The Bitcoin (BTC) market has proven to be quite turbulent in the past week after a price drop below $75,000 rebounded by more than $83,000. With the best cryptocurrencies showing signs of a sustained upward trend, blockchain analytics firm Cryptoquant has identified two potentially important zones of resistance that are in the waiting list.

Bitcoin reveals a potential strong barrier with prices of $84,000 and $96,000

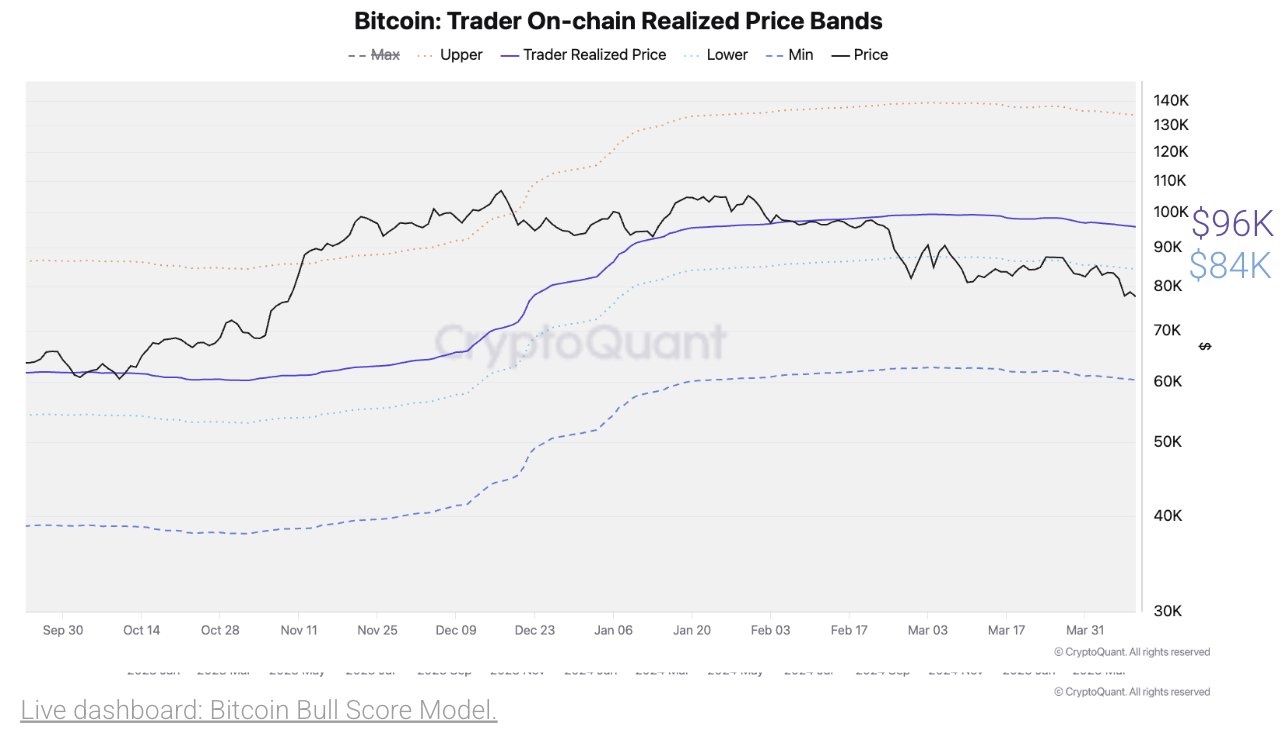

In an X post on April 11th, Cryptoquant shares an on-chain report on the BTC market, showing two major resistances and potential encounters of $84,000 and $96,000 if Bitcoin maintains its current upward trajectory. These price barriers are revealed by realised price metrics that reflect the average price that determines the overall market cost base, reflecting the average price that has last moved BTC’s current supply.

When Bitcoin trades above this level, it shows a healthy bullish momentum in which the majority of its owners make profits. Conversely, if BTC is below the threshold, most investors hold losses, suggesting underwater sentiment. Therefore, realized prices often serve as important market pivots that act as strong support in bull markets, and are intense resistance at the bear stage. According to Julio Moreno, Cryptoquant’s research director, the realisation price for BTC’s current chain is $96,000, while the immediate low price range is $84,000.

Interestingly, these two price levels serve as key support zones during the early bullish stages of the current market cycle. However, both zones could act as resistance amid ongoing market corrections. However, if Bitcoin can move beyond $84,000 and $96,000, it could mean a reopening of a bull market, where the best cryptocurrency could be $130,000. This projected profit represents a 55% increase in current market prices.

BTC price overview

At the press conference, Bitcoin continues trading at $83,180, reflecting its 3.65% profit over the past day. Meanwhile, daily trading volumes fell 11.99%, equivalent to $391.9 billion.

Amid the ongoing macroeconomic development driven by US government tariff changes, the crypto market continues to show a strong level of uncertainty, and assets are unable to establish clear momentum. However, Blockchain Analytics GlassNode reports that Bitcoin investors have formed a strong support zone at $79,000 and $82,080, with over 40,000 BTC and 51,000 BTC respectively.

With the emergence of downtrends, both price levels offer short-term support and prevent further price drops. Its market capitalization is $1.66 trillion, and Bitcoin is the largest digital asset with over 60% of its crypto market capitalization.

CNN featured images, charts on tradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.