Bitcoin (BTC) has moved to regain its $86,000 price level following a 2.65% increase in the last 24 hours. In particular, the best cryptocurrencies have risen by more than 15% in the past several since retesting the $74,000 US zone. In the potential reopening of the wider Bull rally, renowned crypto analyst Burak Kesmeci highlights the prominent development of Bitcoin’s short-term holder MVRV (market value to realised value) ratio.

Bitcoin Market Recovery awaits the Final Signal: Analysts

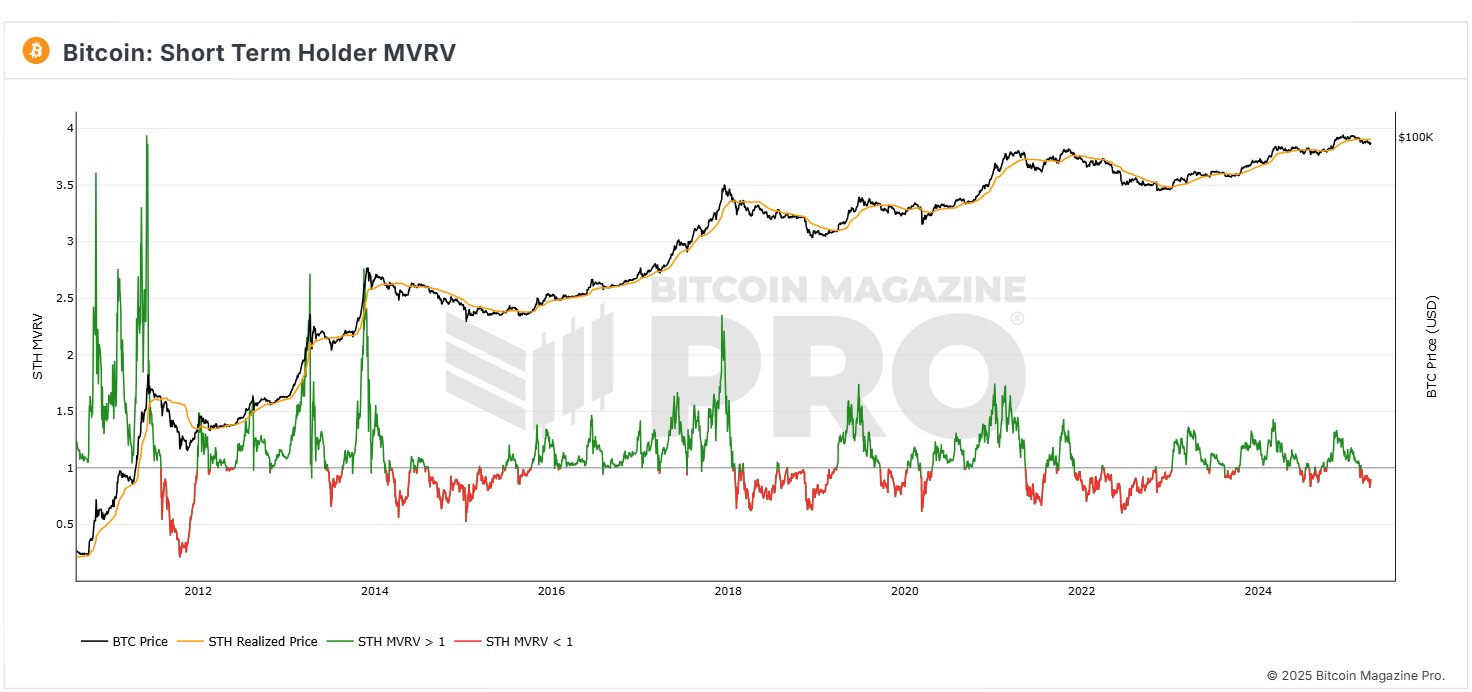

In a new post from X, Kesmeci explains that Bitcoin is showing early signs of a market recovery following the recent development of Bitcoin MVRV for short-term investors. In the context, MVRV measures the profitability of an investor by comparing the market value of an asset with the acquired price. An MVRV score below 1.00 indicates that the average owner has a loss, while a score above 1.00 indicates a profit.

The short-term Bitcoin holder MVRV, or addresses that hold Bitcoin less than 155 days, is particularly important as this cohort of investors is usually the most responsive to price changes. In particular, STH MVRV provides insight into market sentiment and potential price directions.

According to Kesmeci, Bitcoin STH MVRV is now at 0.90, close to profit levels above 1.00. STH MVRV has reached 0.82 amid the recent “Tax Tax Tax Poker” crisis that was ignited by international tariff changes by the US government. In particular, this decrease is lower than that seen in the Japan-based carry trade crisis, when STH MVRV was immersed in 0.83 on August 5, 2024.

Over the past few days, STH MVRV has risen to 0.90 along with the revival of BTC prices, but Kesmeci has warned that Bitcoin must be seen above 1.00 for a significant price rise for short-term investors. That said, rising from 0.82 to 0.90 continues to be a positive development indicating a continuous change in market sentiment.

BTC price outlook

At the time of pressing, Bitcoin is trading at $85,390, following a small price drawback in the past few hours. Of recent daily profits, the best cryptocurrency has increased by 2.11% on the weekly chart and is up 4.33% on the monthly chart as it continues to gain bullish momentum among investors. However, if the current uptrends need to persist, Market Bulls should offset a 38.98% decline in daily trading volume.

In particular, BTC investors should expect to face sufficient resistance at the $88,000 price range, which has served as a strong price range in the past. Meanwhile, with the emergence of price drops, immediate price support is around $79,000.

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.