Cryptocurrencies have been on the rise since the U.S. federal government was shut down late Wednesday night over partisan fiscal issues.

Bitcoin nears all-time high due to federal government impasse

We’re in the third day of the federal government shutdown, but you wouldn’t know it by looking at the market. Stocks are mostly rising, with the exception of a few tech companies such as AI company Palantir Technologies (NASDAQ: PLTR), which plunged 7% on Friday. The broader cryptocurrency market has risen 1.48% since yesterday to nearly $4.2 trillion, with Bitcoin (BTC) less than $2,000 away from its all-time high.

The U.S. government ran out of money late Wednesday night, forcing the country into its 15th government shutdown since 1980. Senate Republicans and Democrats had proposed temporary funding bills to avert a shutdown, but none passed, leaving millions of federal workers in limbo. The last shutdown occurred in late 2018, also under the Trump administration. It lasted 35 days, the longest ever, and cost an estimated $3 billion, according to Democrats.

And just hours after the close on Wednesday, human resources firm ADP reported that the country’s private sector had lost 32,000 jobs, a scathing indictment of the Fed’s previous interest rate policy and surprising economists who had predicted a 45,000 job gain. However, investors remained undaunted and became even more bullish in anticipation of further interest rate cuts later this year, bringing Bitcoin to this moment on the verge of hitting new all-time highs.

“Bitcoin will hit a new all-time high next week and will soon reach my Q3 forecast of $135,000,” said Jeffrey Kendrick, head of digital asset research at Standard Chartered Bank. “This shutdown is significant. During the last Trump shutdown (December 22, 2018 to January 25, 2019), Bitcoin was in a different place than it is now and had little effect.”

Overview of market indicators

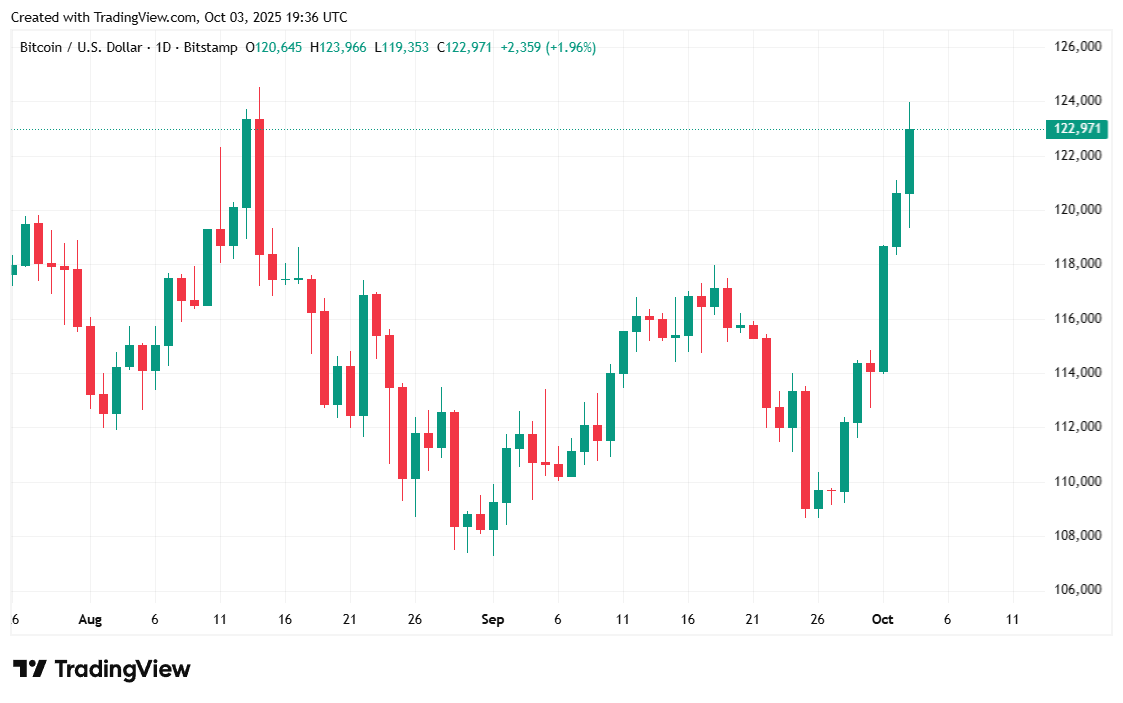

At the time of reporting, Bitcoin price was $122,958.26, up 1.62% in 24 hours and 12.55% in 7 days, based on Coinmarketcap data. Since yesterday, the digital asset has fluctuated between $119,344.31 and $123,944.70.

(BTC Price/Trading View)

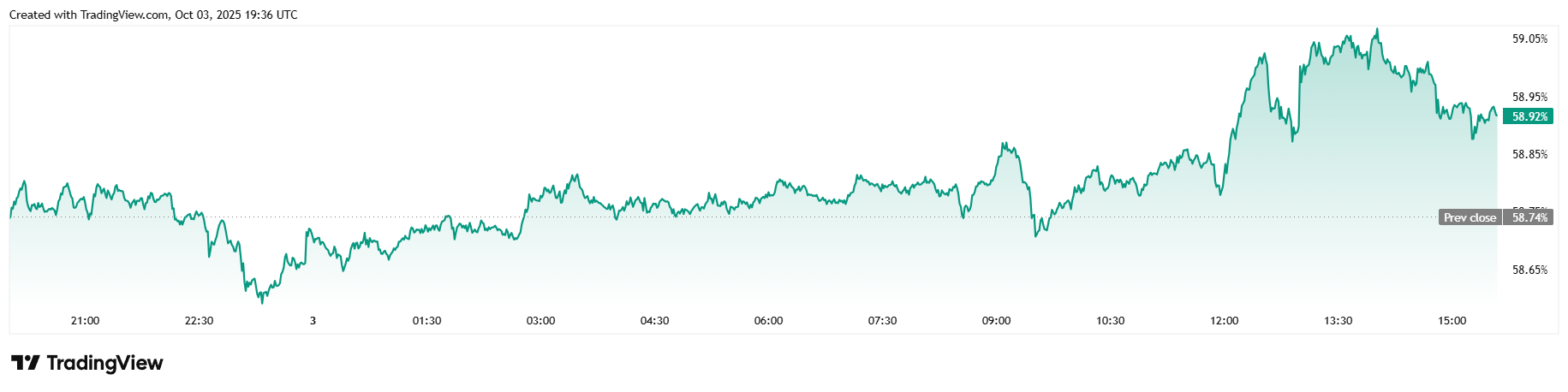

The 24-hour trading volume increased by 19.25% to $87.09 billion, and the market capitalization increased by 1.44% to $2.44 trillion, in line with the price. Bitcoin’s dominance rose 0.31% to 58.91% as the cryptocurrency outperformed most of the altcoin market.

(BTC Dominance / Trading View)

According to Coinglass, total Bitcoin futures open interest increased by 1.03% in 24 hours to $89.63 billion, and Bitcoin liquidations jumped to $211.58 million from yesterday. The majority of these were short-term liquidations, amounting to $153.36 million, and the rest came from longs, which accounted for a smaller share of total liquidations at $58.22 million.