Bitcoin markets had an eventful trading week, with multiple failed breakouts from the $115,000 resistance zone despite the US Federal Reserve’s announcement of further interest rate cuts. As the price trend is currently stable around $110,000, Bitcoin options market data provides insight into trader behavior and the prevailing situation. Emotions.

Bitcoin options traders bet on a stable market

On Friday, prominent blockchain analytics firm Glassnode shared a weekly update on the Bitcoin options market, analyzing traders’ beliefs about future price movements. As mentioned earlier, the Fed announced its second rate cut for 2025 on Wednesday. While this is a generally bullish move, the hawkish tone suggesting that future rate cuts are unlikely has dampened traders’ optimism, resulting in a temporary rally in risk assets such as Bitcoin.

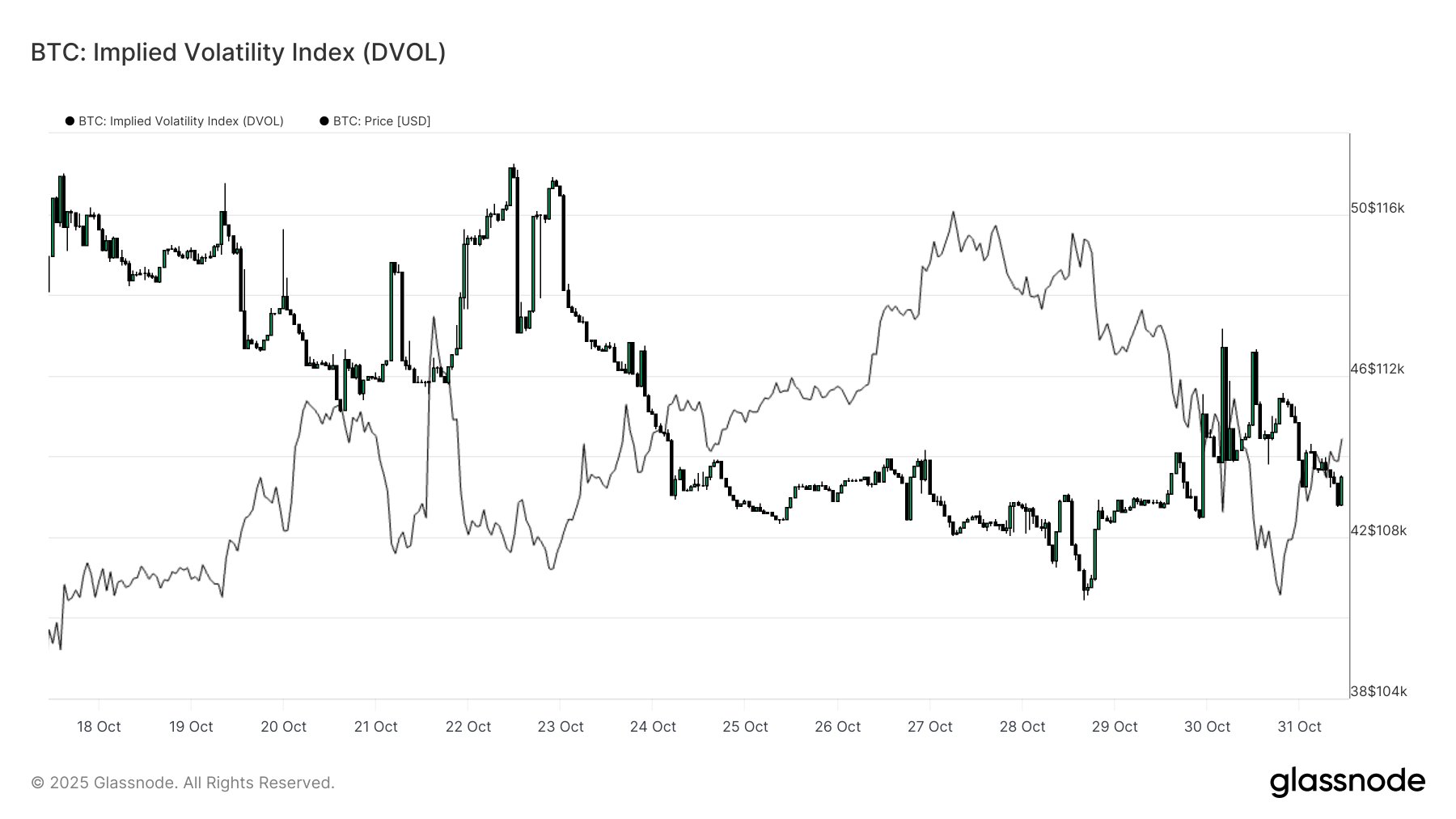

Amid these developments, the BTC Implied Volatility Index, which measures how much volatility traders expect in the future, continues to decline. This data suggests that despite the current macro noise, traders are pricing BTC more calmly, not expecting large price movements. On the other hand, the 1M volatility risk premium also turned negative as realized volatility moved faster than implied volatility. Glassnode expects this development to be mean-reversed. This means short-term volatility is expensive and traders are likely to sell, thereby confirming the expected benign market story.

Furthermore, the put/call volume also showed another side of this story, creating a complete retest to the October lows. Notably, traders initially displayed bullish behavior with the call wave, but quickly changed their sentiment in line with the broader market. However, with calls dominating, Glassnode points to neutral directional confidence, meaning the buy and sell pressures are equal, confirming the market’s lack of confidence in an immediate bullish or bearish move.

Do you have low expectations for price increases?

The 25 Delta skew chart provides another story of heightened alarm. Specifically, this indicator measures the implied volatility between calls and puts. 25 If the delta skew is neutral, it means that the trader considers the risk of the put to be balanced and the price of the call to be equal. After a brief stint in this neutral zone, the indicator is now rising again, indicating that traders are valuing puts more highly and actively hedging against price declines.

Therefore, while we do not expect large price movements in the short term, Bitcoin options traders appear to be very wary of price declines. At the time of writing, Bitcoin’s value is $109,304, reflecting a slight increase of 1.94% over the past day. Meanwhile, the daily trading volume decreased by 11.62% to $65.18 billion.

Featured images from iStock, charts from Tradingview

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.