Since spending new time over $111,000, Bitcoin has brought price adjustments over the past week, seeing a cool-off of key markets. Bitcoin has dropped by 4.36% over the past seven days, forcing its price to $104,000, according to data from CoinmarketCap.

To establish bullish momentum, a well-known Crypto analyst using the X username Daan Crypto, says the best cryptocurrency that represents a vital price region in the current price structure must determine $106,000.

Bitcoin prices outside the combined range – forward negative

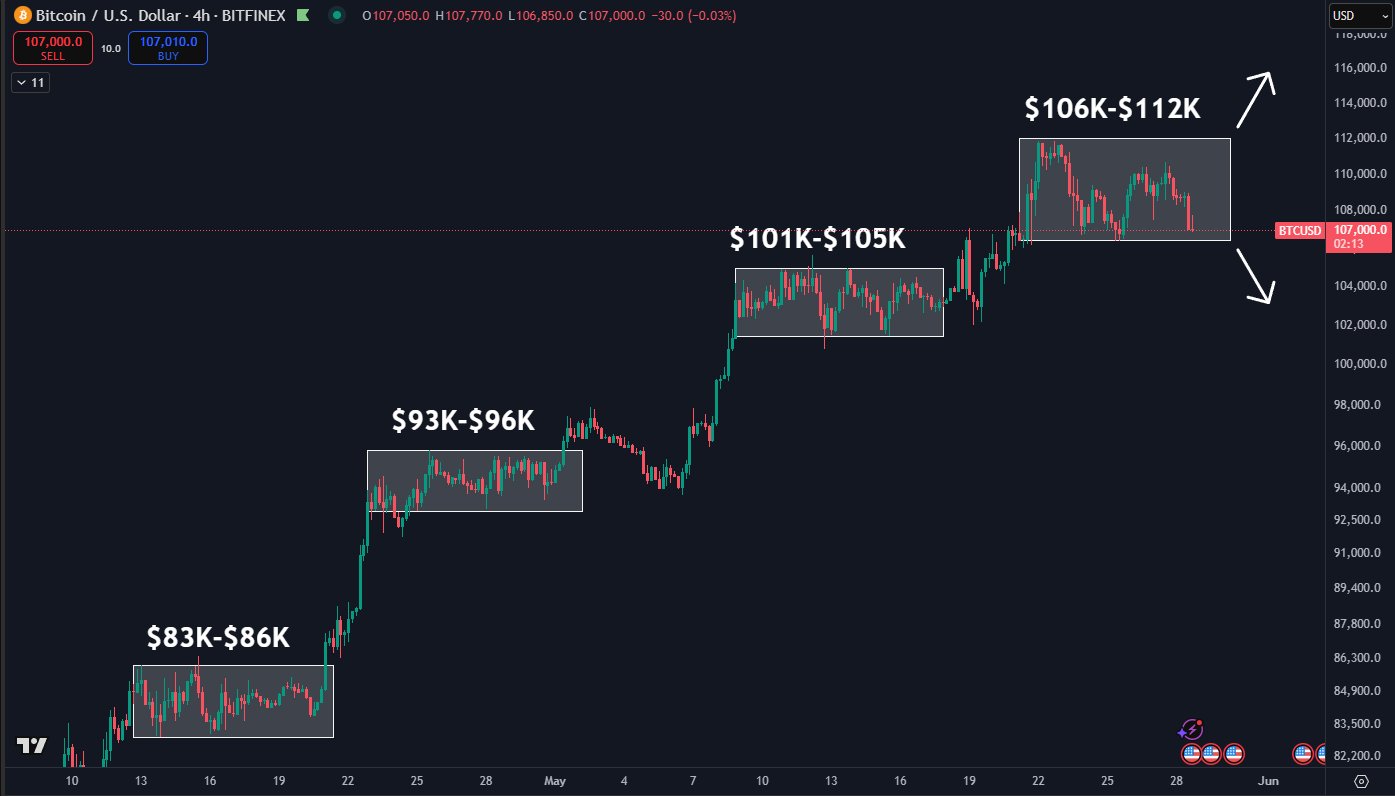

Following the reboot of Crypto Bull Market in April, Bitcoin showed a specific price pattern listed in the price surge of an estimated $10,000, followed by consolidation within a certain price range for about 7-10 days when another rally occurred.

After rising to $111,970 as the latest new ATH, the price of the BTC appeared to have settled into a range-bound move between $106,000 and $112,000, in preparation for another potential rise. However, recent negative market responses, including macroeconomic pressures as a report, suggest that US-China trade talks hit a wall, forcing trade low at $103,867, below the integrated zone.

According to Daan Crypto on the X Post on May 30, the Bitcoin Bulls will need to collect price ranges above $106,000 to halt the current decline and establish their intention to maintain the current uptrend.

In particular, a potential denial at this price level indicates that Bitcoin may have reached the top of the market at $111,970, with further price adjustments scheduled for next week. This bearish development potential is very high, especially considering that Bitcoin Spot ETF registered a negative net inflow on May 29th, marking it for the first time on its first trading day over 10 days.

While certain market analysts have expressed their views on the possibility of overwhelming bear pressure on a price target of around $100,000 to $102,000, while others believe that a major price crash can be set in alignment with the crypto market cycle.

Bitcoin price overview

At the time of writing, Bitcoin was traded at $103,539, reflecting a past 2.60% loss. Meanwhile, daily trading volume of assets fell 2.24%, indicating a slight decline in market sales pressure amid the current decline.

More than 1.27 million people have now fallen due to Bitcoin retracement, according to data from Blockchain Analytics firm Sentora. However, there is strong evidence to support market rebounds when retesting regions with prices of $100,000.

Pexels featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.