Bitcoin prices have continued to be impressed this weekend, recovering strongly from the blues in the week that fell to $101,000. From a broader perspective, BTC will target the $110,000 mark and try to regain the highest price ever. With the best cryptocurrencies already locked up at the $106,000 level, the question is, where is the next obstacle on this recovery journey?

BTC prices face a huge resistance to over $106,000

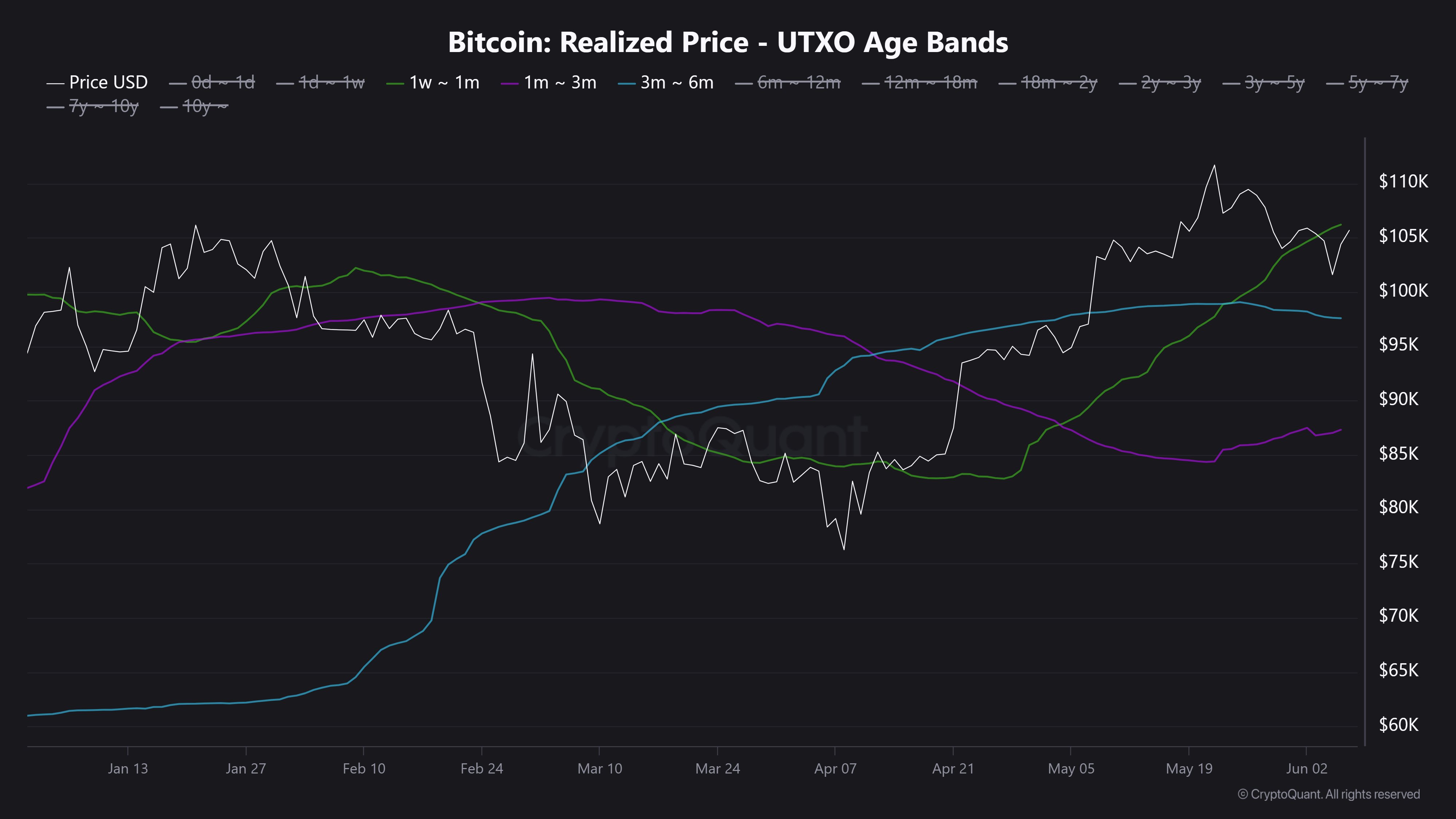

In a new post on social media platform X, on-chain analyst Burak Kesmeci revealed two key levels that are important for the medium to long-term trajectory of Bitcoin prices. This analysis is based on the realised prices of a particular class of investors known as short term holders (STHs).

Short-term Bitcoin holders are known for their reactive and speculative nature, as they are often triggered by sudden price movements. Therefore, these investors tend to open and close positions in a short period of time.

In a post to X, Kesmeci revealed three important levels based on the realised prices of investors within a certain unadvanced transaction output (UTXO) age band. Specifically, on-chain analysts highlighted the investor’s cost base within a week. It highlighted the age bands from four weeks ($106,200), one to three months ($87,300), and three to six months ($97,500).

Source: @burak_kesmeci on XAccording to Kesmeci, Bitcoin prices could face great resistance at around 106,200 levels, where investors from one to four weeks have a cost base. The rationale behind this is that when STH returns to the cost base, it may close the posture, leading to the formation of downward pressure and resistance levels.

Conversely, Kesmesi highlighted the realised price ($97,500) of short-term investors within the band from three to six months ($97,500) as another important level of Bitcoin prices. Analysts said investors in this class view this realized price move as an opportunity to protect their position, leading to the formation of support cushions.

Essentially, this on-chain data suggests that Bitcoin may be approaching a major resistance level, slightly above $106,000. If successful at this level, investors may see the best cryptocurrency revisiting the highest ever-growing $111,871.

Bitcoin price at a glance

At the time of writing, BTC priced around $105,700, reflecting a 1.3% increase over the past 24 hours. According to Coingecko data, market leaders have grown by more than 1% over the past seven days.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.