The first quarter results for Bitcoin (BTC) miners could be disappointed as daily mining profitability measures have further declined and trade tariffs have heaviered markets, asset manager Coinshares (CS) said in a blog post Friday.

“The Q2 results could indicate degradation as tariffs on imported mine rigs range from 24% (Malaysia) to 54% (China),” wrote an analyst led by James Butterfill.

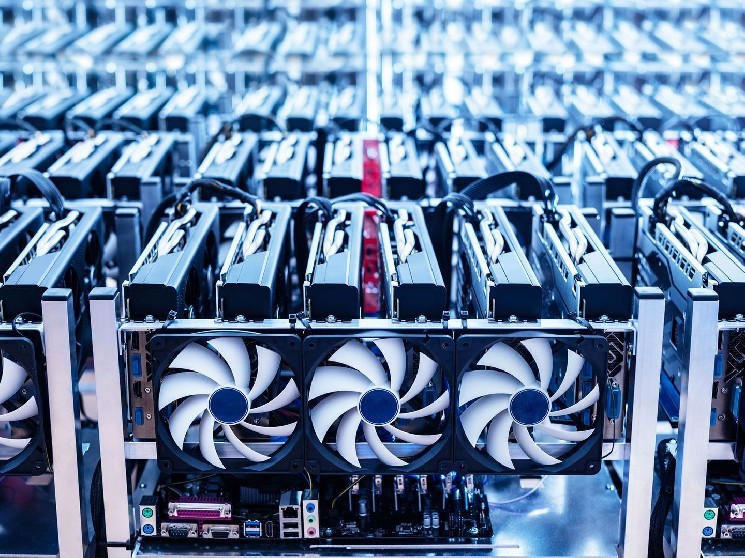

Bitcoin miners relying on older or less efficient rigs face higher exposure to these tariffs, according to the report.

The author wrote that Core Scientific (CORZ) “is more insulating as it moves to HPC,” adding that Bitdeer (BTDR), which makes its own rig, could put margin pressure on sales outside the US.

The asset manager predicts that the Bitcoin network hash rate will reach 1 Zettahash per second (Zh/s) by July and 2 Zh/s by early 2027.

The outlook for Hashpris is not particularly positive.

The asset manager model shows that “a gradual structure reduction, with prices likely to remain in the $35-$50 per day range until the 2028 Harving Cycle.”

Asset Manager Grayscale said in a research report earlier this month that tariffs and trade tensions could be positive about Bitcoin adoption in the medium term.

read more: Bitcoin miners with HPC exposure have low performance in the first two weeks of April: JPMorgan