Bitcoin price has fallen by more than 1% in the past 24 hours. It is currently trading around $108,200 as sellers pushed BTC down from the day’s highs and there was an opportunity for a breakout.

However, while short-term pressures still remain, both on-chain and chart data indicate that this pause may be temporary. A broad rebound in BTC price may already be forming below.

Selling pressure slows, but certain indicators suggest re-accumulation

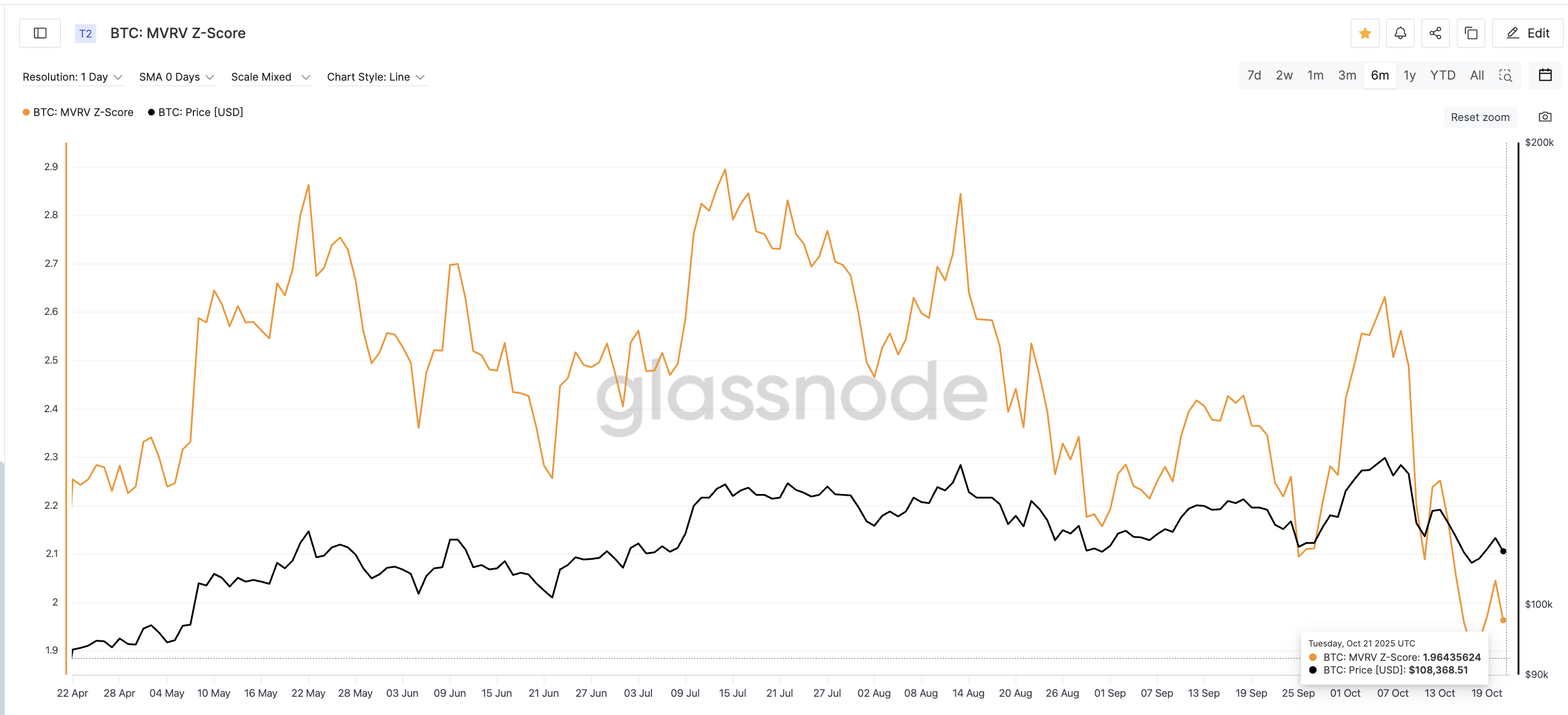

Bitcoin’s MVRV Z-score, which compares its market value to its fair value, remains near a six-month low of 1.96. It has risen slightly from 1.90 on October 17th (3-month low). This small “higher low” is important.

The last time a similar pattern appeared was between September 25th and 27th, when MVRV increased from 2.09 to 2.11. And Bitcoin’s price rose nearly 14%, jumping from $109,692 to $124,714 in less than a week.

Bitcoin MVRV-Z Score: Glassnode

This pattern suggests that while selling pressure is easing, long-term holders are not capitulating and are holding out despite the push.

Want more token insights like this? Sign up for editor Harsh Notariya’s daily crypto newsletter here.

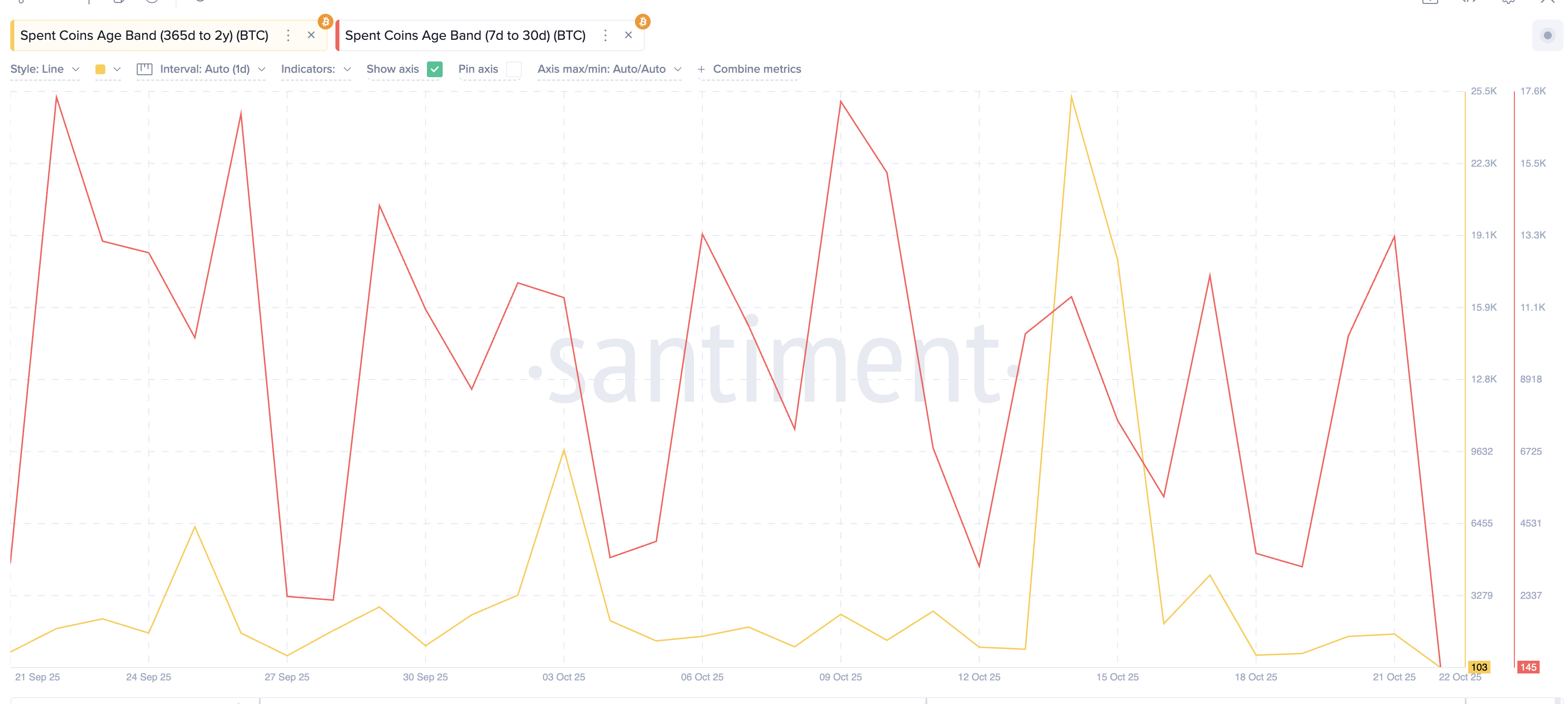

Spent coin age band indicators support the MVRV-driven outlook. This tracks the moving supply of timeframe-specific holders.

Coins held for 2 years from 365 days decreased by 99.6% between October 14th and 22nd, with the number of spent BTC units decreasing from 25,263 to 103. Short-term coins (7-30 days) decreased from 13,273 to 145, a 98.9% decrease from yesterday.

Both sharp declines (monthly lows) indicate that fewer coins are being sold, meaning both long-term and short-term sellers are losing momentum.

Both short-term and long-term holders ease selling: Santiment

Together, the two indicators suggest that large holders are stable, short-term profit-taking is largely complete, and the sell-off could be setting the stage for a rebound.

Bitcoin price chart still maintains reversal setup despite bearish rejection

On the 12-hour chart, Bitcoin continues to move inside a descending wedge, which typically breaks to the upside. BTC price briefly tested a ceiling around $114,000.

However, on a long upward wick, sellers stepped in and pushed the price back to near $108,000. Still, a doge candle formed shortly thereafter, indicating indecision between buyers and sellers, and was often the last stage before a reversal.

The Relative Strength Index (RSI), which tracks the strength and speed of price movements, confirms this. From September 25th to October 21st, BTC price made new lows and RSI made new lows, forming a bullish divergence. This setup often indicates that selling pressure is weakening before a trend reversal.

If Bitcoin breaks above $111,500 (the upper limit of the wedge), we could see a short-term breakout towards $114,000. A close above this level would open the door for a rally to $116,000, and if momentum gains, it could move further towards $124,200.

Bitcoin Price Analysis: TradingView

A decline below $107,500 would slow this move, but a decline below $103,500 would completely invalidate the bullish position.

The post “Bitcoin sellers block bullish breakout — but here’s why the rally isn’t over” was first published on BeInCrypto.