Bitcoin BTC$90,016.95 It rose from $88,000 in Asian time to more than $90,000 in European afternoon time on Monday, but there remains reason to be cautious as U.S. markets take over the baton.

In recent weeks, BTC has tended to find early support during Asian and European hours, only to weaken as US investors return to the market.

This dynamic makes the US session a key test of whether the rally can be sustained. Rise above previous key levels, including $90,000, often reversed during New York time as hedges were added and profits were booked, often leading to liquidations of hundreds of millions of dollars in seesaw trades.

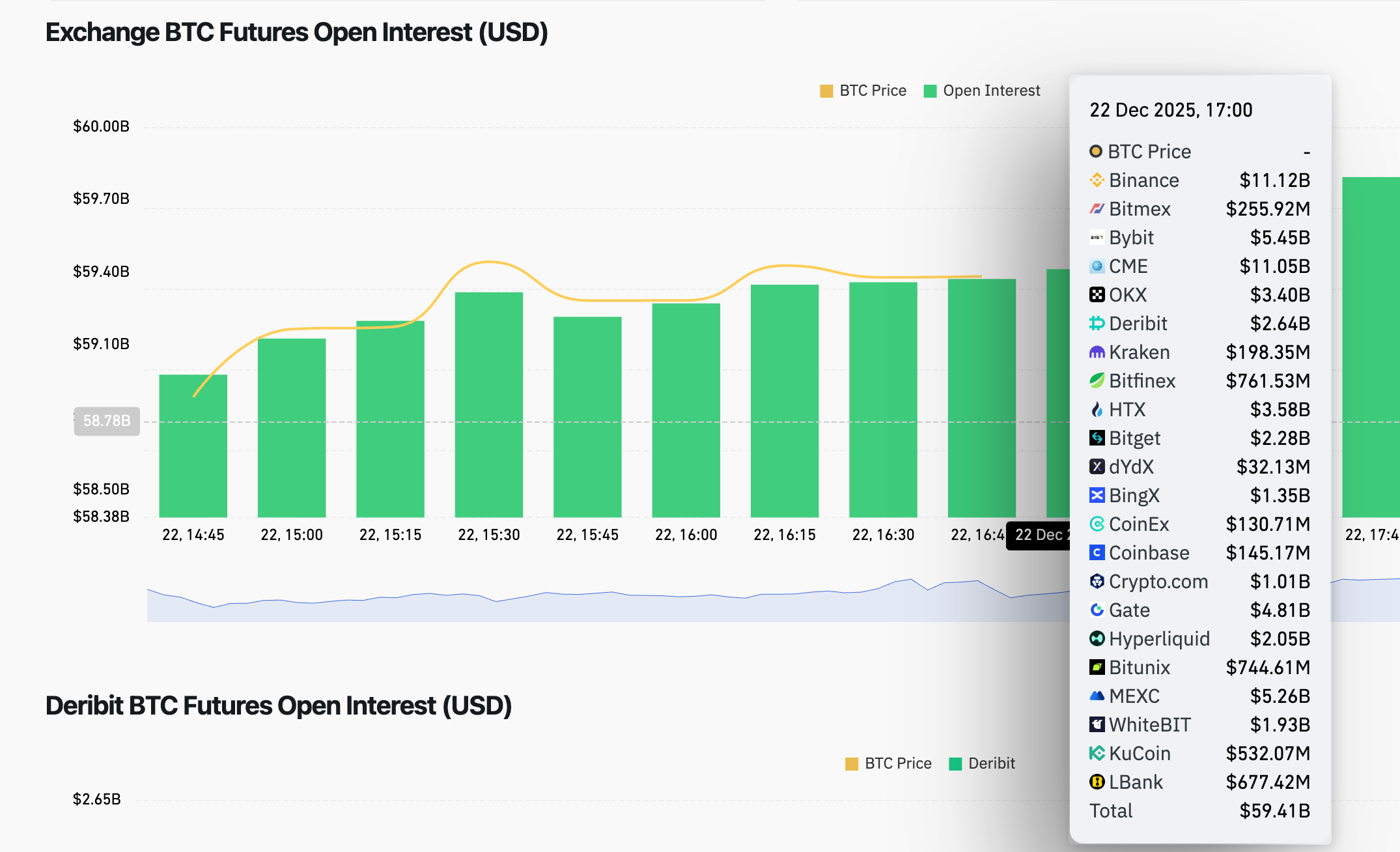

Derivative positioning shows that risk increases with price. Bitcoin futures open interest steadily increased as BTC rose on Monday, rising towards $60 billion across major venues, according to data from CoinGlass.

Binance, CME, and Bybit have all seen notable gains, suggesting that new leverage, not just short covering, is entering the market.

This dynamic has become well-known in recent weeks as prices strengthen during U.S. after-hours, followed by a barrage of selling when U.S. traders come online.

The concern now is not the breakout itself, but whether the rally is being supported by spot demand or whether there is an increased reliance on leveraged futures.

While open interest rising with price does not automatically indicate trouble, it does raise the stakes. If this movement holds, leverage could rise further. When momentum stalls, positioning becomes crowded and the market becomes vulnerable to rapid declines as long positions are unwound.

The risk for bulls is that failure to hold $90,000 during U.S. hours could reinforce the market’s recent pattern of lowering highs and quickly falling back.

In contrast, a sustained move above this level would mark a break from the close-selling behavior that characterized much of December.