James Van Stratin (all times unless otherwise indicated)

Bitcoin

This creates the problem that it could even decrease even further. In the context of a continuous bull market, double-digit revisions are not uncommon, with the biggest drawdown reaching 30% since this cycle began in January 2023.

One notable technical factor is the CME Bitcoin futures gap between $114,355 and $115,670. These gaps usually occur outside of CME trading hours, when price movements occur over weekends, and are often filled later as prices revisit these levels.

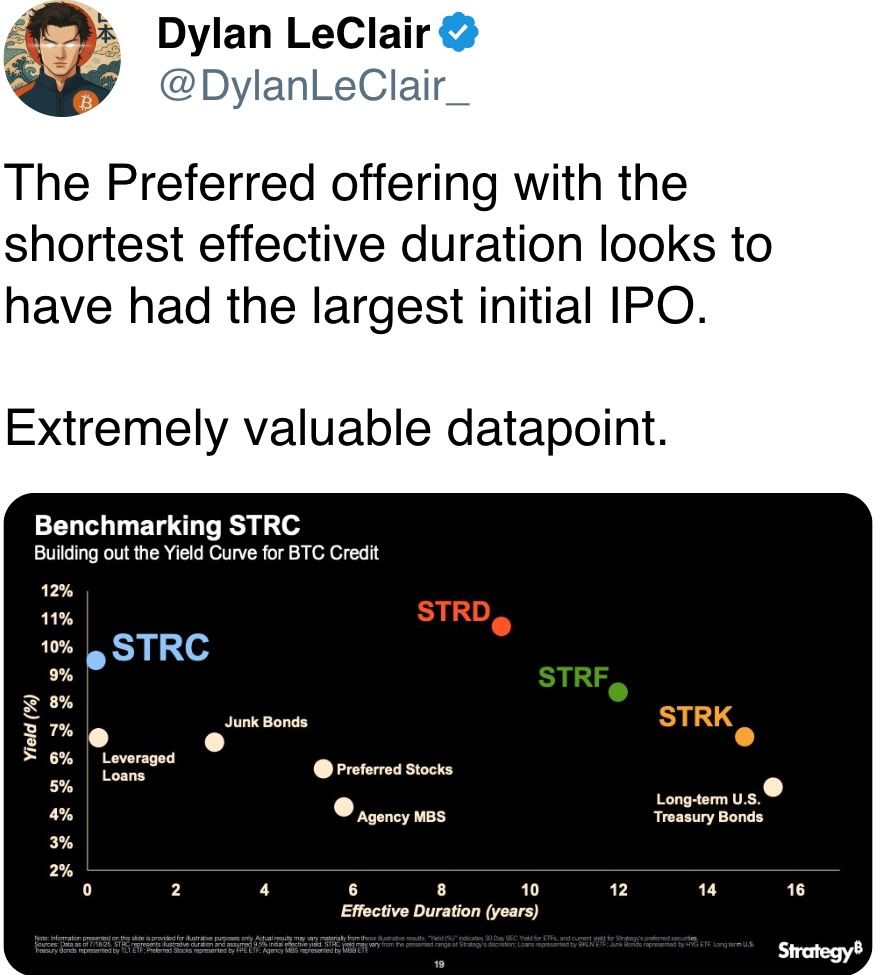

Other news reports that the Strategy (MSTR) has quadrupled the size of its permanent preferred stock sales of Stretch (STRC). Analyst Brian Brookshire noted that the service includes 28 million STRC stocks. At $90 per pop, that totals over $2.5 billion, with potential demand of around $21,500 BTC of $115,000.

Meanwhile, demand appears to have already surpassed supply, according to GlassNode’s on-chain data. Since the beginning of this month, over 210,000 BTC has been on sale with long-term holders (people who own BTC for more than 155 days) and short-term holders purchased by approximately 250,000 BTC.

As the end of the month is just a week away, Bitcoin is about 8% higher than when it started. It follows that historical trend. On average, the largest cryptocurrency returned around 7% in July 2013.

Ether (ETH) has skyrocketed over 46% in that segment, and is currently trading nearly $3,725. This is the third top 40% since November. Interestingly, in all other months it fell.

August is usually quiet and often reduces market liquidity. Keep alerts!

What to see

- Crypto

- July 28th: StarkNet (STRK), Ethereum Layer-2 Effectiveness Rollup (ZK-Rollup) launches V0.14.0 on MainNet.

- July 31st, 12pm: A live webinar featuring Bitwise CIO Matt Hougan and Bitzenship founder Alesandro Palombo discusses the potential of Bitcoin as the next global reserve currency amid a trend of derailment. Registration link.

- August 1: Helium Network (HNT), currently running in Solana, has reduced its annual new token issuance to HNT 7.5 million after half of the event.

- August 1: Hong Kong’s stablecoins ordinance comes into effect and a licensing system will be introduced to regulate stubcoins activities in cities.

- August 15: Record the date of the next FTX distribution to the holders of the Class 5 customer qualifications, general unsecured and convenience claims for Class 6.

- Macros

- July 25th at 8:30am: The US Census Bureau produced durable order data in June.

- Durable product order Mom Est. -10.8% vs. 16.4%

- Durable product ordered from the defence mom before. 15.5%

- Durable product order ex transport mom EST. 0.1% vs. 0.5%

- 8am, July 28th: Mexico’s National Institute of Statistics will release June unemployment data.

- August 1st 12:01 AM: Effective for imports from trading partners that have not been able to reach the contract by July 9th. These increases in duties range from 10% to 70%, affecting a wide range of products.

- July 25th at 8:30am: The US Census Bureau produced durable order data in June.

- Revenue (Estimation based on fact set data)

- July 29: PayPal Holdings (PYPL), in front of the market, $1.30

- July 30: Robin Hood Market (Food), Post Market, $0.31

- July 31: Coinbase Global (Coin), Post Market, $1.39

- July 31: Reddit (RDDT), Post Market, $0.19

- July 31: Sequans Communications (SQNS), former market

- August 5: Galaxy Digital (GLXY), in front of the market, $0.19

- August 7: Block (XYZ), Post Market, $0.67

- August 7: Coincheck Group (CNCK), Post Market

- August 7: HUT 8 (HUT), pre-market – $0.08

- August 27: Nvidia (NVDA), Post Market, $1.00

Token Event

- Governance votes and phone calls

- Aavegotchi dao is voting for a proposal to sell the Treasury Department, which is approximately US$3.2 million in controlling investments by VC companies from around US$3.2 million. The VC company aims to expand Aavegotchi globally while Pixelcraft retains IP ownership. Voting will end on July 25th.

- Lido Dao is voting for a new system that allows validator exits to be automatically triggered through the execution layer, not just node operators. This includes tools for various approval routes, emergency management, and building restrictions to prevent misuse. This update is expected to make staking more decentralized, safer and more responsive. Voting will end on July 28th.

- Gnosisdao voted for a proposal to offer $30 million a yearly quarter to Gnosis Ltd., a nonprofit organization, and built a team of 150 people to maintain key GNOSIS chain infrastructure, products (such as GNOSIS Pay and Circles), business development and operations. Voting will end on July 28th.

- Aavegotchi Dao is funding three new features in its official decentralized application. Wearable lending UI, Gotchis Batch Lending, and BRS Optimizer. Voting will end on July 29th.

- Nearby protocols are voting for the possibility of reducing Near’s inflation from 5% to 2.5%. Two-thirds of validators must approve the proposal for it to pass, and in that case it can be implemented by the second half of the third quarter. Voting will end on August 1st.

- July 25th: MEXC, Ethena and Ton will be holding X-space sessions at “Stablecoin for you & me.”

- July 29th, 10am: ether.fi will hold a two-way analyst call.

- Unlock

- July 28th: Jupiter unlocks 1.78% of its circulation supply at 1.78%, worth $28.77 million.

- July 31: Optimism to unlock 1.79% of distribution supply worth $22.08 million.

- August 1: SUI unlocks 1.27% of distribution supply worth $16,278 million.

- August 2: Ecena unlocks 0.64% of distribution supply worth $22.29 million.

- August 9: Unlocking 1.3% of distribution supply worth $13.38 million (IMX).

- August 12: APTOS unlocks 1.73% of distribution supply worth $53.27 million.

- Token launch

- July 25th: 5irechain (5IRE), Aperture Finance, Ertha, Gummy, Pip and Teleport System Token (TST) will be delisted from Bybit.

meeting

Coindesk Policy & Regulation Conference (Formerly known as Cryptographic State) At a one-day boutique event held in Washington on September 10th, generals, compliance officers and regulatory executives will be able to meet with civil servants responsible for crypto law and regulatory oversight. Space is limited. Please use Code CDB10 for 10% off registration until August 31st.

- July 25th: Blockchain Summit Global (Montevideo, Uruguay)

- July 28th-29th: TWS Conference 2025 (Singapore)

- August. 6-7: BlockChain.rio 2025 (Rio de Janeiro, Brazil)

- August 6th-10th: Rarebo (Las Vegas)

- August 7-8: Bitcoin++ (Latvia, Riga)

- August 9th-10th: Baltotic Honey Badger 2025 (Riga, Latvia)

- August 9th-10th: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token talk

By Shaurya Malwa

- WWE legend Hulk Hogan passed away Thursday after a cardiac arrest, causing a wave of tribute posts for wrestlers and a surge in near Ethereum and Solana branded memo coins.

- According to Dextools, the newly launched ETH token, Hulkamamania (Hulk), pumped over 122,000% within hours of its launch, peaking at $0.001,335, pushing its seven-figure market capitalization for a short time.

- At Solana, Memecoin, named Hulkmania (Hulk), launched in June 2024, surged by more than 2,000% in 24 hours, trading nearly $0.0006,146 with a revived market capitalization of $500,000.

- Despite the rally, Solana-based Hulk has been far below $18.8 million in history since last year, following a tweet from the now-deprecated promotion from Hogan’s official X account.

- Hogan claimed at the time that the post was not made by him.

- None of the current Hulk tokens officially have partnered with Hogan’s real estate or brand, suggesting that multiple mimic versions have already disappeared from the Dex landscape, suggesting that they are likely to be rugpur and honeypots.

- Hogan joins the list of celebrities who have seen the posthumous Mimecoin’s rapid speculative influx, often ejecting fluidity quickly to arrive before fueling nostalgia, shock and social media virals.

- It is worth remembering that Though Tribute Mime Coin is the fastest token on the DEX platform during news-driven spikes, it does not offer legitimacy, roadmap or protection.

Positioning of derivatives

- Bitcoin’s open interest (OI) across top derivative venues is always the best.

- According to Velo, the OI is currently at $34.1 billion. Binance still leads with open interest of $14.2 billion, followed by BYBit at $9.5 billion.

- The BTC’s three-month annual standard is 6.3%, falling from 9% at the beginning of the week.

- As for permanent quantities, ETH volumes are currently above 140.6 billion BTC amounts, compared to 121.4 billion, respectively, according to Coinglass.

- According to VELO, Bitcoin’s put call volume is currently 44,600 contracts, accounting for 52% of the total. Bitcoin options are below all hours of $83.5 billion, according to Coinglass.

- Meanwhile, Ether currently has a 196,400 put-call contract volume, with 54% being phones. Currently, open interest is $9.6 billion, below the all-time high of $14.8 billion in March 2024.

- BTC’s funding rate APR is currently muted at most venues except for high lipids, which have 90% annual funding. This is far outweighed Altcoins such as Sol and hype. This shows annual funds of 10% and 32%, respectively, according to Coinglass.

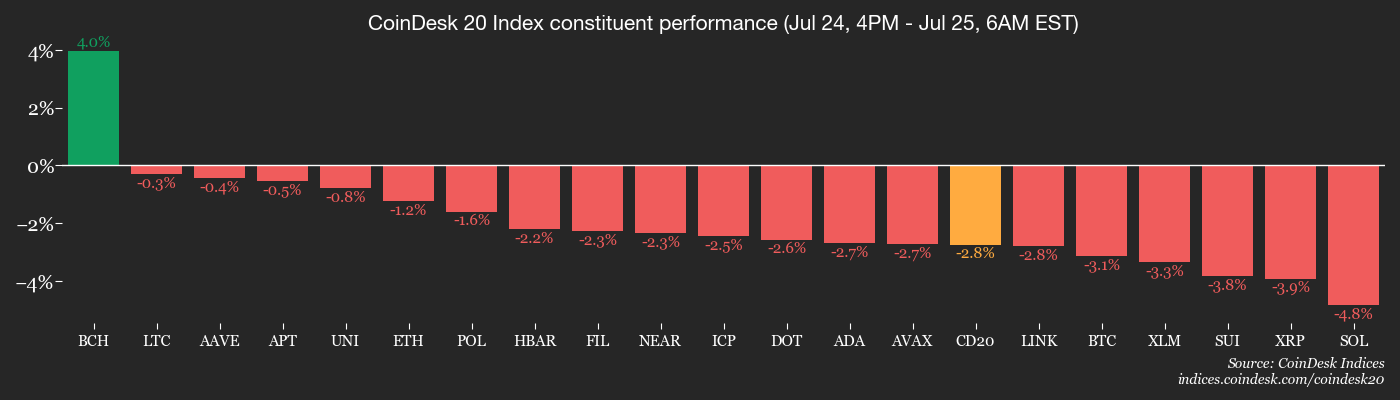

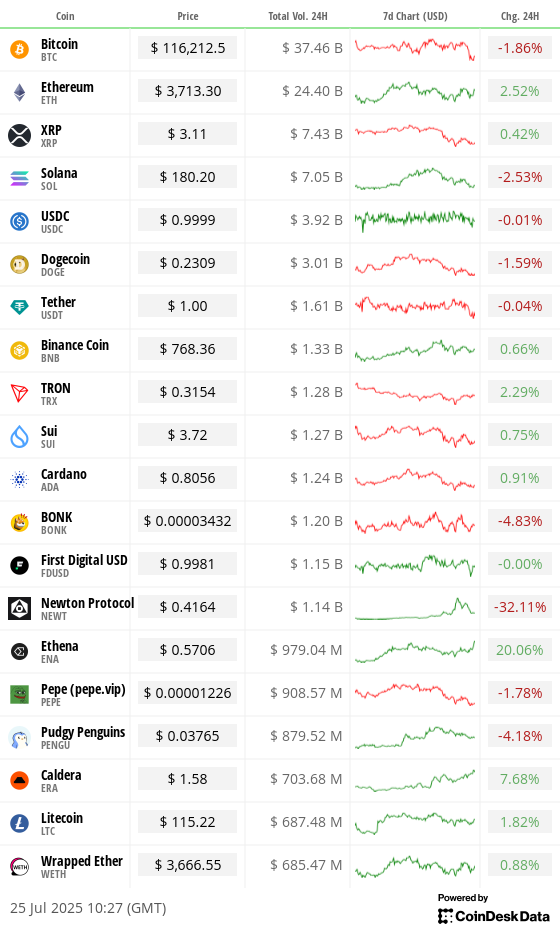

Market movements

- BTC fell 2.39% from 4pm on Thursday at $115,912.54 (24 hours: -1.99%)

- ETH is down 0.41% at $3,721.30 (24 hours: +2.54%)

- Coindesk 20 is down 1.94% at 3,940.10 (24 hours: +0.64%)

- Ether CESR Composite staking rate is up 1 bp at 2.96%

- BTC’s funding rate is 0.0367% (40.1865% per year) for Kucoin.

- DXY is up 0.32% at 97.68

- Gold futures fell 0.72% at $3,349.30

- Silver futures fell 0.34% to $39.09

- Nikkei 225 closed 0.88% at 41,456.23

- Hang Seng closed 1.09% at 25,388.35

- FTSE is down 0.29% at 9,112.22

- The Euro Stoxx 50 is down 0.15% at 5,347.34

- DJIA fell 0.70% on Thursday at 44,693.91

- The S&P 500 was unchanged at 6,363.35

- NASDAQ Composite rose 0.18% at 21,057.96

- S&P/TSX Composite fell 0.16% at 27,372.26

- S&P 40 Latin America closed 0.44% at 2,627.58

- The 10-year financial ratio in the US is 4.42%, up 1.2 bps

- E-Mini S&P 500 futures are no different at 6,407.00

- E-Mini Nasdaq-100 futures remain unchanged at 23,374.00

- The e-mini dow Jones Industrial Average Index is up 0.13% at 44,956.00

Bitcoin statistics

- BTC dominance: 61.46% (-0.58%)

- Ether Bitcoin Ratio: 0.03184 (1.65%)

- Hash rate (7-day moving average): 914 EH/s

- Hashpris (spot): $59.04

- Total fee: 9.82 BTC/$1,166,840

- CME Futures Open Interest: 147,320 BTC

- BTC priced in gold: 34.4 oz.

- BTC vs. Gold Market Cap: 9.66%

Technical Analysis

- Ecena’s ENA was one of the most powerful performers on the market following the announcement of STABLECOINX, which raised $360 million to acquire ENA as a financial holding.

- In the daily time frame, ENA broke down the downtrend and retested previous resistance at $0.45.

- This bullish story is further supported by the low Monday and the confluence of recovering the 50-day exponential moving average on a weekly chart.

Crypto stocks

- Strategy (MSTR): $414.92 (+0.55%), with -2.44% closed in the previous market at $404.79

- Coinbase Global (Coin): $396.7 (-0.28%), closed at -1.75% at $389.74

- Circle (CRCL): $193.08 (-4.61%), closed at -0.64% at $191.84

- Galaxy Digital (GLXY): $31.89 (+2.77%), closed at -4.2% at $30.55

- Mara Holdings (Mara): $17.26 (-1.76%), $16.75 at -2.95%

- Riot Platforms (Riot): $14.69 (+2.44%), closed at -2.59% at $14.31

- Core Scientific (CORZ): Closed at $13.69 (+1.48%) and has not changed before the market

- CleanSpark (CLSK): $12.34 (-0.88%), closed at -2.35% at $12.05

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $27.11 (-0.84%)

- Semler Scientific (SMLR): $38.89 (-1.09%), closed at -3.57% at $37.5

- Exodus Movement (Exod): $33.61 (-1.75%), +3.01% at $34.62

- Sharplink Gaming (SBET): $23.32 (-9.65%), +2.44% closed at $23.89

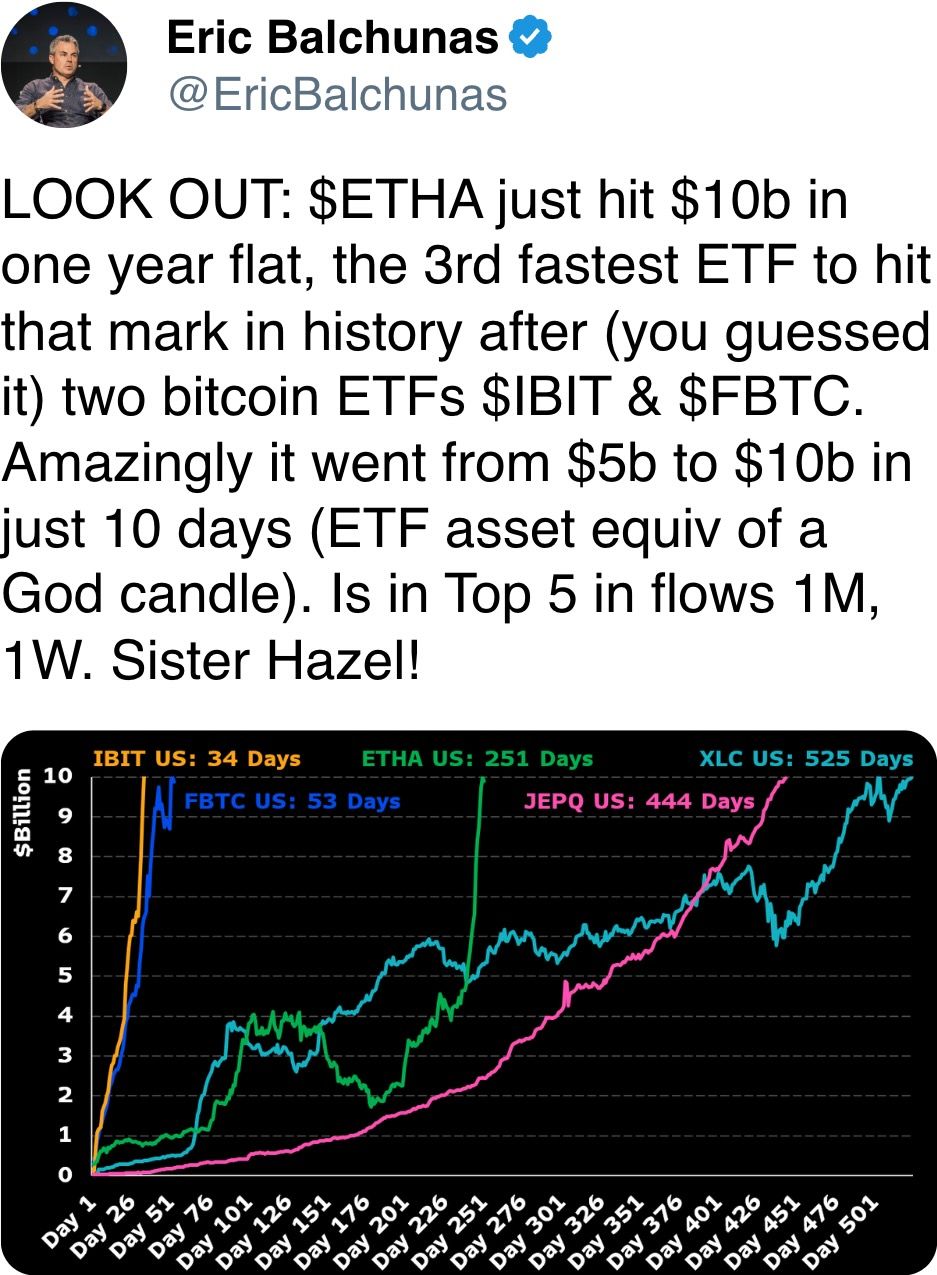

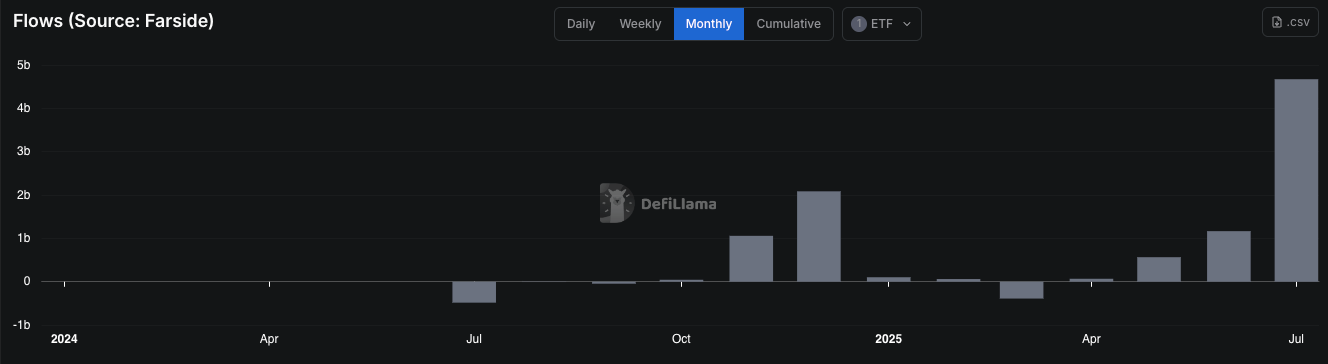

ETF Flow

Spot BTC ETF

- Daily Net Flow: $226.7 million

- Cumulative net flow: $546.7 billion

- Total BTC holdings: 129 million

Spot ETH ETF

- Daily Net Flow: $231.2 million

- Cumulative net flow: $8.9 billion

- Total ETH holdings: 534 million

Source: Farside Investors

One night flow

The chart of the day

- The US Spot Ether ETF recorded a net inflow of $4.67 billion in July alone.

While you’re asleep

- Trump’s tariffs are being picked up by Corporate America (The Wall Street Journal): American companies are soaking up price hikes and tariff costs for now as foreign sellers provide limited relief and adds uncertainty about who will ultimately pay.

- Iran is launching new talks about its nuclear program today. Here’s what you need to know. (The New York Times): European officials will resume talks with Iran in Istanbul and warn that if Tehran does not re-engage in the US and curb enrichment, it will restore UN sanctions suspended by the end of next month.

- Bitcoin achieves $135,000 by the end of the year in base case forecasts, $199,99,000 in bullish scenario: City (Coindsk): In the bank’s most bearish setup, the forecast drops to $64,000.

- Companies stack up niche crypto tokens to raise stock prices (Financial Times): Some public companies rely on Altcoin Treasuries to promote differentiation and evaluation. Analysts say this speculative trend does not provide a long-term solution for businesses already facing financial distress.

- Volmex’s Bitcoin and Etheric volatility futures have exceeded $10 million in volume since their debut as traders exceed their prices (Coindesk): Traders use recently launched products on decentralized platforms to express their opinions on market turbulence without measuring the direction of BTC/ETH prices or managing complex options strategies.

- Digital asset company OSL has raised $300 million to expand its crypto business around the world (Bloomberg): As Hong Kong awaits the stability law, which came into effect on August 1, CFO of one of the earliest licensed exchanges says the new funds will support a broader push into the overseas digital asset market.

With ether