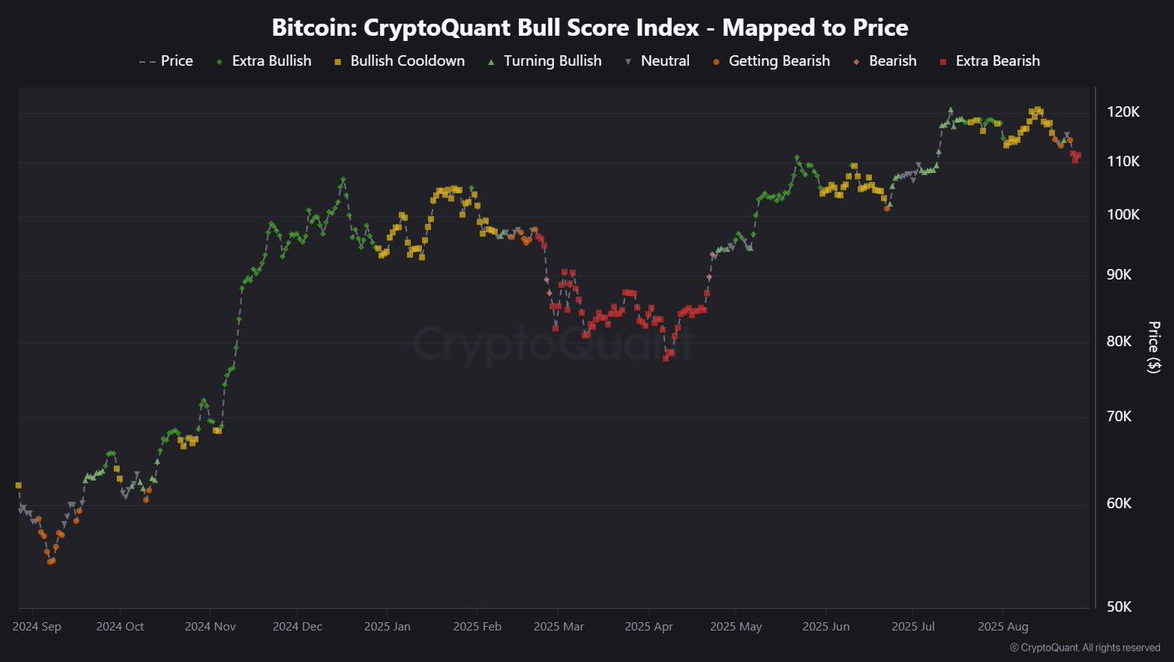

Cryptoquant’s Bitcoin Bull Score Index fell to a value of 20, suggesting that potential bear transitions may have occurred for the assets.

The Bitcoin Bull Score Index is currently in the “extra bearish” area

In a new post on X, Cryptoquant community analyst Maartunn shared how Analytics Firm’s “Bull Score Index” has changed with Bitcoin after the recent price cuts. The Bullscore Index is an indicator that tells you about the current market stages of cryptocurrency. This is determined by referring to a bundle of important on-chain metrics.

Below is a chart showing indicator trends over the past year.

As seen in the graph, Bitcoin entered the “bulging cooldown” phase at the beginning of August. This signal was interestingly persisting even when its price was set at a newly high (ATH) later in the month. This is a potential sign that breakouts will always be short-lived.

In this peak-footed market slump, the Bullscore Index first immersed itself in the “bearish” zone and now falls to “extra bearish” level. “This is serious,” Maartunn said.

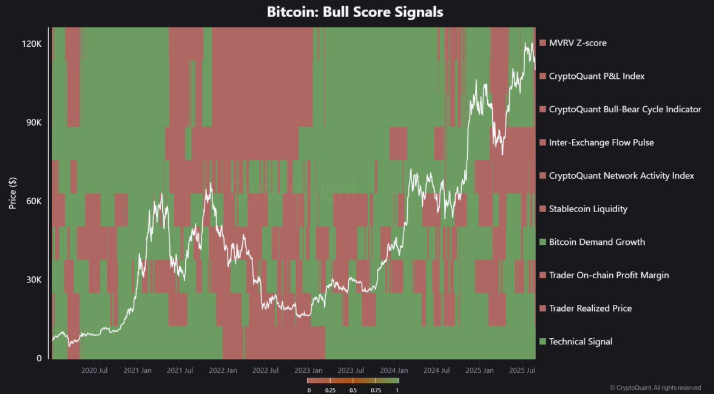

This is another chart. This decomposes the individual signals that contribute to the value of the Bullscore index.

Almost all indicators are giving bearish signals at the moment, as shown in the graph. Perhaps the most popular indicator on the list is “market value versus realised value (MVRV) Z scores,” which is related to investor profitability. The current market situation seems bad enough to force it to turn red.

The last time the MVRV Z-score and Bullscore index became Beash, it returned in February this year. Following the signal was the expansion phase of Bitcoin’s negative price action. Given that the Bullscore Index once again shows an extra bearish for cryptocurrency, it is still unclear whether we will see another price transition.

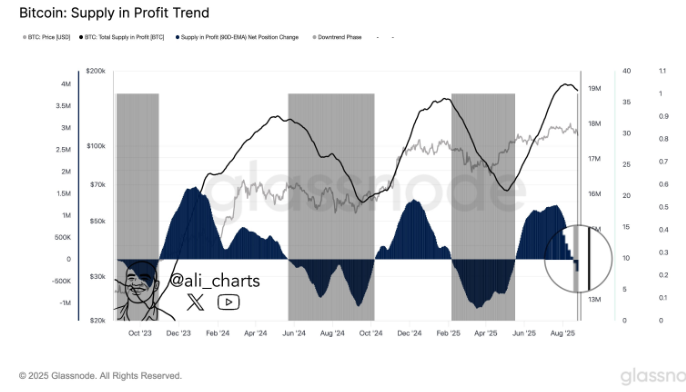

In reply to Maartunn’s post, analyst Ali Martinez agreed with the warning and shared another signal that could point to a similar outcome for Bitcoin.

The indicator cited by Martinez is a change in the net position of the 90-day index moving average (EMA) Bitcoin supply in profits. It is clear from the chart that the metric has recently become negative. This also happened before the bear market stage at the beginning of the year.

BTC price

On-chain metrics may point to a bearish conclusion for Bitcoin, but its price has now recovered to $113,000.

Dall-E, Glassnode.com, cryptoquant.com feature images, tradingview.com charts