Bitcoin continues to impress as one of the best performers of a large asset, with this value rising nearly 25% over the past month. Furthermore, Bitcoin prices were able to exceed the six-figure valuation threshold despite slow market conditions last week.

After weeks of strong bullish behavior, the flagship cryptocurrency appears to have settled within the consolidation range of between $102,000 and $105,000. Despite the cry of recovering the all-time highs of the market, Bitcoin prices now appear to be facing some degree of indecisiveness among investors.

BTC prices may be prepared for sale

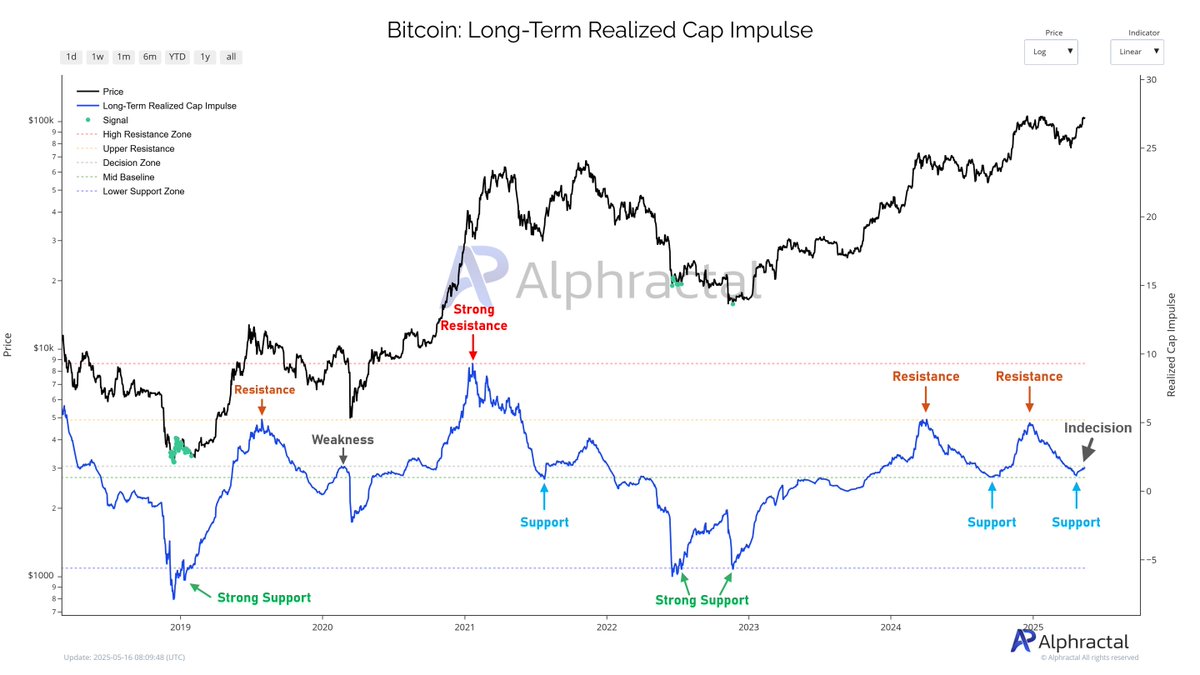

In a May 16 post on social media platform X, on-chain analytics company Alphractal explained that Bitcoin’s price is at the time. This may be important for future trajectories. This on-chain evaluation is based on long-term realised cap impulses. This is a metric that measures the growth rate of realized capitalization for long-term holders.

To be clear, the positive value of long-term realised cap impulse signals is that long-term investors are purchasing more BTC at higher value. This trend usually indicates the onset of bullish times or bullish markets when long-term holders are in accumulation mode.

On the other hand, if the long-term realised cap impulse metric is negative, it means that the long-term holder is offloading the coin at a price lower than the cost base. This is usually seen in the late bull cycle and early bare markets where long-term investors distribute assets.

Furthermore, the long-term realised cap impulse indicator provides insight into the supply and demand dynamics of Bitcoin, highlighting key support and resistance zones. As shown in the chart provided by Alphractal, the price of Bitcoin lies at a key point marked by the horizon, known as the level of indecisiveness.

Source: @Alphractal on X

Market intelligence companies point out that long-term realisation from this level of cap impulse metric breakouts can prove crucial for Bitcoin’s long-term health, and are ongoingly strong demand and potential price increases.

However, Alfractal attaches historical relevance to this level and notes that in March 2020, the long-term realised cap impulse metric was rejected in the indecisive zone just before the Covid-19 dump.

Bitcoin price at a glance

At the time of this writing, BTC priced around $103,713, reflecting just 0.6% increase over the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.