The Bitcoin market has experienced a significant price correction in the past few hours, with the price dropping to around $110,000 as the US-China trade war could still resume. Prior to this decline, the cryptocurrency market leader led a strong rally, hitting a new all-time high of $126,198.17 on October 6, 2025. Interestingly, recent data from the Bitcoin options market showed a wave of cautious positions among institutional investors amid this price rally prior to the current market downturn.

Financial institutions retreat as Bitcoin rally turns to euphoria – Glassnode

In an October 10th post on X, blockchain analytics firm Glassnode offers some interesting insights in its weekly options market update. In particular, Glassnode analysts report that while Bitcoin prices have soared more than 10% in the recent rally to new all-time highs, institutional traders appear to be maintaining a calm approach to the market, choosing to lock in profits and protect the downside rather than chasing the upside.

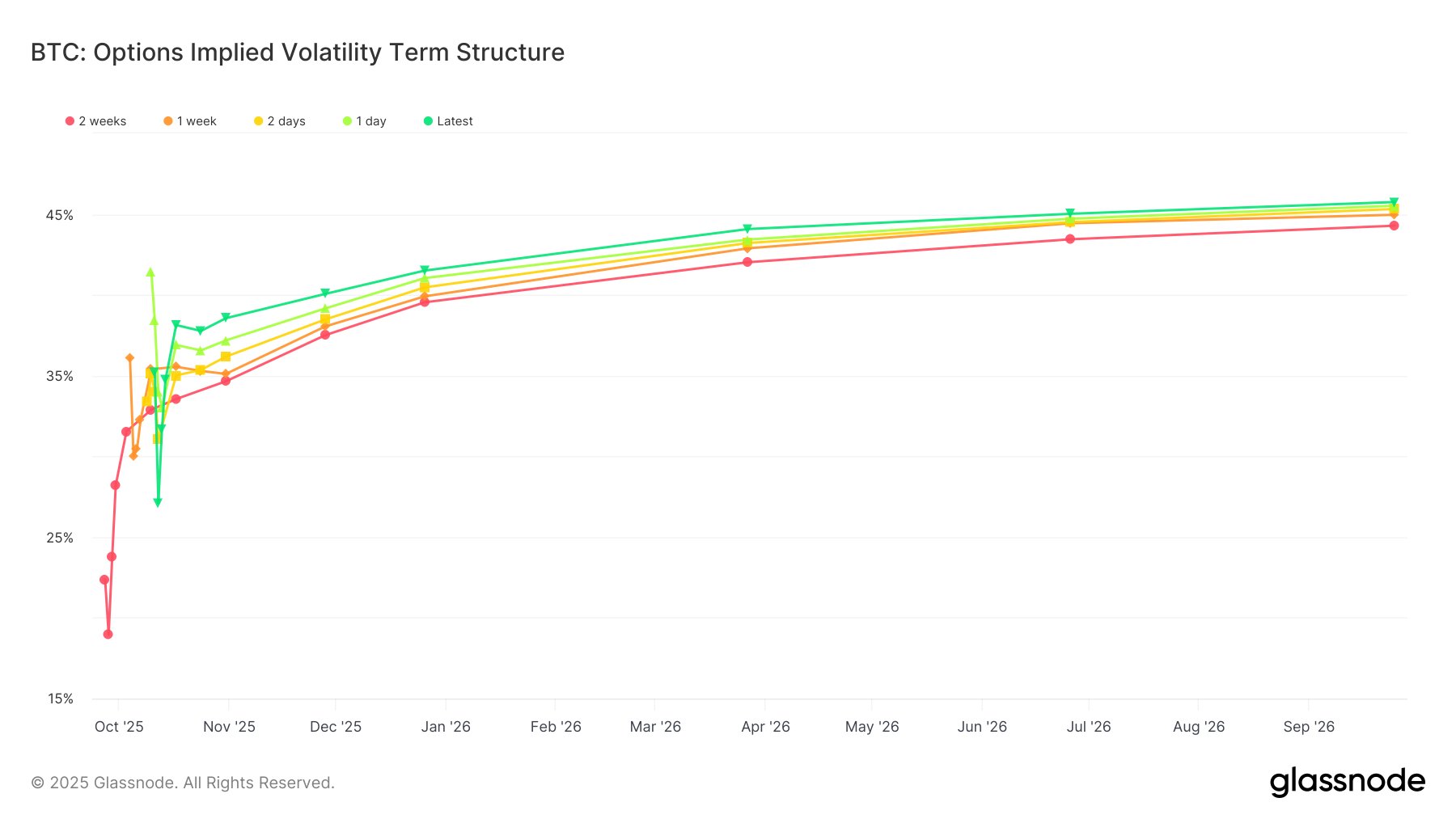

Despite the sharp rise, implied volatility, a measure of expected price movement, has remained largely unchanged, hovering around 38-40%. Normally, a rally of this magnitude would lead to more volatility as traders rush to call and increase their exposure. However, the muted reaction suggests the coolness of institutional investors who were either already preparing for this move or simply were not willing to pay for the additional upside room.

Glassnode analysts also note another subtle but obvious skew in sign-in options. Even at the height of the bull market, demand for put options remained strong and the market continued to rise. This shows that many large players were selling calls through the options market, effectively capping potential upside while maintaining insurance in case the market reversed.

Moreover, the put-call ratio also reinforces this cautious pattern among financial institutions. Amid options expiration on Friday, October 9, this ratio rose above 1.0, indicating that there were more puts than calls as traders were busy hedging positions ahead of the current decline rather than chasing momentum and locking in recent gains.

In general, Glassnode explains that the Bitcoin market has adopted a different dynamic this cycle, driven by institutional discipline rather than the spike in volatility and retail boom seen in previous cycles. The preponderance of institutional funding through spot ETFs and the recent emergence of crypto treasury firms may have added maturity to the $2 trillion market.

BTC market overview

At the time of writing, Bitcoin is trading at $110,805, down 7.54% in the past 24 hours. Meanwhile, the daily trading volume surged 150.37%, indicating increased market activity as traders reacted to the sharp pullback.

Featured image from Flickr, chart from Tradingview

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.