Cryptocurrencies appear to be unmoved by significant developments in the broader economy.

Stock step on water as a bitcoin flat line

US President Donald Trump announced that he had just finished a “very good call” with Chinese leader Xi Jinping on Thursday morning and initially sent stocks up, but Bitcoin (BTC) barely sprouted and stocks later retreated.

“I concluded a very good call with Chinese President XI, discussing some of the complexities that have been created recently and agreeing to trade deals,” Trump noted the agreement in May that the two countries abolished the triple-digit retaliation fees previously imposed on each other. “The call lasted about an hour and a half, and it led to a very positive conclusion for both countries,” the president added.

According to CNBC, the S&P 500, Nasdaq and Dow rose by 0.41%, 0.72% and 0.26% respectively, respectively, with the S&P 500, Nasdaq and Dow jumping into the news, but those profits had disappeared when they reported. CoinmarketCap data shows that Bitcoin is bordered 1.84% lower and is currently trading just under the $104,000 mark.

Even the $1.05 billion initial public offering (IPO) by the Stablecoin Issuer Circle (NYSE: CRCL) failed to support BTC and the wider crypto market as it was published today on the New York Stock Exchange. CoinMarketCap shows the Crypto sector has shrunk by 2.24%, bringing its market capitalization to $3.24 trillion.

Market Metric Overview

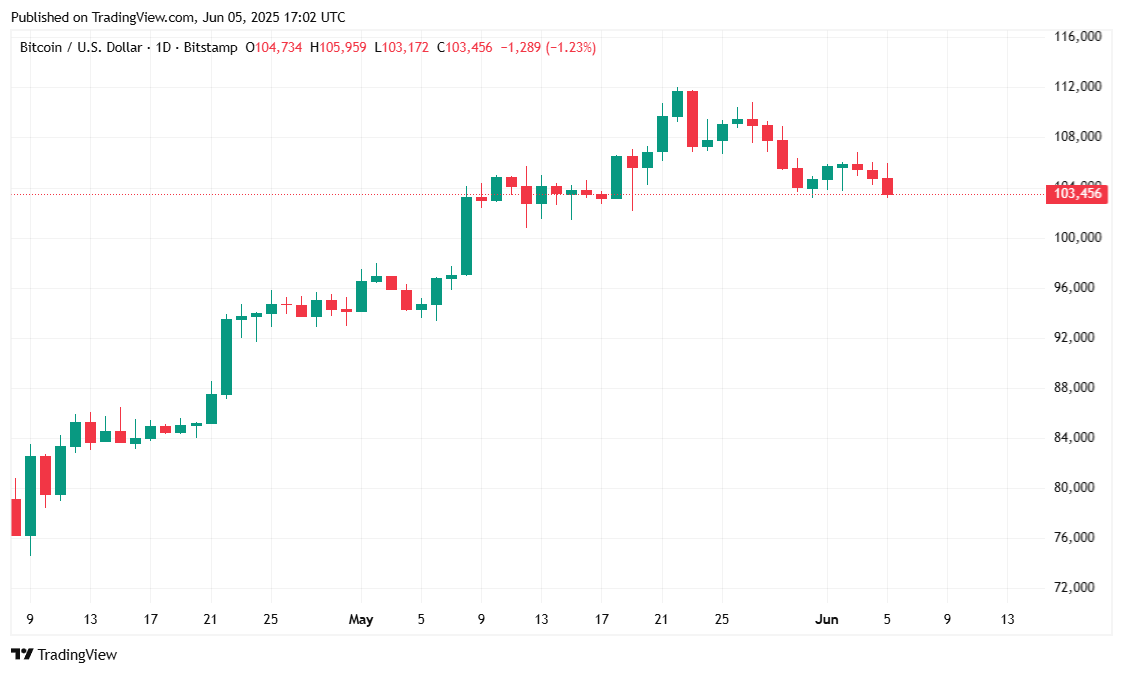

According to Coinmarketcap, Bitcoin has soaked 1.84% in the last 24 hours at its current price of $103,517.75. The decline extends the wider 7-day slide of 3.05%, with price action being limited between $103,483.65 and $105,936.69. The suppressed movement suggests an on-the-scene approach among traders despite news about US-China trade development and circle IPOs.

(BTC Price/Trade View)

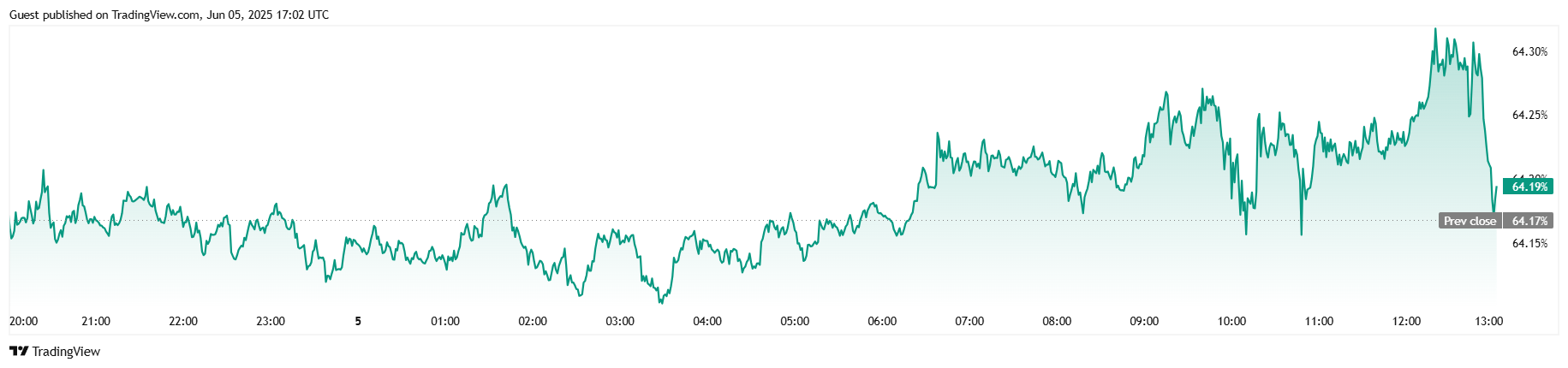

Market activity reflects price suffocation as 24-hour trading volume fell 8.06% to $41.84 billion. Bitcoin’s market capitalization fell 1.85% to $2.05 trillion, while BTC’s control rose 0.08% to 64.21%, suggesting Altcoins’ relatively weak performance. The futures market is slightly higher, with total open interest rising 0.40% to $71.03 billion, reflecting a stable desire for speculative positioning.

(BTC dominance/trade view)

Margin trading data from Coinglass reveals interesting changes. The total liquidation initially faded at around $83,770, but later swelled to $12.93 million.