Another follow rejection At the $120,000 level, Bitcoin (BTC) is beginning to show signs of cooling. Some analysts predict that BTC’s next top could approach $150,000.

Bitcoin’s current overheating stage shortened

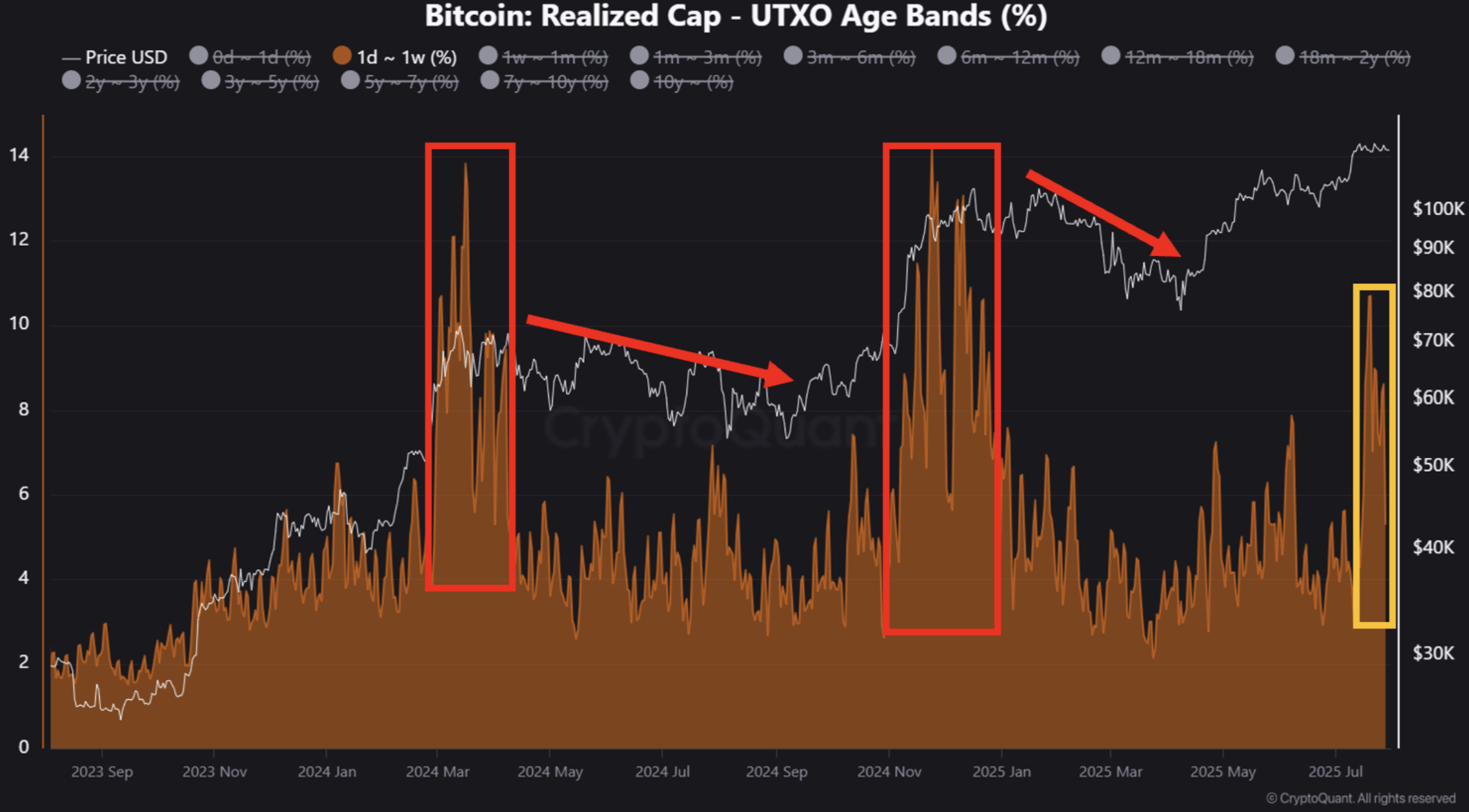

According to a Quicktake post on Crypto Dan’s Crypto Dan, Bitcoin is currently in the cooling period after a short-term overheating phase. Warning signs are most prominent in a cohort of BTC retained from one day to one week.

Crypto Dan shares the following chart showing this short-term holding cohort recording spikes consecutively, suggesting that overheated market conditions have been eased.

Analysts compared the current environment with previous overheating stages seen between March 2024 and October 2024 and January and April 2025. In both cases, the overheating lasted longer and became more intense (as indicated by the red box).

In contrast, current overheating conditions (shown in yellow box) show a shorter range and duration compared to the two instances mentioned above. Analysts added:

Also, recent price increases have been relatively modest, which may result in milder and shorter corrections in the short term. However, it is important to look forward to the potential upward trends in the second half of 2025.

The rise in BTC prices at the latest rally marked a surge in digital assets from around $108,000 on July 1st to $123,128, to the new all-time high (ATH) on July 13th.

Is BTC ready for the next big move?

As Bitcoin consolidates, some analysts suggest that the best cryptocurrencies may be gearing up for a big move. Titan, a veteran Crypto analyst at Crypto, noted that Bitcoin is now a “pressure cooker.”

Crypto’s Titan shared the following chart, highlighting the bollinger band tightening while volatility is shrinking. At the same time, the relative strength index (RSI) is compressed – in many cases, happen.

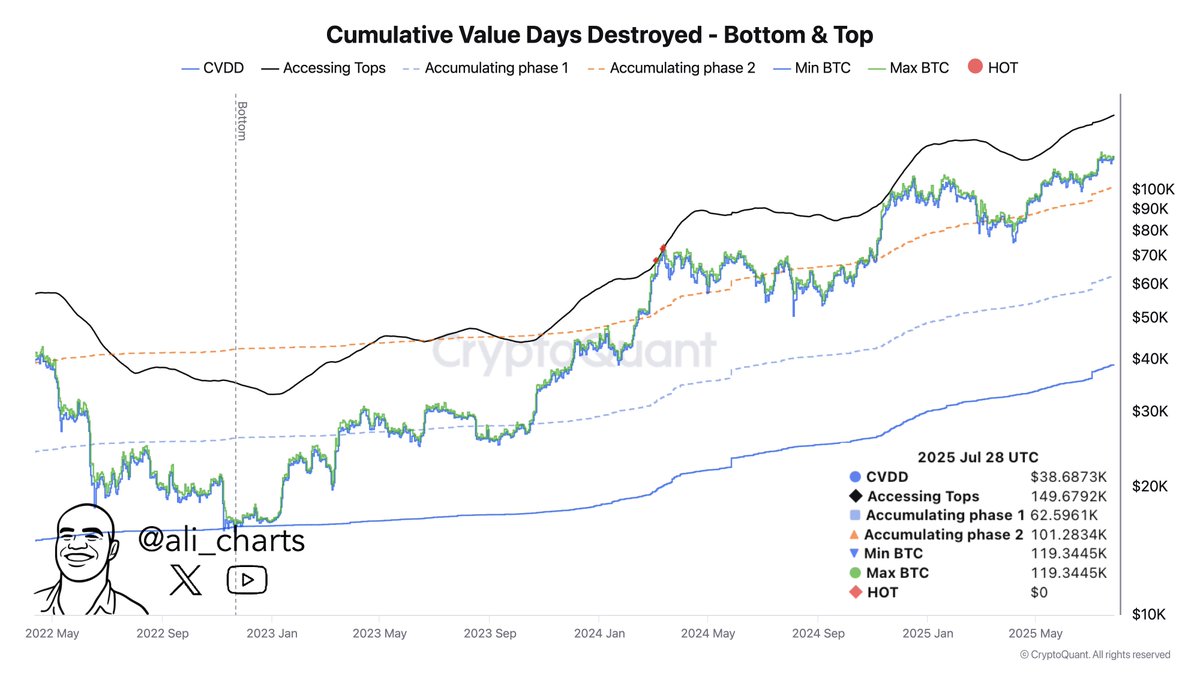

fellow analyst Ali Martinez added that BTC’s next top could reach $149,679 based on the destroyed cumulative value date (CVD) metric. In the context, CVD metrics measure whether a buyer or seller controls the volume over time.

That said, there are still some warning signs. Recently, Bitcoin exchange reserves arrived One month’s heightsuggesting that some holders may be preparing for sale – could put pressure on the current bullish trend. At press time, BTC will trade at $117,546, a 0.4% decrease over the past 24 hours.

Featured images from charts on Unsplash, Cryptoquant, X and tradingView.com