Bitcoin price action last week was largely red as major cryptocurrencies regained their place beyond the psychological $100,000. This recent burst of bullish momentum reflects healthy growth among investors.

On Friday, May 15th, Bitcoin price reached $103,800. This is the highest level since January. However, the latest on-chain data shows that there is no investor activity in the derivatives market that is normally seen when BTC values reach this level.

Is BTC price about to hit a obstacle?

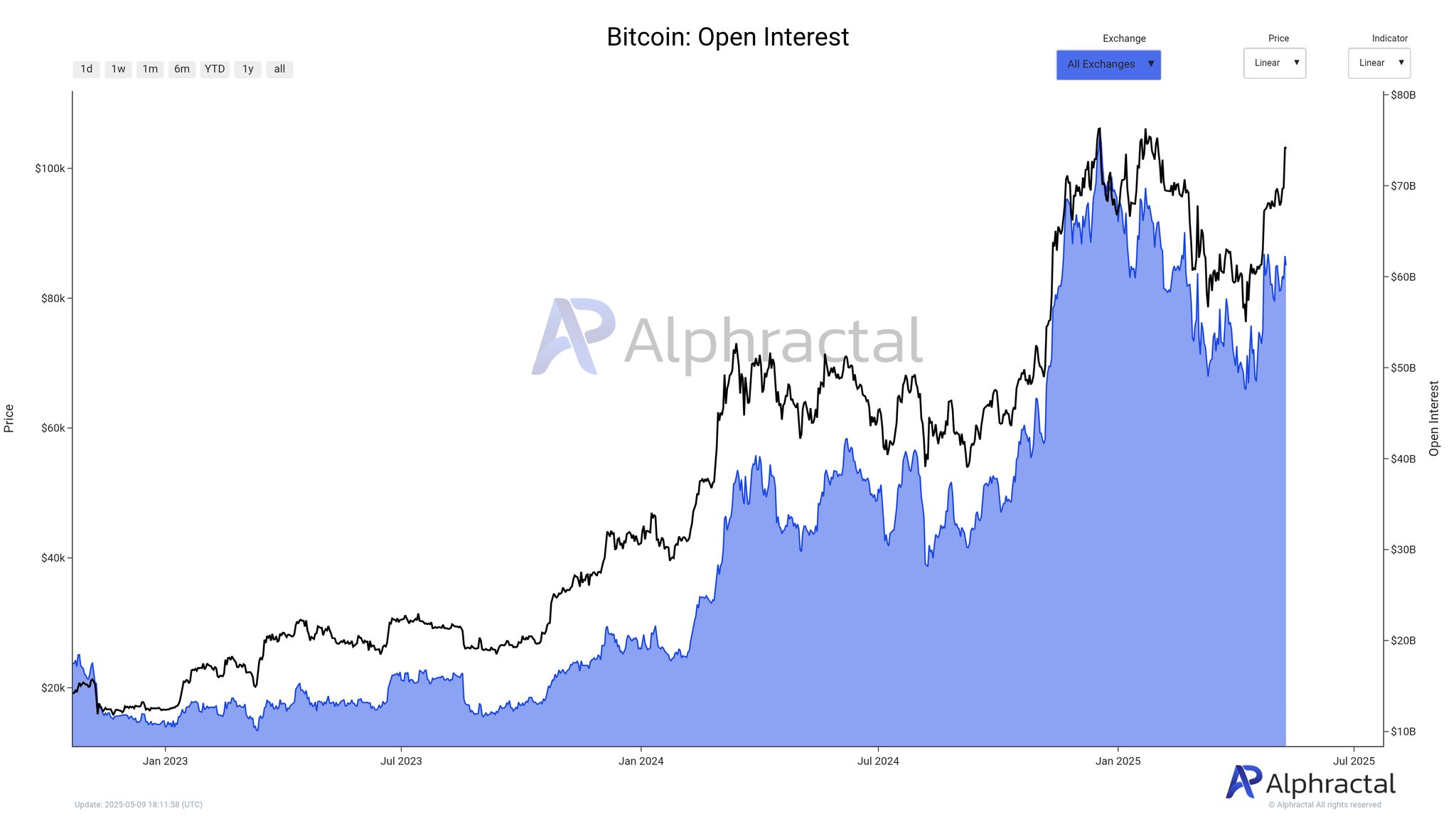

In a recent post on social media platform X, Crypto Analytics platform Alphractal shared that over the past few days, no open interest (OI) has been moving in parallel with Bitcoin prices. Open-In Test Metrics measure the total amount of money that flows into BTC derivatives at any time.

A growing open interest is often seen as a bullish signal for the best cryptocurrencies, especially as it suggests a fresh influx of capital into the market. Ultimately, this trend suggests that it improves investor sentiment and surges trader trust.

According to Alphractal data, Bitcoin’s current aggregated OI (valued at around $103,000) is an estimated $61.3 billion. When BTC was last at this monumental price, open interest amounted to over $68 billion.

Source: @Alphractal on XThe final price was $103,000, as Bitcoin is less than OI. Alphractal said the trend suggests lower leverage and reduced activity in the largest crypto market. The analytics company further explained that the phenomenon could be due to either a recent wave of liquidation or a location closure.

In X’s post, Alphractal revealed other reasons why the flagship cryptocurrency prices are at risk for short-term correctional movements. The associated on-chain metric supporting this bearish projection is the whale’s positional sentiment.

Whale location sentiment metrics track both directional bias and trading behavior of large holders. It usually reflects changes in whales’ net positioning, market sentiment, and open positions.

Chart showing a decline in the Whale Position Sentiment from 1 to around 0.7 | Source: @Alphractal on XAlphractal concluded that the decline in whale position sentiment reflects the interest of large investors in closing long positions, thereby changing market sentiment. If metrics continue to decline, on-chain analytics companies speculated that prices could be stagnant or worse yet, corrected.

Bitcoin price at a glance

At the time of writing, the BTC price is $103,035, and does not reflect any significant movements in 24 hours. While recent bullish momentum suggests that the best cryptocurrencies could reach their all-time highs in the coming days, investors may wish to take note in light of recent chain observations.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.