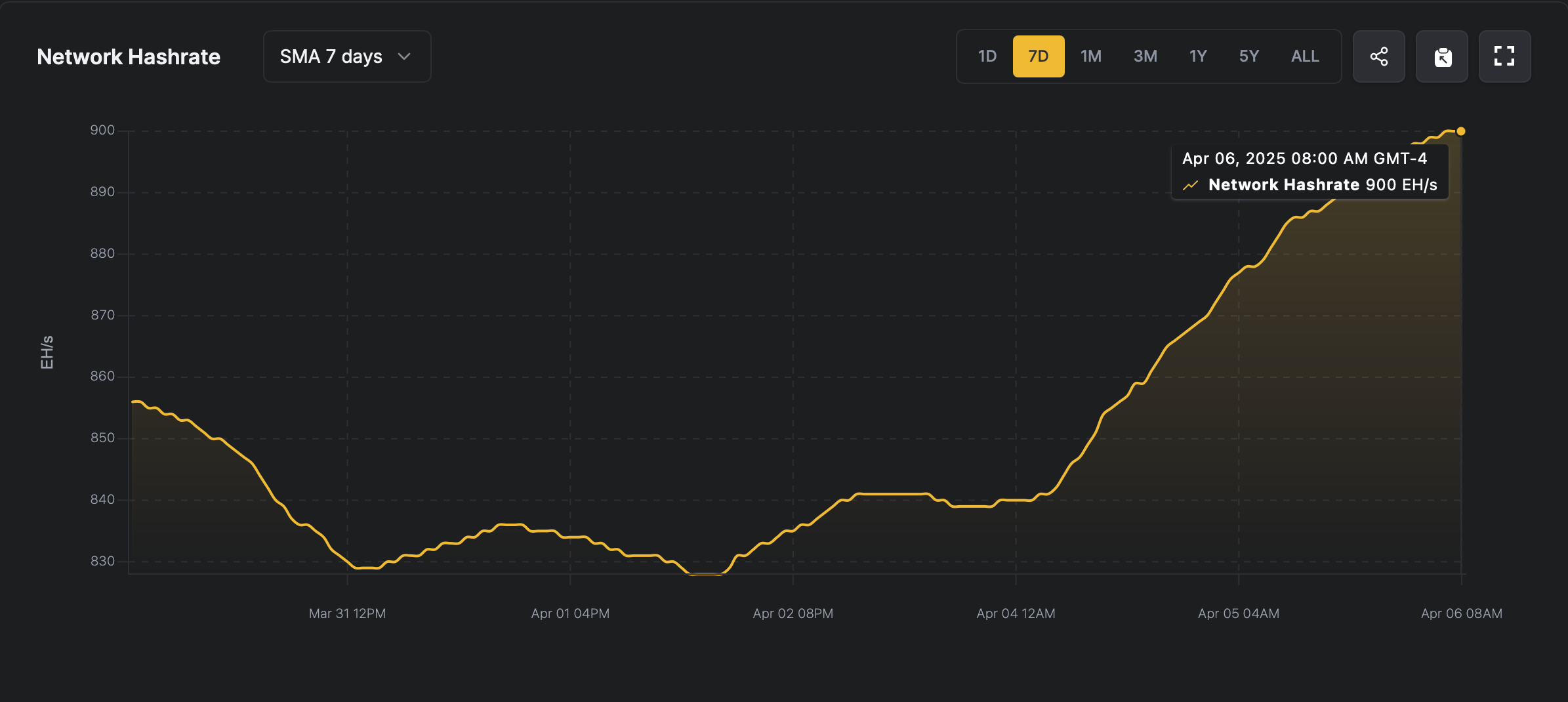

Bitcoin hashrates skyrocketed to unprecedented heights, hitting an astounding 900 exahash (Eh/s) as of April 6th.

900 EH/s Milestone: Bitcoin Security Fortress Will Be Stronger

At block 891,072 a day ago, the network difficulty was adjusted upwards from 113.76 trillion to 121.51 trillion. Traditional wisdom suggests that as difficulties climb, mining becomes more difficult and often promotes calculus power as participants emerge.

But contrary to expectations, the hashrate was not only held firmly, but it also accelerated. After brushing the noble 883 EH/s on April 5th, it was arched to 900 EH/s the following day. This translates to 17,000 petahashes (ph/s) per second, or 17 Eh/s, which are woven into the network in just one day.

7-Day Simple Moving Average (SMA) via HashrateIndex.com on Sunday, April 6, 2025.

Prior to the difficulty adjustment, 1 PH/s forecast revenue (1 PH/s forecast revenue) was sold for $46.67 on April 5th. Now, reflecting the changing economy of mining, it has settled at $43.27 per PH/s. Furthermore, the blocking interval was much faster than the average of 10 minutes, making hiking difficult.

The current reality tells a different story. As of 9am on April 6th, the hashrate is immersed in 889.62 EH/s, slowing block times and averages a slump of 11 minutes and 39 seconds per HashrateIndex.com. Transaction fees remain negligible, and more prioritized transfers are cleared with only one SAT/VB (only $0.12). Meanwhile, a modest queue of 2,686 unconfirmed transactions remains with the members.

The network’s latest performance reveals a winding mining sector, but is not broken, but readjusted with wise accuracy. Subtle variations in key metrics indicate tidal changes that indicate tidal changes that could reconstruct profitability and miner tactical roadmap.

The subtle balance between computational demand and supply refers to the high stakes dance of incentives. There, we advance the efficiency of ingenuity and tenacity in potentially contested arenas.