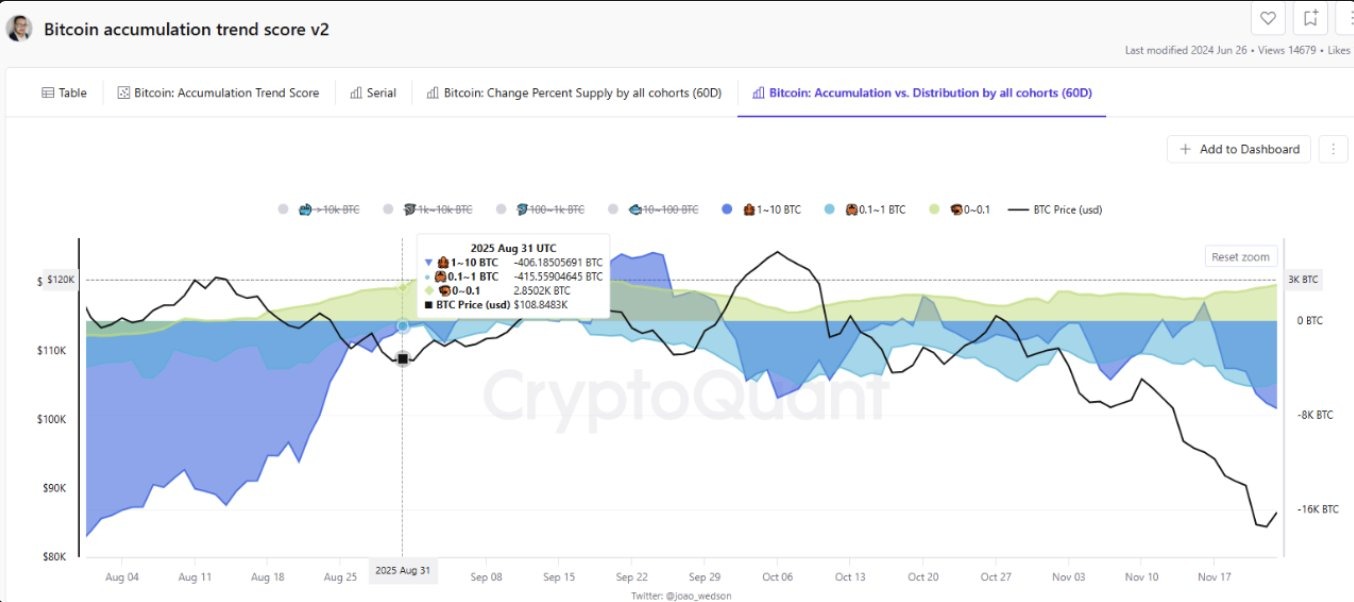

Whales holding 1,000 to 10,000 BTC sold off in large numbers, creating strong pressure when Bitcoin fell.

Only holders of 10-100 BTC and 100-1,000 BTC accumulated consistently during the adjustment period.

Bitcoin has recovered from $81,000 to $87,000, but first the whales have to stop selling.

Bitcoin’s sudden 20% drop in November shocked the entire crypto market, wiping out more than $1 trillion in value. After hitting a record high of over $125,000 in October, it plummeted to around $81,000 before recovering slightly to $87,236.

Many traders are now wondering, “Has Bitcoin finally found the bottom?” CryptoQuant, a leading on-chain data provider, believes:

Big whales took profits and caused Bitcoin to crash

According to CryptoQuant analysis, the recent Bitcoin crash was not just a case of panic selling, but a complex mix of whale action, retail pressure, and heavy futures liquidation.

In the weeks leading up to the crash, wallets holding between 1,000 and 10,000 BTC gradually reduced their positions. These large companies, including institutional investors and major funds, were selling off Bitcoin’s strength by locking in profits from its all-time high.

Surprisingly, retail investors did not intervene. Small wallets holding less than 10 BTC and even up to 1,000 BTC were also sold during the correction.

Therefore, there was no solid buying support left for Bitcoin when both whales and retailers opted for safety, profit taking, and risk reduction after the October rally.

The only buyers were medium sized holders

Among all the sell-offs, medium-sized holders, especially those holding 10-100 and 100-1,000 BTC, are the only group showing steady buys throughout the correction.

Their buying added some support and slowed the decline, but it was not strong enough to counter the whale mass distribution. The weight of whales on the market is simply smaller compared to larger whales.

Futures liquidation worsens decline

CryptoQuant also points out that the real damage came from the futures market. There was a massive unwinding of long positions over a period of 13 days.

This caused Bitcoin to drop from $106,000 to $81,000, turning a normal correction into a sharp and violent crash.

The forced sales set off a chain reaction as long-term traders were liquidated one by one.

So, is this the bottom? Not at all!

After reaching $81,000, Bitcoin finally showed some vigor and returned to $87,000 within two days. This rebound is the first real sign that the market may be forming a local bottom.

However, a true reversal will only occur if the 1,000-10,000 BTC group stops selling. Until then, the recovery looks hopeful but still fragile.

Bitcoin may be nearing its bottom, but its next move will depend on the behavior of the whales over the next few days.