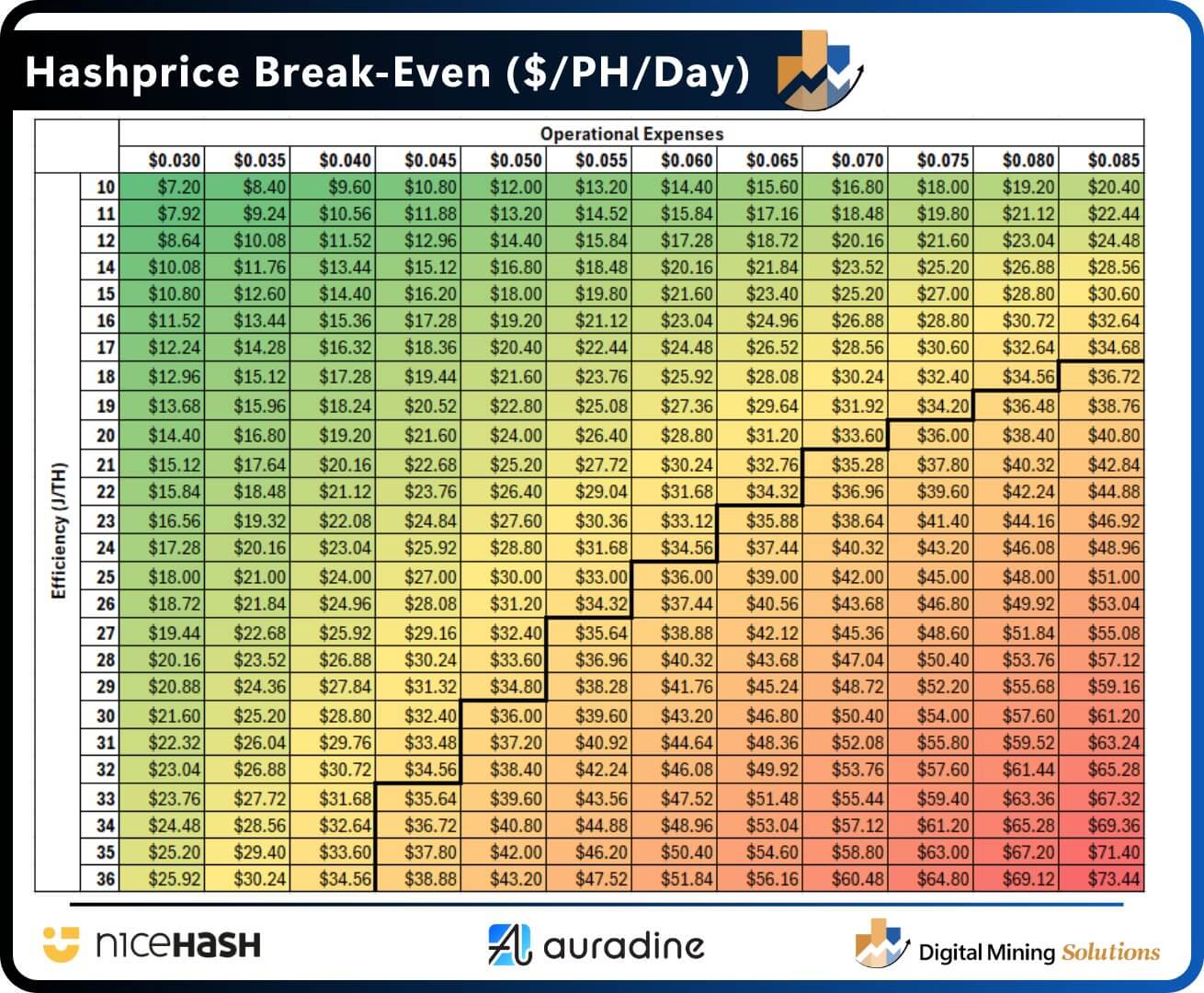

Hashprice, an industry measure of daily revenue per unit of compute, has fallen by almost 50% in recent weeks, hitting an all-time low of nearly $34.20 per petahash/second. At this valuation, the average operator’s gross profit evaporates.

Nico Smid, founder of Digital Mining Solution, explained that this means a fleet running its hardware at an efficiency of less than 30 joules per terahash will have a break-even total electricity cost of less than 5 cents per kilowatt-hour, after rent, labor and maintenance are taken into account.

This threshold created a watershed that saw thousands of older rigs go dark, but was quickly offset by industrial-scale adoption.

However, this does not explain why total hashrate has changed little or why total security work remains above 1 zetahash.

The answer lies in fleet composition. Small-scale miners without access to cheap electricity are capitulating. On the other hand, businesses with ample financial power, such as long-term power purchase agreements (PPAs), sovereign-related facilities, and off-grid power generation, are either doing well or continuing to expand.

For context, stablecoin issuer Tether has reportedly halted its mining operations in Uruguay, citing high energy costs and fee uncertainty. So if a company like Tether can’t lock in durable terms, smaller miners will face an even tougher situation.

Integration through suffering

Two consecutive drops in BTC difficulty do not indicate that the protocol is stagnant. Rather, they are signals that the network’s competitors are changing.

As revenues decline, broken fleets are moved. Creditors seize inefficient sites, and brokers repackage used rigs for lower-cost regions. The most efficient miners clear out stuck capacity.

So the current headline hashrate resiliency is actually consolidation. Although networks appear to be stronger by normal measures, the number of organizations that can fund their strength is decreasing.

This focus has a trade-off. From extreme weather events to grid cuts to local permitting battles, exposure to single points of failure increases.

At the same time, financing is also moving to narrower balance sheet groups that can secure fixed-price energy, post collateral for interconnections, and hold inventory through long-term drawdowns.

As a result, capital markets are rethinking the definition of a miner.

As such, many investors are now treating the sector as a strong data center business with a volatile crypto overlay instead of a pure beta Bitcoin proxy. This is evidenced by the fact that as BTC revenues decline, many miners are adopting high performance computing (HPC) clients to enhance their revenues.

Changes in the power balance of Bitcoin mining

Geopolitics is also redrawing Bitcoin’s hash rate map. Despite a total ban in 2021, China’s return to an estimated 14% of the global hashrate signals a tectonic shift.

Underground and black market operations have re-established traces that had all but disappeared. In energy-rich states with surplus hydropower or adjacent coal industry loads, sites can operate intermittently and largely unnoticed.

This “zombie capacity” keeps the hashrate rising and acts as a permanent tax on compliant Western miners.

But Western Bitcoin miners face a narrowing path.

Operators squeezed by rising financing costs, stricter disclosure requirements, and unstable interconnection schedules can only compete on cost if they lock in multi-year power contracts, move to a more flexible grid, or share infrastructure with data center tenants.

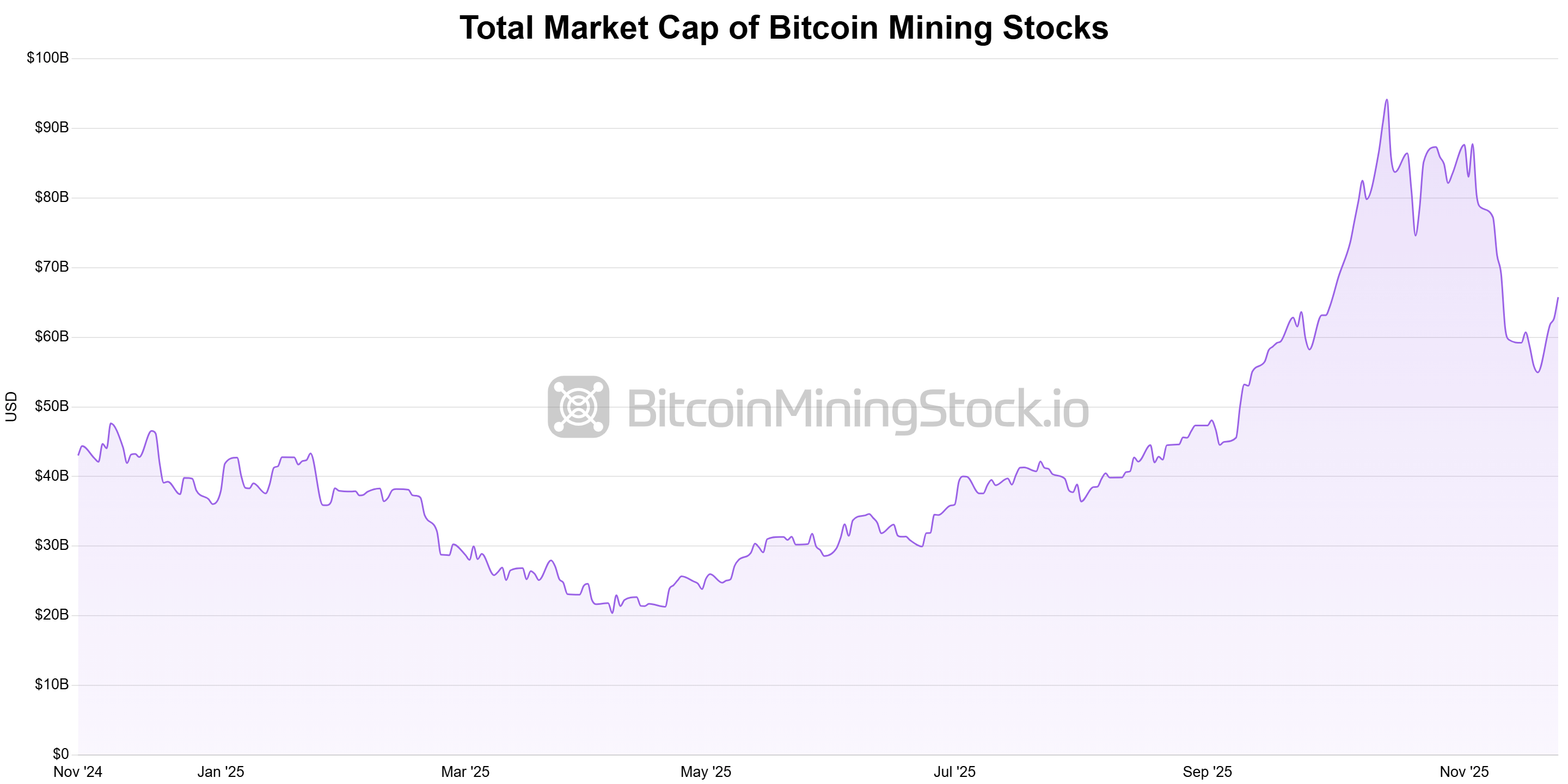

Naturally, this affected their business, with public mining stocks wiping out nearly $30 billion in market capitalization in November.

These BTC miners have seen their stock price fall from a peak around $87 billion to around $55 billion, before partially recovering towards $65 billion.

What to watch next

With this in mind, industry players are monitoring three specific dials to determine the next steps in this restructuring.

The first one is difficult. Deeper negative retargeting would support high-cost fleet-to-fleet phasing out. A sharp snapback would suggest that suspended capacity is being reactivated as power contracts are repriced or rates rise.

The second is transaction fees. Waves of registration and persistent mempool congestion can increase miner revenues for weeks at a time, but the base case is a lean fee environment where hash prices are fixed near break-even for many fleets.

The third issue is policy and supply chain. Tightening export controls, security reviews, and grid interconnection rules could shift the cost of capital overnight.

Miners have already begun to adapt by expanding their business mix. Many have repositioned themselves as data infrastructure companies, signing multi-year contracts for AI and high-performance computing to smooth cash flow that Bitcoin alone cannot guarantee.

This model allows you to maintain marginal sites and maintain upside exposure even if the hash price recovers. Still, it draws scarce power towards more stable margins, leaving Bitcoin as a flexible sink that absorbs volatility.

The immediate risk to Bitcoin is not a security breakdown. The zettahash era saw record aggregation efforts and protocols continue to be adjusted on schedule.

Risk is structural. Aggregated metrics make the system appear healthier while reducing the number of actors providing work.

As capital gets tighter and energy costs remain high, we are likely to see more asset sales, mergers, and migration to friendly jurisdictions. However, once prices and rates recover, some of the current idle capacity will return, often with new ownership and new power terms.

That is the paradox of the Zettahash era. At the protocol level, Bitcoin looks stronger than ever. The mining industry is facing serious difficulties behind the scenes.